Financial Milestones By 35

When it comes to your finances, you may be wondering where you should be financially at age 35. This is a great question to ask because 35 is truly the age of maturity. This post will dive into the specifics of where you should be in terms of net worth, savings, and other important milestones at age 35.

Most 35 year olds have left the party scene behind and are beginning to settle into careers. A good portion of us have even found life partners to start families with. Additionally, home ownership has become a reality.

These things motivate us take life much more seriously than we used to. Maybe it’s because we are starting to realize that life is actually pretty short or that we aren’t invincible like we once thought.

One thing that is for certain is that we are all more concerned with our financial positions than ever before.

Contents

Recommended Savings Rate At Age 35

The first, and most important consideration in your financial order of operations should be your savings rate. This is because your degree of success in every other long term financial metric will depend on your ability to save money.

With that understood, I’ll start by saying that you should generally aim to save as much as possible so you can achieve financial independence much earlier than average. Even if you plan on working into your later years, having the option to retire early can be empowering.

Above all, I recommend that you achieve a savings rate of at least 20% by the age of 35.

The basis of this recommendation is to steer you away from the longstanding 10% savings rule which is far too low for anyone looking to build wealth. Sure, 10% is better than the historical average U.S. savings rate of 4.6% – but it still won’t get you to the finish line. Plus, the average American retiree is severely behind on their retirement savings which shows that you’d want to be well above average in terms of savings.

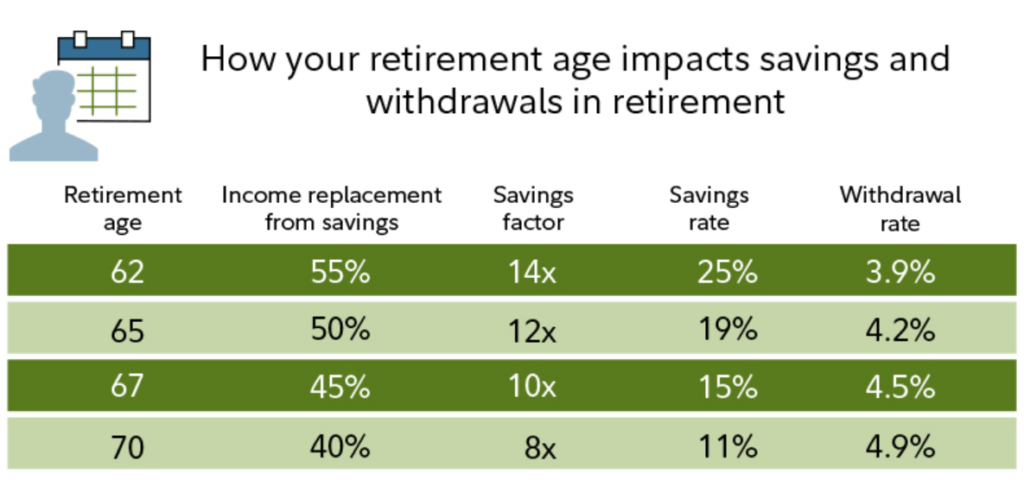

Additionally, a high savings rate will generally produce better long term results across two distinct dimensions. For one, a higher savings rate will speed up your time to retirement. And secondly, more savings prior to retirement produces more disposable income during retirement. The following chart by Fidelity breaks this down nicely.

How Much Should I Have Saved By 35?

For starters, we will define savings as any assets accumulated in investments, bank accounts, home equity, and cash. As a general rule, your goal at 35 is to have your total savings equal 2x your annual salary. For example, a person earning $70,000 per year would want to have saved $140,000 before age 35.

This recommended savings target ensures that you are on pace to make it to retirement with adequate funds to live a lifestyle similar to the one you have today. Afterall, no one wants to have to work hard for 30+ years and then suddenly have to skimp in retirement just to make ends meet.

Unfortunately, this may still end up being a reality for many current 35 year olds if we don’t start to take our financial futures more seriously.

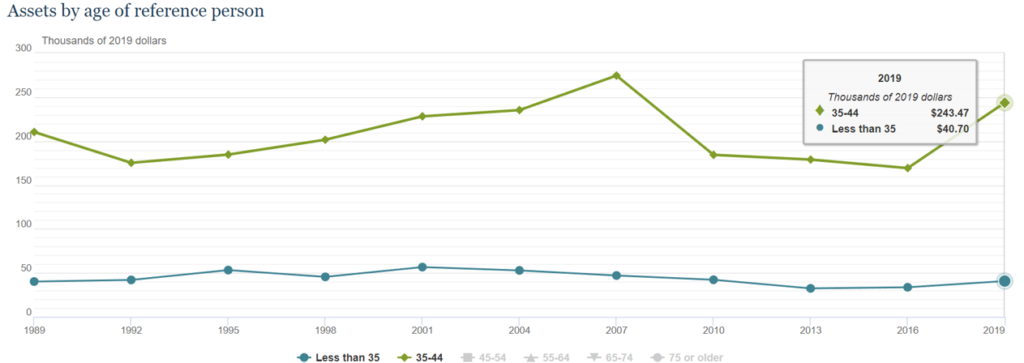

That is, the Federal Reserve reports that the average person under age 35 has total assets (including home values) of $40,000. Sure, there are a lot of younger people who will skew this data downward, but the savings metric should still be higher considering the average person in this group earns $48,000.

For balance, I will also mention that the average person aged 35 – 44 has much higher assets at $243,000. So with that, I think we can safely estimate that the average 35 year old has around $45,000 – $60,000 in savings.

Alternatively, another reasonable savings benchmark would be to have at least 2x the $48,000 median salary for the below 35 age group by the time you turn 35. This would put your savings target at a respectable $96,000 which I would say is impressive relative to the rest of the pack.

The Ideal Net Worth By Age 35

Net worth is defined as your assets minus your liabilities. Said differently, subtracting the value of your debts from the value of your assets will produce your net worth figure. As such, exploring the same Federal Reserve data from earlier reveals that the average 35 yr old has a net worth in the ballpark of $20,000 – $35,000.

Surprisingly, this range may be adequate depending on the individual. But of course, this is highly circumstantial and will vary from person to person. That said, there are a few ways to dial in your ideal net worth by age 35, so let’s explore those next.

Net Worth For A Top Tier 35 Year Old = Age x Pre Tax Income / 10

This net worth target was introduced by Thomas Stanley, author of Millionaire Next Door. Stanley’s formula was derived from national surveys of millionaires that took into account participant net worth and age.

Interestingly, this formula has received a good bit of criticism over the years because of how aggressive it is – especially for younger borrowers. In response, Stanley actually validated the criticism by saying that his formula is indeed heavily skewed by older individuals and may not be realistic for those earlier in their careers.

Therefore, the vast majority of 35 year olds won’t meet the net worth target produced by this formula. But be that as it may, a good portion of 35 year olds will have a net worth that exceeds this metric – in fact I personally know a few myself.

Beyond that, an even larger number of 35 year olds should be here.

That is, those who have been earning top dollars for most of their careers could reasonably have a top tier net worth. They aren’t here because they have mistakenly perceived their high earnings as making them rich and thus have spent lavishly rather than saved aggressively.

Hats off if you are a 35 year old with a top tier net worth. This is certainly an exceptional feat and serves as an aspirational target for those of us who aren’t quite there yet. And speaking of the rest of us, let’s now discuss a more modest net worth target.

Ideal Net Worth To Have By Age 35

As a bare minimum, you should aspire to have a net worth that is 3x annual spending by age 35 to ensure you are on pace for a comfortable retirement. For example, a person making $60,000 per year may have annual expenses totalling $30,000. In this case, they would want their net worth to be $90,000 by age 35.

This currently seems to be the generally accepted metric and you can check out the methodology yourself. Personally, I like this methodology because it accounts for your current lifestyle and is not as heavily influenced by your income.

This shows that everyone can set themselves up for a good retirement regardless of how much money they make. With the right lifestyle choices and a good dose of consistency, we can all get there.

Other Finance Related Milestones To Achieve By Age 35

While the factors already mentioned directly relate to the dollars and cents in your bank account, there are still a few other milestones that indirectly impact your finances that you’ll want to focus on tackling by age 35.

Optimal Health By 35

At 35, you’re really just entering the prime of your life and your health should reflect that. This is not the time to take your foot off the gas and allow life to just happen.

Instead, 35 is the prime age to achieve the best health you’ve had since your high school or college days. This is because you likely have the means to tap into resources such as dieticians, meal services, personal trainers, and fitness classes.

Competing responsibilities at age 35 will certainly put a squeeze on your time and discretionary funds. Still, a focus on health is worthwhile for the long term returns on investment.

That’s because those who enter older age in good health usually stay in good health. While on the other hand, those who enter old age in poor health rarely flip the switch and ultimately incur steep health related financial costs for many years to come.

Marriage And Family Goals

At minimum, we should all have at least an idea what our plans are when it comes to marriage and family.

Many 35 year olds are already married and raising young families while others are still single. Either spot is fine, but it would be advantageous to be intentional about what you’re doing.

If you’re a bachelor for life, then lean into this and plan your finances accordingly. Likewise, if you know you want a large family – then ensure you are marrying someone who is on the same page.

After all, the last thing anyone wants is for you to show up on a first date and report that you don’t know what you’re looking for. This may land well in your 20s, but few 30 something year olds have tolerance for uncertainty. Even worse would if you’ve married someone who has different family goals than yours.

Set your course so you can ensure the ship of your life is heading in the right direction. And in terms of finances, this can really help you avoid financial catastrophe since we know money is a major cause of divorce.

A Career You Love (Or At Least One You Don’t Hate)

Simply put, every person deserves a career that they don’t hate.

This may sound a bit different than common advice saying everyone should have a job that they love – and that’s because it is different. Career passion for all would be a very wonderful thing, but it is unrealistic in real terms.

This is because we are all bound by constraints such as money, opportunity, education, location, and time when finding the right job. Our career choices are even limited by more obscure constraints. Just ask the millions of high school athletes who are either too short, slow, or unathletic to realize their dreams of making it to the pro ranks of their chosen sport.

That said, a better target that all should reach for is to land in a career that you don’t hate. Even this would be a tremendous shift in how this are today considering upwards of 50% of workers hate their jobs.

At 35, most professional have had more than a decade at the chopping block. This is more than enough time to have moved around a few times searching for a career that’s reasonable.

What If I've Fallen Behind At Age 35?

As my 35th trip around the sun comes to a close this year, I look back on my journey with gratitude. Much has changed for me in just a few short years and I am more convinced than ever that we are all capable of achieving a lot of progress in a short amount of time.

I’m in the black for the first time in my life. But like many, I still have ground to make up on several financial milestones. So what are we to do if we realize that age 35 is near or already behind us and we’re not where we should be?

For starters, let’s all just stop and smell the roses because life can still be pretty amazing even if we are working on fixing our finances.

From there, it’s time to buckle down and get to work so you can catch up by age 40. To do this, you to examine the current state of each metric listed above so you know how much ground you need to go to get back on track.

Once you know your current status, you must then devise a plan for how you will get things on track. For some, this will mean earning more money to accelerate progress. For others, it may mean slashing expenses and downsizing. And not to mention the auxiliary items that need to be focused on.

Whatever your required steps, now is the time to get started because if there is one thing we know about time – it’s that it waits on no one.