Saving 50K

I love a good challenge and have undertaken several over the past few years aimed at improving my life.

First it was the challenge of meditation for 90 days for greater tranquility. Then it was the challenge of eliminating alcohol which improved my finances and my health. And finally, I topped things off with a month long no eating out challenge in an effort to rein in crazy restaurant spending at the end of last year.

Now I’ve set my sights on something bigger in the form of a challenge to save $50,000 over the next 10 months. Sounds crazy? Well, keep reading to figure out how I plan to pull it off.

Contents

Why I’m Saving $50,000

My personal motivation to save $50,000 comes down to an impending investment opportunity that I’d like to capitalize on in the near future. And since I’m currently short by this amount, I have plenty of motivation to achieve my goal.

In addition to meeting this financial goal, there are additional benefits of saving $50,000 that I look forward to enjoying along the way.

6 Wonderful Benefits Of Saving $50,000

- Saving $50,000 Is The First Milestone To Saving $100,000: Before we make it to the infamous $100,000 savings, we must pass the $50,000 milestone. Being halfway to any major accomplishment is a great place to be because by then we’ve proven to ourselves we can make it. Who knows, maybe I will decide to keep going once I hit the $50K mark.

- Saving $50,000 Forces Financial Discipline: Since I’ll no longer be a top earning man, saving $50,000 will be quite the feat. Making it to this milestone will take considerable time, commitment, focus, and discipline. These are all good things to help me further develop my financial muscles.

- I Will Have To Act Broke To Get Rich: Perhaps I’d want to splurge on a second fancy vacation to Mexico later this year. Or, maybe I’d get car fever like so many other Americans. While I can technically afford to do both, I will skip those purchases because I recognize that acting broke is an easy way to accelerate my progress toward that $50,000 goal.

- Having $50,000 Will Make Me More Resilient: Unexpected children, job loss, or even natural disaster are scenarios that can create financial stress. Given that, having a huge pot of money is a great buffer to help protect me from inevitable surprises in this unpredictable world.

- It Will Help Me Feel More Free: My version of freedom is about expressing my thoughts, having flexibility, and maximizing my ability to take action. There is no doubt that having an extra $50,000 lying around could enable all of these things.

- Saving Money Could Help Me Stay Healthy & Fit: While the average American is spending $352 per month on restaurants and alcohol, I’ll be busy saving $50,000 which means I won’t have much room in the budget to pay someone else to cook my food. And along with saving those dollars, I’ll also save on calories which means I would likely become both healthier and fitter in the process.

My Gameplan For Saving $50,000

Now that I’ve established the great benefits of saving $50,000, it’s time for the fun to begin.

What follows is my tactical plan for how I will go about saving such a large sum of money over the next 10 months.

I’m writing this post mid February 2024 which means I have about 2 weeks before the 10 month ticker begins. In this time, I need to arrange things in my life to enable me to successfully achieve my $50,000 savings goal by year’s end.

I gauge that my current odds of success are between 50 – 70% based on the duration of the challenge and unpredictability of my income.

These odds are lower than I would like, but all it takes is one little thing to go wrong and I can be thrown off course. As such, I’ll account for risk in my plan and plow ahead because as they say – nothing ventured, nothing gained.

So, let’s just get on with it!

Step 1: Ensuring I’m Truly Committed To Saving $50,000

A key step of mine before undertaking any major endeavor is ensuring I’m sufficiently motivated and committed to the process. Because if I’m not, what’s the point in starting?

I’ve already covered my motivations above, so I won’t belabor the point. But just know that I’ve gone through a lot of introspection before committing to this challenge.

Step 2: Identifying My Strengths And Weaknesses

I’ve been contemplating how I will go about saving $50,000 for a few days now. My thoughts have primarily centered around the weak areas in my finances that stand the greatest chance of derailing my progress. But, writing this post has caused me to think about my strengths as well.

Let’s analyze those strengths and weaknesses next.

Financial Strengths That Will Help Me Save $50K:

- Low Expenses & No Debt. A major benefit of a debt free lifestyle is that I get to enjoy the full sum of every dollar I earn. Once the rent and a few other small bills are paid, there is really nothing else laying claim to my dollars. Combine that with extremely low expenses, and you can imagine how a single guy can save $50,000 in 10 months.

- Sufficiently High Income That Will Make Saving Tolerable. Though I have a few in my back pocket should the need arise, I am unlikely to need any extreme savings strategies to get the job done.

- Experience With Saving Money. If there’s one thing being broke taught me, it is how to save money. More specifically, the process of escaping debt required multiple years of diligent saving which now makes this current challenge a lot more realistic.

The ultimate goal of understanding my strengths is to have an idea of which factors can be leveraged the most as I work toward my goal.

For example, my past saving experiences gives me wisdom to know that eventually things will get tough. And it is in those moments that I can rely on the fact that I’ve been there before. Having this familiarity can help me weather the storm.

Financial Weaknesses That Could Prevent Me From Saving $50K:

- Eating Out At Restaurants. Restaurant spending won’t necessarily break me. But, it is a great indicator for how well I’m doing overall with my finances. When my eating out is in check, I am usually being pretty consistent across the board. Meanwhile, high restaurant spending is a sign that I may not be doing a good job of controlling my spending in totality.

- Dating & Socializing. As much of a blessing it is to have a vibrant social life, I must admit that it is also exhausting and expensive. That’s because being out and about with people requires both energy and money – with particular emphasis on money.

When it comes to weaknesses, my goal is to figure out how to mitigate these as best as possible.

As such, I plan to hit the ground running with another no restaurant month starting in March. I’m also focused on restructuring my approach to dating and socializing which I will touch on in detail in an upcoming article.

These changes should significantly reduce negative impacts of my weak areas.

Step 3: Assessing My Current Financial State

In this third step along my path to saving $50,000, I will establish a basis for where my finances are today. This step will enable me to then formulate a plan for achieving my $50,000 goal.

I’ll use the following few questions to guide myself forward:

Q: How Much Do I Make Each Month?

Sounds like a funny question, but we often don’t know.

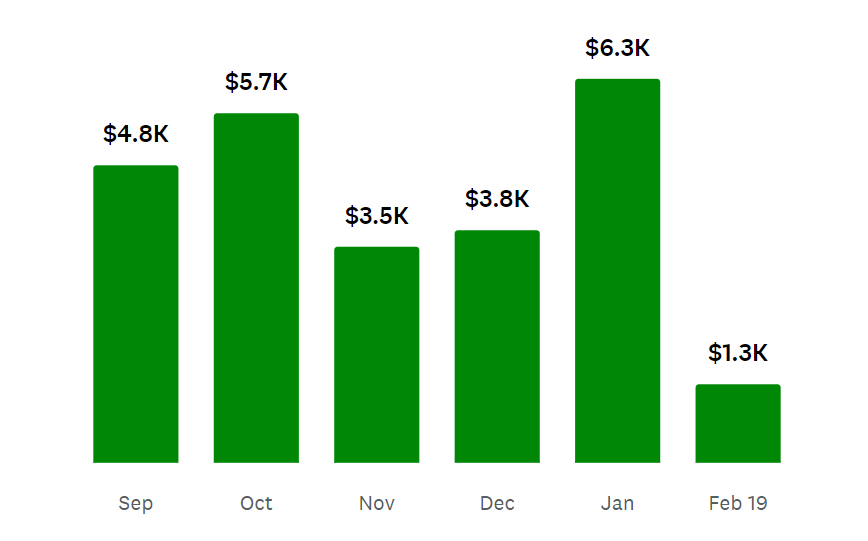

This is primarily due to direct deposit being the norm which means we may not see the exact amounts hitting our accounts on payday. I also have a somewhat irregular income and therefore need to take an average of the last several months to get as close to an accurate estimate as possible.

After a stellar 2023 where I earned a top 15% income, I anticipate that I will earn a lot less in 2024. As such, I’m thinking my monthly income will fall in the $8,000 – $10,000 range for the bulk of the year.

Q: How Much Am I Spending Each Month?

Answering this question was a bit more involved as I had to capture my average monthly spending and expand the process by determining what exactly I’ve been spending on.

To accomplish, I used tools currently at my disposal which include Mint (now Credit Karma) and my actual physical card statements.

I now a more accurate picture of where my money is going after doing a forensic deep dive of my statements for the last couple of months. I also now know that I spend roughly $4,800 per month broken down as follows:

Q: What Is My Current Net Cash Flow?

Again, the whole point of this exercise is to understand where my finances currently stand to determine how I can best move forward with saving $50,000 in the allotted time.

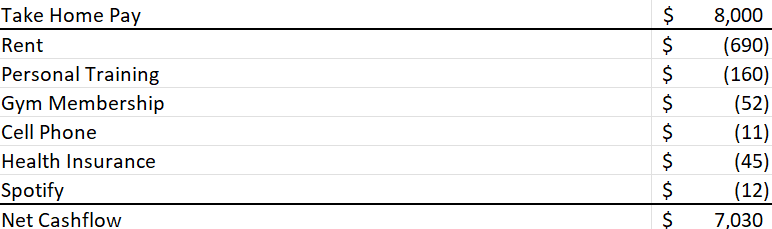

Taking from the steps above, my current cashflows are broken down as follows:

Average Take Home Income: $8,000

Average Spend: $4,800

Net Cash Flow: $3,200

We can see that my current spending pattern would leave me short by about $1,800 per month, resulting in a total shortfall of $18,000.

Clearly, something has to give. So let’s address that next.

Step 4: The Future State Of My Finances That Will Get Me To $50,000 Savings

Step 4: Outlining My Future State

The analysis of my current state revealed that I have some work to do if I’m going to meet my $50,000 savings goal. In other words, I must now create a desired financial state that will get me there.

The following questions are guideline to help me in this step.

Q: Where Are My Spending Leaks?

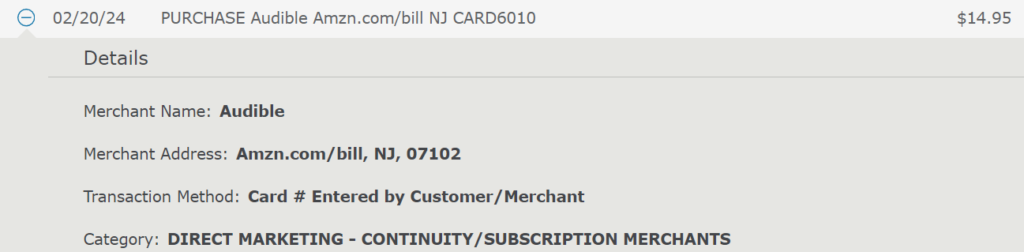

Over time, those free 30 day subscriptions come back to bite us in the form of spending leaks we may not even know we have. For example, this charge from Audible hit my checking account in the last few days.

I most likely would have overlooked this charge for a lot longer had it not been for this exercise.

This shows the importance of regular spending audits on our finances to ensure we are free of those pesky charges that slowly drain us of our hard earned money.

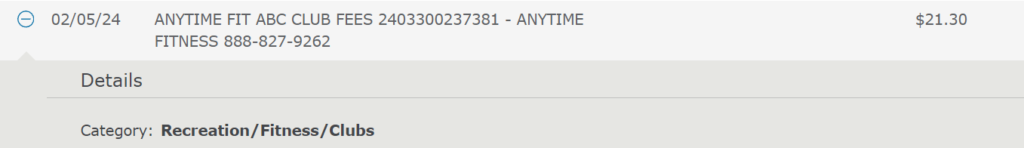

Here’s another leaky expense that I found during this exercise. This one’s for my old gym who I’m currently in contract with through the end of the month. I just got off the phone notifying them to remove the sneaky auto renew that would have kept this going well into the future:

Q: What Areas For Opportunity Do I Have?

I’ve taken care of the spending leaks but the job is not done. The next step for creating my future state is to review your spending habits to identify opportunities to save more money. Because the harder I cut, the easier it will be to reach the $50,000 mark.

In doing this exercise, I was able to identify the following items that will be immediately cut from the budget.

- Rent: Slashed my rent by 20% by simply asking my landlord for a deal. In his own words, I’m “one of his best tenants”. So he was pretty open to the idea of giving me a deal to keep me around.

- Haircuts at the barbershop: Why pay 20 or more dollars for a haircut when you can do it yourself? That was the thought I had as I’ve decided to slash this very optional expense.

- Restaurants & Cafes: My weekend coffee ritual won’t be the same without my 2 lattes. But who said it has to go away? Instead of paying someone else to make me lattes, why don’t I learn to make them at home myself? I’ll have to buy the latte machine to pull it off, but I can then amortize the cost of 4 lattes per week over the life of ownership and enjoy savings once I pass the breakeven point.

- Transportation Costs: I just sold my beloved 2009 Corolla that I wasn’t using. I’m now free of car insurance and maintenance expenses that costs $60 per month as the car sat idle.

Q: What Is My New Cashflow Profile?

Seeing where my spending is going and cleaning things up has positioned me to create a new cash flow plan that will get me to my goal.

For this step, I will be precise in designing my future monthly cashflows to ensure I they will drive me in the right direction.

Here is a breakdown of my non discretionary expenses each month going forward.

Step 5: Establishing A Monthly Saving Requirement That Will Get Me To $50,000

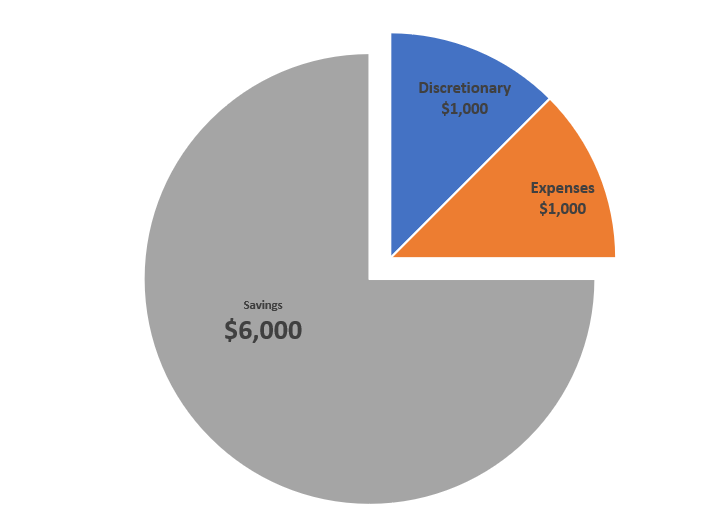

Based on my adjustments, I have about $7,000 remaining after expenses that I could feasibly save each month.

This is actually where the difficulty begins because it is after I’ve covered my mandatory expenses that I’m left to do the arduous task of managing my discretionary funds.

Even as I write this, I do so while sipping a latte that I purchased with funds that could have gone toward saving $50,000. Ahh, the woes of life!

Making Saving A Little Bit Painful

As in the words of the great Financial Samurai, I want to save so much it hurts. As a result, I I’m aiming for a savings target of $6,000 per month as I march toward $50,000.

I could easily set my savings target at $5,000 per month – but I think it would be problematic for a few reasons.

For one, $5,000 per month would be minimum amount required to reach my $50,000 goal. Therefore, saving any amount under that would put me off track. As such, the $6,000 target gives me a lot more wiggle room to be imprecise.

Saving more each month also serves as a hedge against future uncertainty. It’ll be nice to have a bit of a buffer built up in the event something bad happens such as job loss.

And finally, the idea of saving $5,000 each month seems too easy to be exciting.

I like challenging goals because they actually motivate me. Plus, saving 75% of my income on my way to $50,000 will make for one epic success story if I actually hit my goal!

Why I Won’t Be Using A Budget While Saving $50,000

They say you need a budget, but I don’t really like them.

It’s probably because I never seemed to be able to stick to one or give it the mental bandwidth it deserved. So, what’s been my workaround?

I simply take my savings off the top.

That is, I’ll determine the amount I want to save each month and remove that from my discretionary funds before I do any spending.

With my savings off the table, I have the flexibility to manage the remaining discretionary funds however I see fit – which I’d prefer.

Step 6: Performing A Risk Mitigation Exercise

As a project manager, one of my duties is to manage project risks to ensure they don’t derail my team from the mission. After all, no company wants to lose millions of dollars to things that could have been foreseen and avoided.

Similarly, this challenge is essentially a project that I’m undertaking. And I must manage my own risks just as I would in my day job.

I’ve identified 2 pretty big ones, so lets review those and how I plan on handling them:

Risk 1: I Could Lose My Job

It was similar reasoning that enabled me to anticipate and capitalize on my layoff in January ‘23.

As for saving $50,000, my job is the ultimate enabler because it is the source of my income. With no job, there can be no savings.

To mitigate this risk, I’m pulling directly from my playbook on dealing career uncertainty. I will be updating my resume, playing a lot nicer at work, and networking to keep my job pipeline healthy.

Risk 2: I Have An Unknown Tax Liability

The IRS has entered the blog post. Perhaps some of their newly expanded technology will notify a few of those newly appointed enforcement officers to check out this post.

Because as they say, all attention is good attention!

Jokes aside, I know I have a tax liability outstanding as I’ve yet to file for 2023. I’m not worried about meeting the April 15th deadline since it’s exactly 2 months away. I’m worried about the fact that I don’t have a gauge of how much I owe – especially since my income was so high last year.

Moving up through the tax brackets is nice since it means I’ve earned more money. It just scares me since I’ve now entered uncharted tax waters.

As such, I know I have the bill to pay and am prepared to fork over whatever I owe as any good tax paying citizen would. I just hope it’s not such a huge amount that it derails my march toward saving $50,000.

Risk 3: I Could Get Injured

A downside of being a former Division I football player is that I have the scars to show it.

I’ve sustained multiple injuries and life is a constant battle to stay upright. As a result, I’ve identified injury as a major risk to my goal as these usually come with hefty costs for surgeries, rehab, and lost wages.

The first step to mitigating this risk is to simply be careful. A lot of my past injuries could have been avoided with a bit more prudence, so those lessons are top of mind.

Then from there, I just have to consistently take care of my body in ways that help stave off injury. For example, I should never go into an intense workout without properly warming up beforehand.

Mental Processes & Strategies To Help Me Save $50,000

At this point, the technical details for how my money will flow to enable me to save $50,000 by years’ end are in place. I could close the post here and get on with the process, but I’d like to add an extra layer of detail to show how encompassing things get at the intersection of money and life.

The following list covers a range of contingency factors that can help make or break my success. These are mental processes and strategies that I will deploy along the way.

Make Saving $50,000 Fun

I think saving money gets a bad rap because most people see it as boring or restrictive. For me it’s the opposite as I find saving money to be fun.

Be that as it may, 10 months is a long time to be disciplined and life will throw a lot of temptation my way. I will have to say no a lot and make sacrifices. And because of that, I’ll constantly remind myself to approach this endeavor as a fun and exciting challenge.

Money Saving Games

One way I will make saving $50,000 fun is by gamifying the process. This is exactly what so many companies have figured out as they’ve designed their products to keep customers engaged. There is just something appealing about see ourselves constantly level up.

As for this challenge, I’ll gamify the process in the following 2 ways:

- Everyone Is Out To Get My Money: From here on out, my finances are like an impenetrable fortress in the middle of a desert. The problem? Foreign invaders want to get the valuable loot behind the walls. Therefore, my job is to stave off these enemies and protect my valuable treasure for the next 10 months. In other words, it’s game on!

- How Extreme Can I Make It: The next game I’ll play during this challenge is called “how extreme can I make it”. That is, just how far can I push myself to save every last penny possible. I started today with 35 minute walk home rather than calling Uber as I normally would. It’s amazing what a slight mental shift can do for your habits.

Opening A Separate Account Just For Saving $50,000

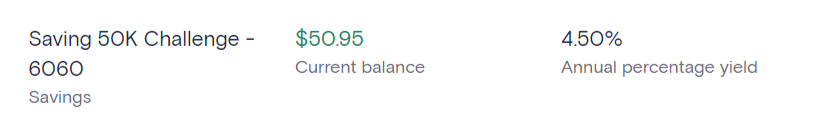

Next is that I will open a separate bank account that is strictly for saving up my $50,000.

This should help bring focus to things and make it clear at all times just how I’m progressing toward my goal. I think this will also gamify the process as I can watch the account grow from a little hatchling to a $50k monster.

Resisting FOMO

Everyone’s out having fun on the weekends. People are taking amazing trips. New restaurants are opening up all over town.

Meanwhile, I’m stuck at home cooking my dinners and protecting my money as if it were really under siege.

Boring! But in reality, it’s only boring if I allow it.

And it won’t help things if my frame of reference is based on what everyone else is doing. Therefore, I will steel my mind and focus on the task at hand without getting wrapped up in the happenings of other people. Time will pass regardless of what I do, so I may as well use it to create the life I want for myself.

Learning To Say No

I touched on this earlier, but an abundant social life is proving to be a bit difficult.

It took a while, but I’ve finally come to the conclusion that I can’t be everywhere and do everything. And I have to start being more comfortable telling people no if I am going to capture back my time and save my precious money.

Remembering That I Can’t Have It All

It is always a good thing to remind ourselves that life is about tradeoffs and that we can’t have it all. Sure, I can say yes to every person who invites me to hangout, but then I would miss the gym or give up too much of my writing time.

I could also try to date every woman under the sun. But tell me the last time we’ve ever seen that go well?

Given this, I’m going into this 10 month endeavor with the mindset that I must give some things up if I am going to successfully arrive at my ultimate goal.

Going Grocery Shopping

I’ve finally gotten to the bottom of my eating out issue. Here is how it unfolds:

I spend the most hours on Saturdays and Sundays working on the blog. I then wrap things up sometime in the afternoon mentally drained. From there all I want to do is relax and have a bit of fun, so I usually dive into socializing.

By the time that all ends, it’s Sunday evening and I haven’t made it to the grocery store. It’s all good though because I will go sometime early in the week. However, I almost never do because I’m strapped for time and energy.

My solution? Head over to my favorite Jamaican spot and fork over my hard earned dollars to pay someone to make food for me that I can probably cook for myself at home.

A better solution would be to carve out time each weekend for groceries.

This had been my routine for years, but I’ve strayed a bit from the path. No worries though as I will get back on track so I can save up that $50,000.

Maybe I Will Find a Girlfriend

One great thing about relationships is the consistency they provide. This is especially true when we form that bond with the right person who doesn’t have too many financial red flags.

At the same time, dating and saving $50K don’t necessarily go hand in hand as most budding relationships center primarily around having as much fun as possible as you get to know your new beau.

Dating and having fun are great things, but they are hardly ever cheap. And because of this, I think it may be time to finally give up the bachelor status.

A Return To Using Mostly Cash

Cash truly is the best payment type if you are trying to stick to a budget and reach your goals. I’ve been using my credit card more as of late which has definitely paved the way to increased spending.

Cash is cumbersome, I must go to an ATM to retrieve it, and I hate dealing with coins.

But, these are all great things as they will force me to slow down a bit when spending. I will also feel that twinge of pain watching my cash leave my hands for purchases which is yet another added bonus.

Figure Out Ways To Enjoy More Time At Home

Whether we rent or own, the greatest benefit of living in a place we like is the utility it provides us.

Our homes serve many functions such as being places to shield us and our things from the elements, as well as places to raise our families or socialize with friends.

In terms of saving $50,000 – my home is a valuable asset because it gives me a base to conduct the bulk of my life without needing to get outside where I’m more likely to spend money. As such, I plan to spend more of my time working, entertaining, and relaxing at home over the next 10 months.

How Would You Go About Saving $50,000?

The details in this post were an overview of my process for embarking on the $50,000 savings journey. I feel good knowing that I’ve given myself the greatest chance of success based on the outline above.

My curiosity is now engaged as I wonder how readers would tackle such a feat themselves.

Is my process reasonable or a bit too involved for your style? What necessary planning steps would you take in my shoes? And what would you focus on the most?

These are my questions for you! So feel free to leave me a comment to let me know.