4 Steps To Stop Spending Money

Getting ourselves to stop spending money is difficult to do. I know this because my own spending spiraled out of control in recent months and I must now take back the reins.

This will be a great post for those who are looking to stop spending so much money. I say that because I will walk through the exact steps that I’m taking to curb my own spending problem. Consider this both a case study and step by step guide for getting your spending under control and boosting your savings rate.

Following the steps in this post will help ensure you are on track with your finances and prevent you from ever going broke.

Contents

Step 1: Address The Mental & Emotional Side Of Your Spending

The first step to curing a spending problem is recognizing you have one. It’s all too easy to spiral down the spending hole without us even realizing we are there.

Had it not been for my recent no eating out challenge, my spending binge may have continued for much longer. Thankfully that challenge grounded me back to reality and opened my eyes to how I’ve been behaving with money lately.

The possible mental and emotional reasons for spending money are too numerous to list individually. Therefore, I will share those that are relevant to my own situation. I suggest you do the same by considering what mental and emotional processes drive your overspending.

Overspending Because I Earn A High Income. How much is six figures? While it’s not that much in reality, earning at that level can still woo us into spending like it’s a lot. Deep in my psyche I knew that I made enough money to be sloppy while not totally sinking my financial ship. The problem with this line of thinking is I’m not taking advantage of my income and losing valuable time toward financial freedom.

Too Lazy To Do The Work To Stop Spending Money. As you will discover in this article, getting control of overspending takes a bit of work. Unfortunately, the challenge with doing things that require work is having sufficient motivation to get in motion. I ran into this problem with my own inability to stop spending money. Simply put, I was too lazy to actually do something about it.

A Busy Lifestyle. This year has been one of the busiest of my life. As a result, I’ve let some important things slip such as managing my finances with the same fine-toothed comb that helped me climb out of debt.

- Ignoring The Spending Problem. If I’m being honest, deep down I knew that I’ve been spending too much money. I just didn’t have to face the music.

Step 2: Understand Your Current Spending

After taking time to examine the mental and emotional side of your spending, the next step is to study your past spending behavior. The goal of this step is to understand spending habits and the mechanics of your recent cash flows.

A lot can happen with our spending that we aren’t aware of. This step helps shed light on our current state, which then will enable us to set our future direction in step 3.

Perform A Spending Analysis

A spending analysis is the process of studying our recent spending behavior to gain a deeper understanding of the nature of our cash outflows, trends, and patterns.

This is a vital step for controlling spending as it sheds light on the areas we need stop spending money on most It also shows us what we are doing well and should continue.

You will need to download a copy of your credit card and bank statements to conduct your spending analysis. These should be for accounts that you actively spend from during the month.

Though I automate my financial tracking with a digital tool, I like to perform this process manually with PDF or printed statements. Of course, the method you use is less important than you actually doing it. Therefore feel free to use whatever tools you have at your disposal to complete this step.

With statements in hand, you will then analyze them with the goal of understanding your general spending profile. This should be a highly focused process where you will go through each statement line by line to answer the following questions:

- Generally speaking, where has your money gone?

- What spending leaks do you have?

- Do you have any problematic trends?

- Have you had any unintentional expenses?

Spending Analysis Example

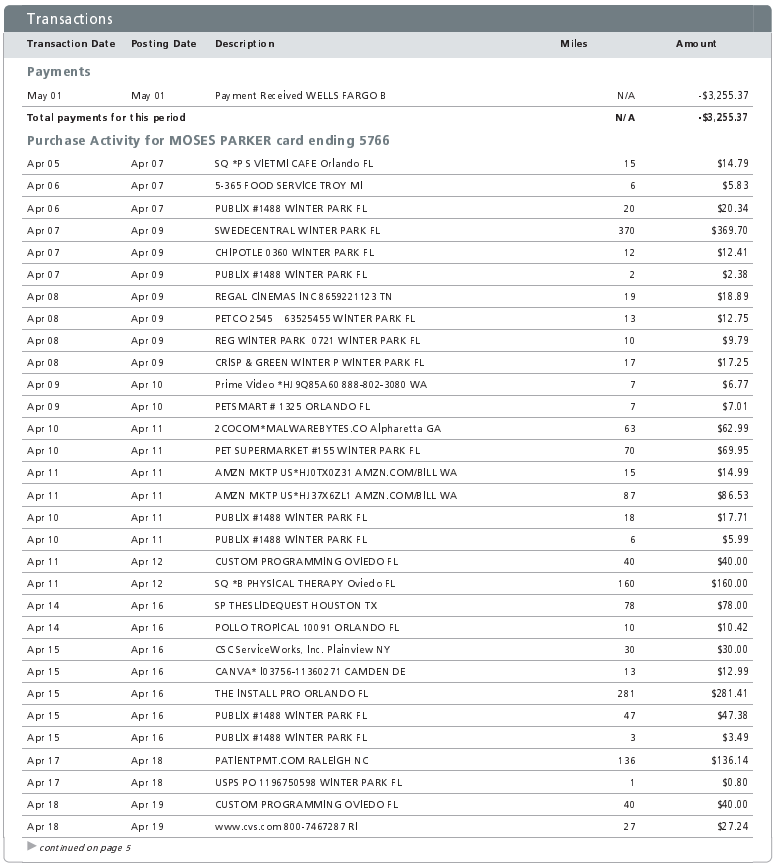

Below is a copy of my actual credit card statement from earlier this year. I’ll review it as an example of the type of spending analysis you will want to do in order to get better control of your spending.

Where Has My Money Gone And Do I Have Any Unintentional Expenses? There are no surprises here. This statement captures relatively balanced spending for my life activities. I don’t review it and feel that there are major concerns.

What Spending Leaks Do I Have? Spending leaks are small expenses that leech our cash flow, but go relatively unnoticed because of their small monthly impact. These are usually fees for services that we’ve signed up for under free trials. Or ones that we once needed, but no longer do.

For example, the above image shows a few expenses from my statement that I inspected as potential spending leaks. These either appear frequently in my statements or are not very familiar to me.

My goal is to vet each expense to determine whether it is for something that I derive value or usefulness from. If not, I want to cut the expense out. Remember that the ultimate goal here is to stop spending much money which means we have to resolve leaky expenses.

Do I Have Any Problematic Spending Trends?

The above statement shows overall healthy spending, but I can still spot a few trends that could become problematic if I’m not careful. For example, I had 3 expenses for movies that totaled $35.45.

While this is not an excessive amount to spend in a month, the above screenshot only shows 2 weeks. I must consider what other movie spending I had during the month. I must also add these to my total entertainment spending alongside items such as streaming subscriptions to get the full picture.

Ultimately, I decided to sign up for the unlimited movie pass at my local theater for $21 per month and stopped renting movies from Amazon Prime. This move helped me spend less each month and consolidated my movie expenses into a single transaction.

Step 3: Design Your Ideal Spending Structure

The first two steps were more reflective in that they had you examine your past spending behavior. Step 3 for controlling spending is different because we now begin to look forward. In this step we will design an ideal spending structure for ourselves which will help ground future decisions.

The Basic Spending Structure

The basic format of your spending structure is an outline of your take home income, expenses, and discretionary spending. The key for this step is to capture your current state numbers. The next step will be to create an ideal structure, but for now we want to see how our spending is structured today.

This is a powerful exercise to complete because it formulates the basis of a future spending plan that is optimized for reaching your financial goals.

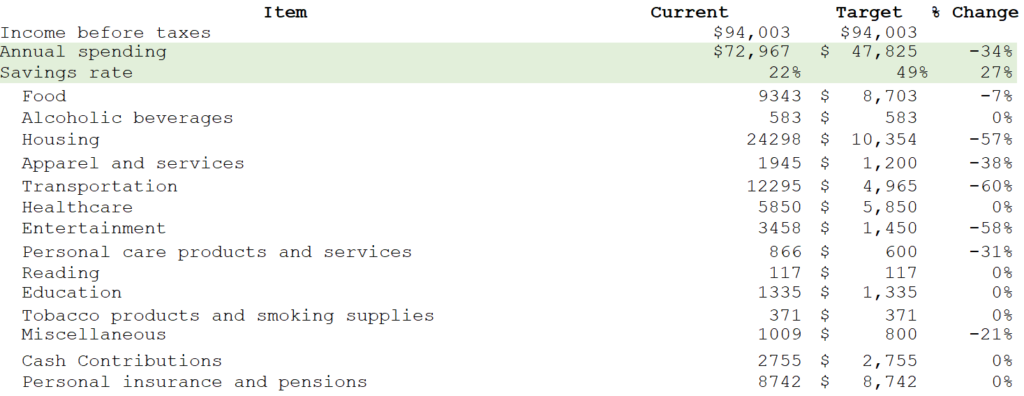

Here is a sample spending structure including common expenses of the average household. The numbers in this table are reported on an annual basis, but you’ll ultimately want to think about your spending on a monthly cadence.

Take a moment to write down an outline of your current spending so you can see where your money has been going. Also note that you don’t need to use every single line item listed in the example below.

Adjust Your Spending Structure To Meet Your Goals

Now that you have your actual numbers laid out, you can make adjustments to ensure your spending will enable you to progress towards your goals.

Since the goal of this exercise is to stop spending so much money, we want to primarily focus on our ongoing expenses, discretionary spending, and savings rate. Here are questions you can consider that will help you land on an ideal spending structure:

- Are there ongoing expenses or bills that can be reduced or eliminated?

- Do I need to make adjustments to my discretionary spending to ensure I am meeting my other financial goals?

- Is my savings rate sufficiently high to ensure I am on track with where I need to be with my finances for my age?

Through this analysis you may find that there are opportunities to spend less money by reducing your ongoing expenses. You may also find that your discretionary spending is the limiting factor in you being on track to meet your financial goals. As a result, you would want to exercise great control of your spending in this area.

Below is my take on how the average family could revise their spending structure to stop spending so much. This is where I would start if I woke up in their shoes today:

Step 4: Develop Financial Goals That Will Motivate You To Control Your Spending

You now understand your spending habits and have outlined a structure for better controlling your money. You should feel better about being positioned to spend less money – but I caution that things could become more difficult from here because you now have to actually do the work.

That said, I’ve found that the best way to stop spending money is to have strong goals that motivate us to want to keep our money. For example, my goal of achieving financial independence motivates me to save as much money as possible because each dollar saved puts me that much closer.

It is ultimately up to you to identify goals that will motivate you enough to keep your spending under control. If you don’t know where to start with goal setting, you can never go wrong with saving up a big lump sum for a future purchase, paying down debt, or buying more freedom.

Strategies That Can Help You Stop Spending Money

Completing the steps outlined above means we’ve addressed our spending psychology, analyzed our spending trends, and designed a structure for how we will spend going forward. We’ve also outlined some goals to strive for that will motivate us to stop spending.

From here, your only task is to start and pay closer attention as you move forward. To help with that, here are a few strategies that you can leverage for better control over your spending .

#1Pay For More Things With Cash

As a simple solution to stop spending money, try doing as much of your spending as possible with cash.

Sure, credit and debit cards are convenient. At the same time, they are proven culprits in our overspending problems as some studies show they can cause us to spend up to 400% more than we would with cash.

Of course, using cash would cause you to lose out on those credit card rewards. But you will also have greater control of your finances and make progress towards your goals at the same time.

#2 Limit Your Restaurant Spending

Simply put, spending money at restaurants is a discretionary expense that holds many people back from making financial progress. Restaurants and alcohol account for about 4.5% of the average budget, which is significant given they are non-essential.

Cutting out spending in these categories could be a perfect way to jumpstart your journey toward not spending money and getting ahead. It certainly did for me as my no restaurant challenge helped me save $850 per month.

#3 Adopt The 30 Days Before Spending Rule

One of my favorite techniques for controlling spending over the years has been the 30 day rule. What’s great about this rule is that it’s the perfect cure for impulse spending.

The 30 day rule essentially says that you must wait a month or some other period of time before making any purchase over a certain dollar amount. For example, you may decide to wait 30 days before making any non-essential purchase over $300.

This produces slower spending velocity. Having time to think through each purchase usually reveals to us that we either don’t really want or need the items in question. Oftentimes we’ll decide to not even move forward with the purchase and opt to not spend.

Conclusion

I think we all can agree that not spending money is hard to do. Life gets busy. And there is a lot of temptation out there to buy things even when we know we should spend less.

My question for you is what things do you struggle the most with when it comes to controlling your spending? Is it a matter of impulse control or poor systems such as not having a budget?

For me, the biggest culprit has been my income. I know that “I can” technically afford the things I buy. But I also know that I could save more to boost my progress. Tis life I suppose!

2 Responses

Way cool! Some very valid points! I appreciate you penning this post plus

the rest of the site is extremely good.

Hi Manuel! Thanks for the positive feedback. I speak from the heart and from my own life, so I’m glad it resonated. Comments like these keep me going!