Cash Is The Best Payment Type If You Are Trying To Stick To A Budget

Simply put, cash is the best payment type for sticking to your budget. I’ll use the rest of this article to explain why cash is king when it comes to sticking to a budget.

Contents

Lessons From a Recovering Budgetary Failure

In the interest of honesty, I must start things off by admitting that I went the entire distance of my debt-free journey without using a solid budget.

I was careful to say “a solid budget” because I did use “a budget”, but the issue was that my budget wasn’t very precise. And I almost always spent more than I originally planned to at the beginning of each month.

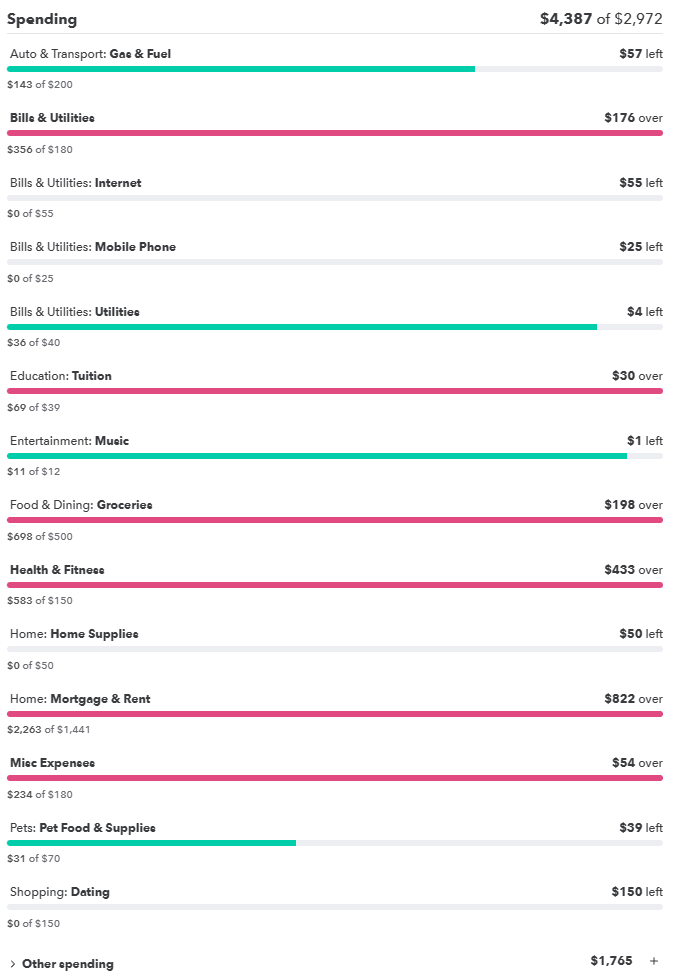

See for yourself below.

As you can see, I didn’t do a great job of sticking to my budget.

Something always came up that caused me to have to spend beyond my intended target. Or, I’d just simply lack the discipline required to keep myself on track.

I suppose that not budgeting well wasn’t that big of a problem since I did eventually accomplish my goal of becoming debt free. But I must also pan out and consider the fact that my debt free journey was likely delayed by 4-6 months due to overspending.

The great news is that I now run my budget with a lot more precision using cash as my primary spending type. My current process – which I’ll eventually share on the blog – makes it easy for me to stick to my budget and reach my goals a lot faster.

And that actually brings me to an important point that we must address before we can proceed.

What Makes a Budget Successful?

Budgets are not just nice things that we do for the simple sake of doing them. On the contrary, they serve as tools that are at our disposal to help us take charge of our money.

That said, there 2 key factors ultimately determine if a budget is actually successful.

Your Budget Helps You Reach Your Goals

Above all, the goal for any budget is to help you manage your money as you progress toward your financial goals. Some common financial goals are as follows:

- You want to live out your financial values.

- You want to live within your means.

- You want to avoid financial stress.

- You want to save for something specific.

- You want to retire early.

No matter your level of discipline and precision with your budget – it will be all for nothing if your budget isn’t bringing you closer to the financial goals you have for yourself.

Therefore, a successful budget is one that helps you accomplish your goals.

Your Budget is Easy To Stick To

No budget system can claim to be successful if it isn’t simple enough to be easily adhered to for the long haul.

Imagine for a moment that I promised a budget system that guaranteed 100% precision, but required you to complete dozens of steps each day to maintain it.

Would you stick to it?

It’s unlikely that this budget system would work for the long haul because of the simple fact that it would be very time consuming and complicated to manage.

The best budget systems are those that not only help you reach your goals, but also allow for easy adherence.

That being said, we can now explore why cash is the best payment type for sticking to your budget.

Payment Types and Technology

In his excellent book entitled Going Broke, author Stuart Vyse proposes several compelling ideas behind why Americans struggle to hold on to their money. Let’s examine one such quote:

Research on self-control tells us that, given the right set of choices, we are all prone to irrational, impulsive decisions, and a close examination of our recent history reveals that we have designed the world in such a way that we can always have the smaller reward right now instead of the larger one later on.

Stuart Vyse, Going Broke

The designs mentioned in the above quote happen to be the technological changes that we’ve experienced in recent decades.

No one will argue against the fact that technology has streamlined things when it comes to money. Yet, the question remains whether or not these new payment technologies are actually beneficial for our long term financial success.

I’ll explore this question next using credit and debit cards as the primary payment types for considerations.

Credit Cards Are Bad For Sticking to A Budget

For starters, let’s quickly remind ourselves of the 2 essential factors required to consider a budget successful. They are:

- Your budget helps you reach your goals.

- Your budget is easy to stick to.

With this in mind, any payment type that we consider for our budgets must check both boxes – otherwise the budget is failing.

So how do credit cards stack up?

Credit Cards Are Easy

Firstly, credit cards are super simple to use and therefore would meet requirement of being easy. It takes almost no effort whatsoever to keep the credit card in your wallet and swipe away when the need presents itself.

Further, it’s relatively easy to manage the credit card bill by logging in to your account to make payments. The only potential difficulty is ensuring payments are submitted on time, but this can easily be handled by setting the account to autopay.

Credit Cards Fail at Helping You Reach Your Financial Goals

I’ll admit that I’m making a lot of assumptions here because I can’t possibly know what everyone’s financial goals are.

Even so, I think I am safe to assume that everyone reading an article about sticking to a budget is at least interested in staying within their planned spending targets for the categories in their budgets.

So how do credit cards stack up? In short, they fail miserably.

Let’s explore why.

1. Credit Cards Make Spending Too Easy

We’ve all heard the saying that there is such a thing as too much of a good thing.

The same can be said for credit cards in that their ease of use and convenience also happens to be their biggest weaknesses when it comes to helping us reach our goal of sticking to our budgets.

I’ll turn again to Stuart Vyse for an explanation.

In ways we hardly notice, the modern world has been smoothed to minimize any friction that might slow our path toward purchases. The effort of travel has been reduced, the work of spending has been eliminated, and losing one’s money can be accomplished with a flick of the wrist.

Stuart Vyse, Going Broke

2. Credit Card Usage Results in Higher Spending

As shown above, the benefits of convenience provided by credit cards may actually overshoot things by making spending a bit too easy. But, I’ll admit that this is just a hypothesis and could use some cold hard data to really make a valid case.

As such, it turns out that a good deal of research has been done on the matter.

A study using MRI brain scans found that credit cards increase spending by activating the pleasure centers of the brain. These are the very same parts of the brain that become activated when someone uses hard drugs such as cocaine.

Further, a study by the Federal Reserve Bank of Boston examined data across various payment types and found that consumers spent an average of 400% more when using credit cards compared to cash.

There are many other examples worth citing, but we can already envision how an increased motivation to spend leads to higher spending.

Why Cash is the Best Payment Type for Sticking to A Budget

I’ve already made much of the case for why cash is the best payment type for sticking to your budget in the previous section. Still, it’s worth diving a bit further into the details to connect all of the dots.

Spending With Cash Is an Intimate Process

Paying with cash comes with several significant benefits that mostly have to do with our psychology. For starters, using cash as our payment type is an intimate process.

For example, buying a cup of coffee with cash means you have to hand over your hard earned money which means you actually see the money leaving your possession and simultaneously experience the psychological pain of parting ways.

This process of seeing and feeling pain or pleasure with spending is referred to as psychological coupling. I’ll return to Stuart Vyse yet again for an explanation.

The unreality of spending with a card has led some people to eschew the use of credit and debit cards altogether. They carry cash and pay cash whenever possible… this may not be a practical solution for everyone in all situations, but for those who want greater control over their out-of-pocket expenses, there is much to recommend the return to a cash economy.

Stuart Vyse, Going Broke

What Vyse is getting at here is that it may be better to use cash since it prevents us from mentally separating a purchase from the actual payment – as is the case when spending with credit cards.

Cash Is Slower and More Cumbersome

I know what you’re thinking – ‘this does not sound like a positive benefit’.

And you would be right in thinking that way, but it is important to recognize that I said slower and more cumbersome in a relative sense.

What I’m getting at here is that using cash is slower and more cumbersome than other payment types and this happens to be a net strength when all is said and done.

Imagine for a second the world many decades before credit and other digital forms of payment were available. Any spending done back in those days required cash which meant that you had to go into a store, physically retrieve your money, and then handle any change.

Sounds annoying doesn’t it?

Well, it turns out that this more cumbersome process is actually why cash is the best payment type for sticking to your budget.

Today, the tiniest momentary impulse to buy can be satisfied almost instantly… one simple method of self-management - for those who can do it - is to make yourself wait, whether online or at the store.

Stuart Vyse, Going Broke

Given that, imagine again yourself back in the days before digital payments and ask yourself how many fewer purchases you would make for the sheer sake of avoiding the hassle of spending.

Cash is The Best Payment Type Because It Leads To Success

Finally, let’s return yet again to our essential factors required to consider a budget successful. This time we are considering a budget using cash as the primary payment type. The requirements are:

- Your budget helps you reach your goals.

- Your budget is easy to stick to.

Virtually all financial goals that do not include spending all of your money or going broke will require that you exert some form of control over your finances.

Cash helps you do this by bringing you a lot closer to your money (coupling), and by slowing down the speed of spending inherent in digital payments.

This means that cash puts you in the driver’s seat of your finances and positions you to make spending choices with a lot more wisdom and oversight.

But is Using Cash Easy to Stick To?

The answer is that it depends.

A budget using cash as the primary payment type wouldn’t work for you if your goal is to maximize convenience while limiting cash flow visibility – all while increasing exposure to debt and risk.

Conversely, if your goal is to establish and maintain a budget that helps you achieve your – then a budget featuring cash is really easy to stick to because it actually works.

It’s up to you to decide what’s more important, but I wholeheartedly recommend cash as the best payment type for sticking to your budget.

Drop a comment and let me know your thoughts on using cash. Is there a better method?

What Am I Missing?

I’m just a guy, which means I’m highly likely to have a narrow view of things. As such, this is just my approach to managing money.

At any rate, I’d love to hear from you!

Drop me a comment below and let me know what your favorite payment type is and why? What might I be missing out on by sticking to cash?

I look forward to learning from you!