You’ve stumbled upon a lump sum of money and are trying to figure out how best to use it. We are fortunate when we receive financial windfalls. We also have to handle them with care. Afterall, it is far too easy to squander all of our money if we are not careful.

I recently received a six-month severance as a result of being laid off and wanted to make sure I got things right. I found that managing a substantial lump sum of cash was a scary proposition because of all of the potential pitfalls.

Fortunately, I’ve handled my windfall well and have even been lucky enough to see the net payout triple in the months since receiving it.

I’ll use this article to discuss what I’ve learned about managing a lump sum financial windfall. Hopefully the guidelines within will help you manage your good fortunes as they come.

Contents

Guidelines For A Lump Sum Of Money

Having established guidelines for how you will handle a lump sum of cash can be beneficial to your financial progress. Guidelines are key because they take the guesswork out of knowing what to do with your windfall.

Rather than winging it and wishing for the best, guidelines will help you make optimal decisions.

T.Rowe Price put together a nice article discussing how to benefit most from a financial windfall. What I liked most about the article is the summary of guidelines it presents as summarized below.

3 Guidelines For Benefiting Most From Your Financial Windfall

- Use your windfall to take care of your top priorities first.

- Seek to increase your financial flexibility with your lump sum of cash.

- Resist that initial urge to splurge with your windfall.

Following these guidelines when handling your lump sum will give you strong odds for success. Be that as it may, it can still be a challenge to know exactly what to do when we are suddenly handed a windfall.

With that in mind, I’ve put together the following list of items one should prioritize when deciding on what to do with a lump sum of money.

This list is organized to flow from what I recommend as highest priority items for using your lump sum, to items of lower priority. My recommendations are intended to help you cover the essential financial basics before moving on to riskier and more advanced options.

What To Do Before Receiving A Lump Sum

It pays to start thinking about your lump sum before it comes.

This doesn’t mean that you should start envisioning all of the things you could buy with your newfound money. Instead, I recommend that you start by establishing a general financial plan even if you aren’t currently holding a lump sum of cash.

A financial plan is a high level goal that helps guide your decisions with money. Examples of a financial plan could include maxing out your 401K or paying off your mortgage. It could also mean having the goal of saving up for a child’s college or an upcoming medical expense.

The specifics of each of our plans will differ, but the important thing is that we all have one. A plan gives us the benefit of having a direction. Much like setting the GPS in our cars when we set out for a trip. A financial plan will guide where we will go with our lump sum of cash.

Do Nothing With Your Lump Sum

When I was a kid, my grandmother used to say that I spent my money “as if it were burning a hole in my pocket”. My sagely old grandmother was simply alluding to how quickly I would spend my money. And she was right. Like most kids, I would spend what little I had with practically no regard for the bigger picture.

After going broke, I walked away with a valuable lesson about patience with money. I learned that going slowly and getting things right always beats rushing – especially when large sums of money are involved.

Squandering a windfall is a painful proposition.

If you don’t have a plan, or aren’t sure what to do with your lump sum of cash – doing nothing is the recommended approach.

And by doing nothing, I mean not committing the money toward any major uses until you are organized, informed, and confident that you are using your windfall wisely. In the meantime, your job is to establish a financial plan and educating yourself on how to best achieve that plan.

Over time, my lump sum of cash has grown to nearly $100,000 as I’ve added more to it. And because I am still figuring things out, I am perfectly happy letting the money sit in a savings account earning a risk free 4.40%.

With the cash safely stowed away, I am now formulating the next iteration of my financial plan. I’m envisioning what I want for my future and being careful with this decision.

Set Aside A 6 Month Emergency Fund

As tempting as it may be to use our entire lump in a single go, it is smarter to keep a portion of your windfall aside as protection from emergencies. We must be careful to remember that an emergency fund is a vital resource to have at any stage of our financial journeys.

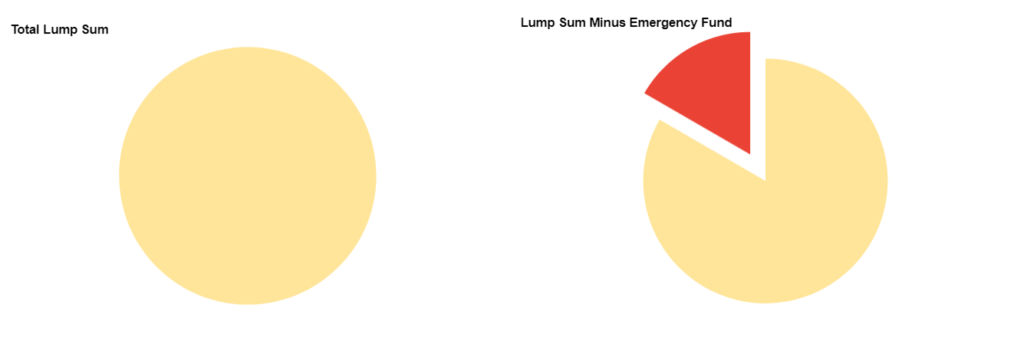

As my lump sum grows, my desire to purchase a house with cash becomes increasingly stronger.

As a result, I find myself making the frequent mistake of looking at my total sum of cash as potential funds for the purchase. I then have to reign myself in and exercise financial discipline to ensure I stay on track with my finances.

Using my entire lump sum on a home purchase would leave me without reserves – thus making me vulnerable to life’s inevitable ebbs and flows.

It is perfectly possible that I could move into the new house and suffer yet another layoff similar to the one that occurred earlier this year. Thankfully I had an emergency fund to lean on back then. I would be wise to ensure I have one going forward as well.

You never know when things like job loss, car accidents, or roof leaks will occur. I recommend that you aim to have a 6 month emergency fund to help alleviate stress during moments such as these. A big pile of cash also helps float you until you can fully recover rather than having to go into debt.

Using your windfall toward building a 6 month emergency fund should be your absolute first step before taking any other action. Once the emergency fund is secure, we can move on to debt, which is the next priority in the financial order of operations.

Debt Payoff Is The Best Use Of A Lump Sum

With an emergency fund in place, there is perhaps no better use for a lump sum of money than paying down debt. Debt paydown is the best use of a lump sum because of its guaranteed return on investment.

That’s right, I said debt pay down has a guaranteed return on investment.

For starters, every dollar paid toward the principal on debt provides a guaranteed ROI in the form of future savings totaling the interest that would have been paid against those dollars.

Lump Sum Debt Payoff Example

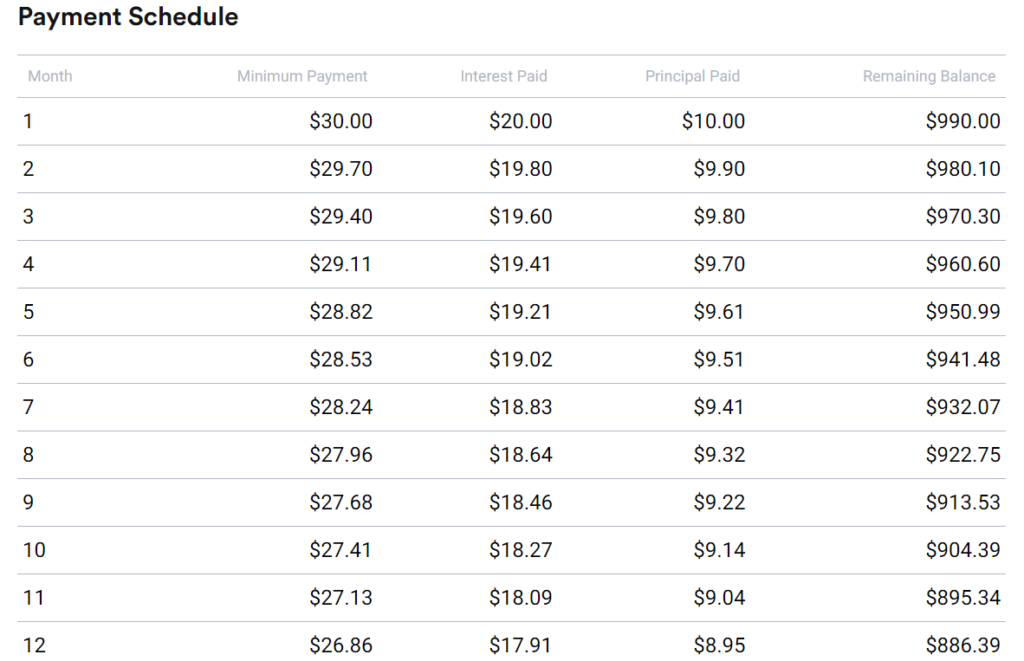

A simple example would be to consider a person with a $1000 dollar credit card balance. At 24.25%, which represents current average credit card interest rates, a person would incur the negative 24.25% outflows for a total of $227.24 over the course of the first year.

Because of this, applying a $1,000 lump sum to clear this debt has a 24.25% ROI since it saves the person from having to incur the negative outflows. Sure, they won’t see the net amount in their bank account increase, but they will prevent it from decreasing which is just as significant.

Thus, using the lump sum for a $1,000 debt payoff would yield a guaranteed, risk free ROI of +25.45% in the case of credit card debt. Correspondingly, this applies to all forms of debt no matter the interest rate.

A guaranteed ROI is just one of the many reasons why debt pay down could be the best use of your windfall. Still, there are additional benefits to paying off debt which include having greater freedom and more confidence.

Use Your Lump Sum To Invest In Yourself

Before investing in the markets or real estate, the best use of your lump sum of money would be an investment in yourself. More specifically, it would be a wise move to use your windfall to improve your knowledge, skills, abilities, and health.

Investing in yourself comes before financial investing because of the asymmetrical returns it could provide. A prudent self investment could not only lead to great financial returns, it could also enhance your personal sense of esteem in ways no financial investment can.

For instance, a $30,000 lump sum of cash could be used to pay for an advanced degree that will accelerate your career. Such an investment could easily net a 15 -20% pay raise after 2 years thanks to a promotion.

More significantly though would be the fact that you will have líkely locked in this salary level as your floor as you continue to march toward greater heights. Having valuable skills and experience goes a long way.

Plus, the higher salary is practically risk free relative to most financial investments.

Considering the stock market historically returns 10.5%, using your lump sum to unlock 15-20% greater earnings beats most financial investment over the long haul. Valuable skills also endure much better during recessions.

You just have to continue to show up and produce, while not making faulty decisions that cause you to backtrack. See my success stacking principle for more on how this works.

Your Lump Sum For Your Health

No amount of money in the world can replace good health. Just ask yourself if you’d instantly give away 30 years of your life for an instant multi billion dollar payday?

Very few of us would accept that proposition.

That said, using our windfalls to boost our health is a winning proposition. Medical procedures that we’ve put on the back burner, exercise programs, and fitness classes are all great uses.

This year I will finally get LASIK surgery to permanently improve my vision. For several thousands of dollars, this portion of my lump sum can unlock crystal clear vision and eliminate the need to deal with contacts and glasses. I also plan to sign up for yoga classes to help improve my mobility as I age.

We are only given one body to live in and one shot at life. Hoarding lump sums of cash may boost our financial positions, but life is constantly progressing and none of us are getting younger. Therefore, a more productive use of your windfall could be improving your health today rather than putting it off for later.

How might you use your lump sum of money to boost your health?

Buy A House With Your Lump Sum

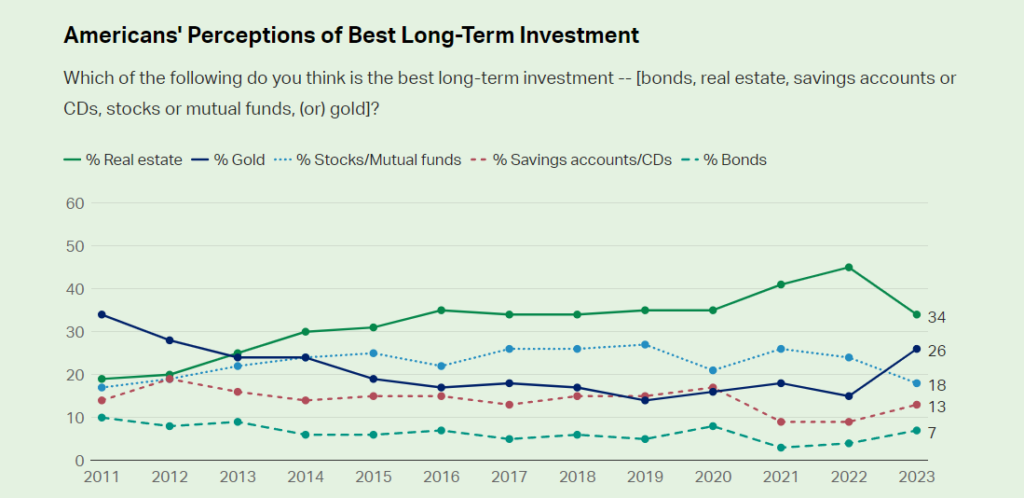

For most people, a home purchase is the best investment for their lump sums. Americans consistently vote homeownership as the best investment with 34% choosing housing versus compared to 18% for stocks.

This is for good reason.

Historically, real estate values have risen at an average rate of 5.4%. And while the stock market has returned 10.12% over this period, homeowners have enjoyed less volatility with an asset that also provides utility.

Buying a home with your lump sum can serve a dual purpose. In spite of the upsides of renting, homeowners have accumulated 40x more wealth than renters thanks to the fact that owning a home serves as a forced savings vehicle. Even if renters could theoretically fare just as well over the long run, most lack the discipline to save in magnitude that ownership naturally forces.

If you have a lump sum of money and no debt, investing in a home purchase may truly be your next best move.

Invest Your Lump Sum Of Money

With an emergency fund in place, and no debt, investing should become pretty easy thanks to increased cash flow. Not having anyone’s hand in your pocket is a great way to enjoy the full power of your income.

That said, knowing how to invest or what to invest in is not always clear.

I’m still in the do nothing stage mentioned above as I educate myself more on investing. Therefore, I’ll pose a theoretical overview of how I think I would invest my lump sum of cash if I were to deploy the funds today.

I believe the following are sound options when considering investments for your lump sum of cash.

Invest Your Windfall In A Money Market Account

Investing your financial windfall in a money market account is a great way to earn risk free passive income. Investing my $100,000 lump sum in an account earning 4.5% is generating me $4,500 a year with no effort involved.

This may not be impressive relative to real estate or bull market returns of recent years, but it is still nothing to scoff at considering the overall low risk and maintenance. For those who are later in your financial journey’s, investing your windfalls in this manner should be quite attractive. It is also attractive for someone like me who is relatively new to investing and still learning.

Max Out A Roth IRA

If you are like me, and received a post tax lump sum of money such as a severance, then a Roth IRA could be a great investment choice.

There are 3 types of Individual Retirement Accounts (IRAs), but the Roth may be particularly advantageous for your lump sum because of the tax free growth and tax free withdrawals they provide. In addition to tax free growth, there are several other benefits of the Roth IRA as nicely summarized by Vanguard and appearing below:

Benefits Of Putting Your Lump Sum of Cash In A Roth IRA

- You can decide when to take withdrawals.

- You may qualify for additional tax credits.

- You may be eligible for a “backdoor Roth IRA” conversion.

- Your beneficiaries won’t be taxed.

- You may be eligible to invest in both a Roth IRA and a 401(k).

- Choose from a wide variety of investment options.

As with any investment, there are also potential downsides of investing your lump sum of money in a Roth IRA.

For starters, Roth IRAs are subject to income ceilings which may make them ineligible as investment vehicles for your lump sum of money. Additionally, higher income individuals may end up paying more in taxes than necessary as a result of investing in a Roth IRA. Finally, Roth IRAs don’t allow for tax deductions.

Use Your Lump Sum Of Cash To Max Out A Traditional IRA

Like me, you may first consider opening a Roth IRA and then find that your income exceeds the qualification ceiling. Or, you could realize that a Roth isn’t your best choice because you will likely pay lower taxes at retirement than you do now.

What options might you have in such cases? Fortunately, the Traditional IRA is a great alternative to the Roth IRA because it avoids these hurdles.

Unlike Roth IRAs, Traditional IRAs have no income limits which should make them attractive to higher earning individuals. Plus, traditional IRAs offer tax-deductible contributions which means they lower your tax burden in the current year.

Given my situation, the Traditional IRA is a more attractive use of my windfall than the Roth. However, there are still some cons that would make them less than ideal for some.

Traditional IRAs have required minimum distributions (withdrawals) that start at age 72 ½. You will also have to pay taxes on the money that you withdraw at retirement. And unlike with Roths, you will pay taxes if you withdraw from a Traditional IRA before 59 ½.

Invest Your Windfall In Index Funds Or Mutual Funds

After doing your research on IRAs, you might conclude that you don’t like the idea of tying up your money in a government savings vehicle until you are 59 ½. You may be like me and desire more freedom much earlier in life. I personally don’t like to be constrained, and the same applies to my investment options.

As a result, you may be looking for an alternate solution to the IRA. This is where index funds and mutual funds come into play.

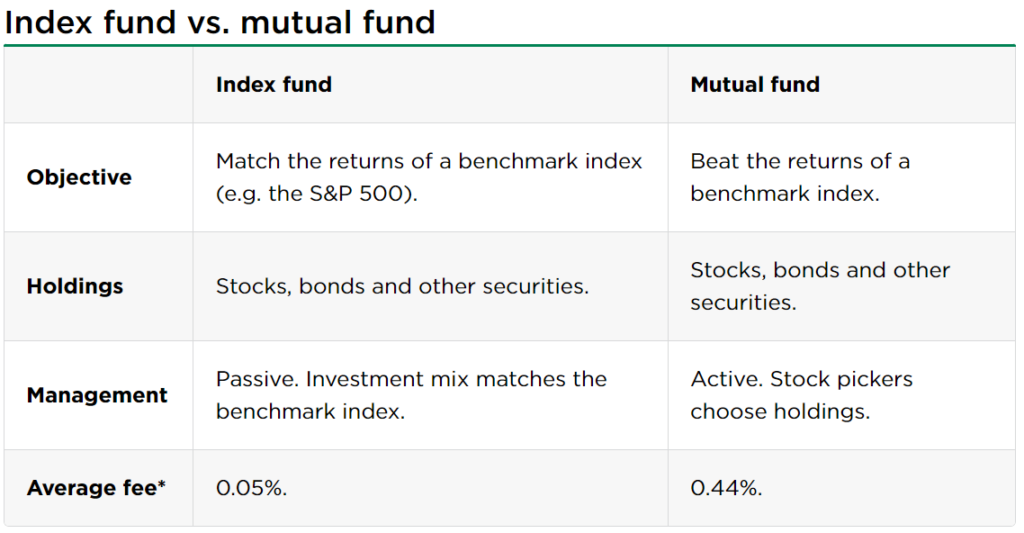

Index funds and mutual funds are investment vehicles that will allow you to deploy your lump sum of money for potentially greater returns than simply keeping the money in cash. They key differences between these investment vehicles centers upon how they are managed, the fees involved, and the specific holding options within.

Which is the right choice for you will depend on your specific goals and preferences. A mutual fund has the benefit of having someone else do the work for you. On the other hand, index funds may take more work on your part to ensure your lump sum performs as intended.

This is why learning about investing is so important. Investing is all about understanding your tradeoffs. Therefore, you want to understand the full scope of your investing options and match these with your goals, risk tolerance, age, and preferences.

Use Your Windfall To Start A Business

Starting a business is the riskiest, yet highest upside item on the list of recommended things to do with your lump sum of cash. It is said that small businesses are the lifeblood of the American economy – and for good reason. Check out these impressive small business stats published by the Small Business Administration:

- 99.9% of American businesses are small.

- There are 33,185,550 small businesses in the United States.

- Small businesses employ 61.7 million Americans, totaling 46.4% of private sector employees.

- From 1995 to 2021, small businesses created 17.3 million net new jobs, accounting for 62.7% of net jobs created since 1995.

- Small businesses pay 39.4% percent of private sector payroll.

- Small businesses generate 32.6% percent of known export value.

Though risky, there is clearly big business in the small business sector. So why not use your lump sum of cash to become the next successful business owner?

Most of us have had at least a few business ideas over the years. Most people fail simply for the fact that they never even try. Having a lump sum of cash to launch you forward could be just the thing you need to get your business ownership dreams off the ground.

Maximize Happiness With Your Lump Sum

No matter how you slice it, we all want to be happy in life. Therefore, there may be no greater use for our lump sum than buying a little happiness.

Happiness has many forms. For me, it would mean feeling healthier and having more free time to do the things I love. It would also mean living in a nice place.

For you, happiness could be achieved eating out at nice restaurants or taking extravagant trips.

Whatever it may be, I suggest that you use your lump sum to achieve it. And don’t wait. Use a good deal of your windfall to increase your happiness today because time isn’t waiting.

Investing for the future, paying off debt, and boosting skills are vital – but they can be a bit boring. Add some excitement to your life by spending your windfall for happiness.

The caveat here is this should be done prudently and with wisdom. If you are broke, not living up to your financial expectations, or behind where you should be for your age – prioritize the other items in this list first.

Then use future windfalls for maximum happiness.

In other words, avoid going yolo and squandering your lump sum in the pursuit of fun. Or, as my grandmother would say, “don’t let the money burn a hole in your pocket”.