How Much Is 6 figures? It’s A Lot Less Than You Think

Earning a 6 figure income is no small feat. If you’ve landed in this fortunate financial position, you may wonder how much your 6 figures is actually worth in terms of the lifestyle it will grant you in the real world.

In this article, I’ll discuss the true value of 6 figures and ways you can maximize this wonderful income if you are one of the lucky few to earn at this level.

Contents

Earning My Way Into The 6 Figure Club

Contrary to what social media may tell you, earning a 6 figure income is really tough to do. Personally, it was a full decade before I would reach this milestone in my own career. And doing so required a major career change plus several more years of accumulated experience in the new field.

Now that I’m here, I feel like it can all be taken from me at any moment. I’m wondering if I’m getting too accustomed to earning at this level and worry that I will start taking things for granted. I can really feel the golden handcuffs begin to tighten.

Beyond that, I’ve also come to realize that 6 figures is not as much money as most of us have been led to believe over the years. Hearing this may come as a surprise, but I will show why it could be valuable for us to recalibrate our view on how much 6 figures really is.

What Is A 6 Figure Income?

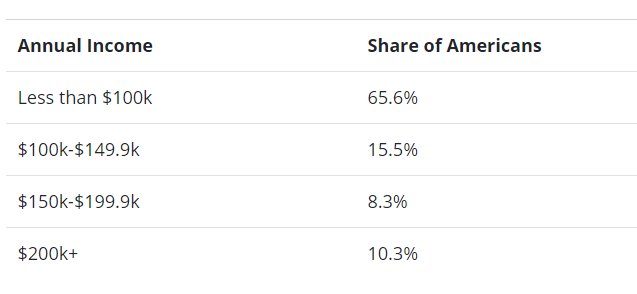

Simply put, a six figure income is any amount between $100,000 – $999,000. It so happens that just shy of over 30% of U.S. households earn at this level with the bulk of these falling on the lower end of the range.

Does A 6 Figure Income Make You Wealthy?

The 6 figure earnings mark has always been an aspirational marker of success. There is just something about crossing that $100,000 threshold that grabs people’s attention.

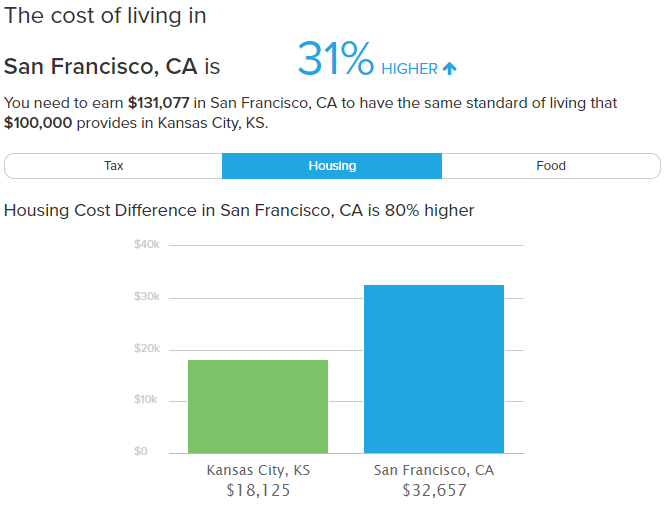

Still, it is important to understand context when it comes to measuring the value of a 6 figure income. For example, a person living in San Francisco on $100,000 will undoubtedbly have a lower standard of living than a person in Kansas City earning $100,000.

But just how much of a difference is there between the two cities?

Well, the person living in Kansas City on $100,000 would need a 31% raise to move to San Francisco and maintain the same lifestyle. In other words, $131,000 is what it would take to break even.

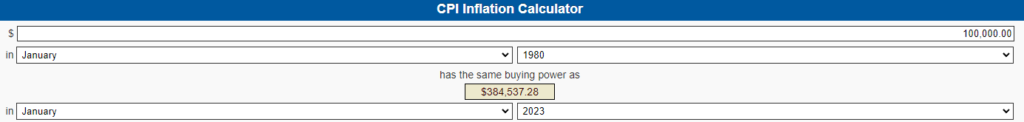

Further, the 18% of American households with 6 figure incomes in the 1980s felt far richer than today’s 6 figure households thanks to inflation. Why might this be so? It turns out that $100,000 in 1980 had the same buying power as $384,537 today.

So in sum, a 6 figure income does not make you wealthy. This is because having wealth and earning a high income are different. In fact, many of the people earning 6 figure salaries are actually quite far from being wealthy.

Many Are Broke While Earning 6 Figures

I first raised the alarm on the precarious situation of high earning Americans back in November when I pointed out that 45% percent of 6 figure earners were living paycheck to paycheck. It turns out that my estimates were slightly off. More precisely, 51% of 6 of figure earners living paycheck to paycheck.

This is a dangerous place to be for the millions of Americans who are in this position. Considering we are facing raging inflation, mass layoffs, and a bleak economic outlook for the next few years – it would be great to see more high earners get their financial situations in order.

How Much Is 6 Figures Really Worth? It’s Far Less Than You Think

I think that the reason a lot of 6 figure earners are in financial trouble comes down to how we value the 6 figure metric. . As I mentioned earlier, 6 figures has historically represented the upper echelons of the socio-economic hierarchy.

And though this was once true, things have shifted over time. More specifically, inflation has significantly outpaced real wages since 1970 which results in consumers’ purchasing power steadily eroding over time.

This means that the 6 figure income of several decades ago fails to purchase the same set of goods today. Let’s use some real price data over the last 20 years to illustrate.

We see that prices in recent times have risen more sharply than at any other period over the last 20 years. Additionally, prices currently sit higher than at any other point in time over this span.

Understand That 6 Figures Doesn’t Necessarily Make You Rich

At this point, we’ve established that the purchasing power of the 6 figure income is not what it used to be. Additionally, we know that many people earning at this level today find themselves in precarious financial situations.

With this in mind, we must ask ourselves if there is something that can be done to improve the situation?

I think a lot of high income people go broke because they fail to understand the true value of the money they earn. More specifically, many of those earning 6 figures likely believe themselves to be richer than they actually are.

Upper Middle Class

There is no set definition for what constitutes the middle class. Plus, there are many involved factors such as family size and location to consider. Despite this, we can still try our best to get a ball-park estimate. That said, the Pew Research Center defines the middle class as households earning $48,500 to $145,500.

And as it turns out, this is the range where the majority of 6 figure households fall.

Furthermore, an interesting report confirms my suspicion by showing that 56% of those earning less than 6 figures believe that they need to earn at least $100,000 to be rich. This goes to show the mystique of the 6 figure income, and just how misled people are when assessing the value of this metric.

Combine this with the fact that most 6 figure earners fall just slightly over the line and we can see how so many people are led astray. They’ve likely worked hard to make it to the 6 figure level and want to live a lifestyle that is symbolic of all the hard work.

How To Maximize Your 6 Figures

Half of those who are earning 6 figures are living within their means which means they are doing at least a decent job of managing their finances. Given that, I can confidently say that the remainder of the 6 figure club should be able to do the same with a little bit of effort.

Factors such as how much you earn, where you live, and your family size all matter. However, there are practical guidelines that everyone can follow regardless of their unique circumstances. Nuance matters, but the fundamentals will always reign supreme.

That said, here are the top 3 things 6 figure earners can do to ensure they are maximizing the value of their incomes.

Don’t Consider Yourself Rich

The moment you start thinking of yourself as rich, your actions will follow in an attempt to make this a reality.

I remember a former colleague of mine falling into this trap. He was just a few years out of college, and enjoying his first big boy job with a nice salary of around $65,000 in 2019. Additionally, the salary came with a generous bonus of almost $10,000 for the year.

While at lunch one day, the topic of bonuses came up and he mentioned that he planned on using his to buy a nice $10,000 watch as a token for all of his hard work. Interestingly, he talked at other times about how he was loaded with student loan debt and a car payment – but desired this watch over being in a better financial position.

Examples like this can cause many high earning people to go broke because their ambitions and desires exceed the value of their incomes. Making it across the 6 figure milestone is certainly something to be proud of. It just should’t trigger anyone into thinking they are suddenly rich before they actually are.

Big houses, fancy cars, nice clothes, and luxury trips should all be carefully planned into a sound financial strategy rather than purchased at whim becuase we think we suddenly deserve more.

Pay Off High Interest Debt

What’s the point of earning a lot of money if you don’t get to keep any of it?

Simply put, debt eats up cash flow. Therefore, if you are not seeing a lot of positive monthly cash flow from your high salary – then it could be because of your high interest debt.

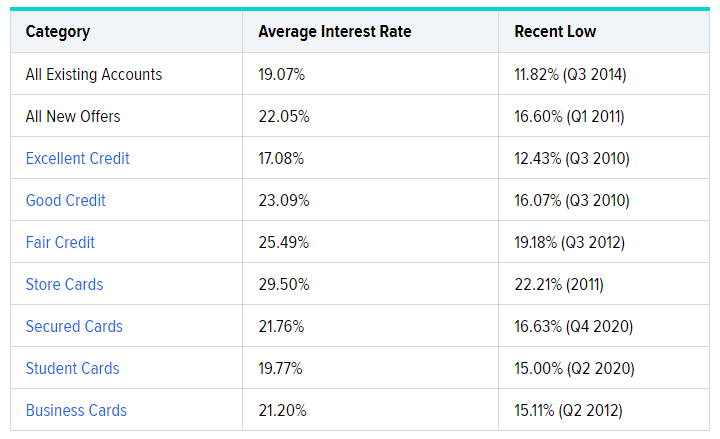

For many, the highest interest debts would be credit cards. Today the average interest rate for credit card holders sits at nearly 22% for new accounts. This is an absurdly high amount of interest to pay for borrowed money. Meanwhile, credit card debt is at an all time high which makes me wonder how many 6 figure earners contribute to this gloomy statistic.

Paying down debt is a wonderful strategy because it frees up cash flow. If you are in debt, think about your monthly income and then envision what life would be like if you were able to keep most of the money you earned each month.

Examine Your Housing Expenses

From a cost of living perspective, housing is the most expensive item in most people’s budgets. Accordingly, many 6 figure earners are likely opting for premier housing in neighborhoods with the best amenities and schools. Unfortunately, living in such places comes with a higher price tag and these costs could easily put a family in a cash crunch.

As a general rule of thumb, I recommend that you aim to keep your total housing expense at less than 25% of their take home pay. This is a very conservative target that will ensure you are as far from the financial edge as possible.

Making 6 Figures And Not Feeling Rich

I’ve had 2 people comment on my level of success in recent weeks. Both times stuck out to me because I don’t think or feel as successful as they apparently consider to me to be.

And I think this is a good thing.

I still drive my 2009 Corolla with body damage, and still live in a cheap studio apartment. I also struggle to spend large sums of money because I fear that everything can collapse underneath my feet at a moments notice.

This type of frugality and paranoia is probably not advisable, but it does enable me to get the absolute most out of my 6 figure income. As such, following the guidelines above enables me to easily save 40% – 50% of my annual salary and live comfortably.

Maybe one day I will start to ease up and enjoy life a little more, but it’s all about baby steps.