Spoiler Alert: Traditional Savings Accounts Earn You The Least Amount Of Money

That’s the ultimate answer to the question of which savings account earns you the least amount of money. So, if you are in a hurry or just looking for answers to a test, then you can take that answer to the bank.

However, if you want to level up your personal finance knowledge then I suggest you stick around.

I say that because this article will not only teach you about the lowest earnings savings account – it will also teach you just about everything else you need to know about savings accounts so you can confidently get the highest returns on your hard earned dollars.

Contents

What Are Savings Accounts Why Are They Important

We’re all familiar with the concept of the savings account. But, did you know there are more than 10 distinct types of savings accounts that will all earn you different amounts of money?

Savings accounts are wonderful for providing a safe and secure place for our cash to accumulate as we work toward your goals. They can even generate passive income which means it’s important to know the differences between savings account types.

I’ll break down the various types of savings accounts soon, but first let’s review a few savings account use cases to highlight their importance.

Each scenario will show you that savings accounts can be used to accumulate cash while potentially generating a bit of passive income.

Savings Account Scenario - Stacking Cash For A House Downpayment

Sarah and Joe are in their mid 20s and enjoying their first year together as a newly married couple. They’ve agreed that kids are in their future, but they would like to enjoy several more years together before growing the family.

Sarah and Joe are planners, which means they will save a healthy downpayment for a new house purchase before their first little one arrives in 3-5 years. In the meantime, they must put their money away safely in a savings account because they know keeping it under their mattress is a bad idea.

Our new couple decides to do an online search for savings accounts and are dismayed by the number of options. It appears that they have a good chance to make a decent return on their savings, but are not sure of the best option to choose given their situation.

Another Savings Account Use Case - Setting Aside An Emergency Fund

Luke is a 50 year old retired veteran who lives comfortably on the fixed income provided by his military pension. Luke grew up poor and never wants to go back to being broke so he avoids debt and manages his money with a fine toothed comb.

He’s old school, so he also keeps a six month emergency fund in cash hidden away in a safe in his apartment.

Luke’s rich friend Steve has finally convinced him to move his cash to a savings account so he can at least earn a small amount of interest to offset inflation. Therefore, Luke is now on the market for a new savings account from his local credit union.

Savings Account Scenario - Financial Arbitrage The Smart Way

Evan is a 35 year old husband and father who works in sales at one of the nation’s top software companies. His wife is a lawyer which means dual six figure incomes puts them well into the top 5% earnings for all families.

Aside from a large mortgage, they enjoy the benefits of living a debt free lifestyle. That is, until Evan recently decided to get clever and do a little bit of financial arbitrage on a new vehicle purchase.

Rather than dropping $30,000 in cash on the vehicle, Evan decides to take out a 0% interest loan while placing the $30,000 in an interest bearing savings account. He figures this is a way to earn a little bit of passive income while also enjoying his new car.

Saving Account Types

Whether you are saving a downpayment for a house or looking for a place to stash your emergency fund – a savings account can help. That said, knowing the difference between the various options can be overwhelming.

Here’s a quick summary of each savings account type for you to reference. I’ll start with the most commonly seen types of savings accounts and then discuss those that are more nuanced.

1) Traditional Savings Account

Traditional savings accounts are typically offered by brick and mortar banks. These accounts are relatively easy to open and feature account management and customer support from the issuing bank which can be accessed in branches, online, or by phone.

2) Online Savings Accounts

As technology expands, many banks have moved away from the brick and mortar format to online only models. Savings accounts at these institutions are usually very similar to those offered by traditional banks. The difference is that they usually offer high returns.

3) High Yield Savings Account

High yield savings accounts are frequently offered by online only banks, but can also be found at local banks and credit unions. As suggested by their name, these accounts offer higher returns but may come with less service and flexibility in how you can use the account.

4) Money Market Savings Account

While very similar to high yield savings accounts, money market accounts differ primarily in how easily you can access your money. Money market accounts offer the benefit of being able to use them for check writing and also usually have linked debit cards so you can spend on the go.

5) Money Market Savings Account

The certificate of deposit (CD) is a savings account that earns a fixed interest on a fixed amount of money deposited by the account holder. They also have specified duration terms associated with them that could range from 3 months to five years. As a result, these are often referred to as time accounts.

6) Other Types Of Savings Accounts

- Cash Management Accounts: Considered “non bank” accounts since they are usually offered by investment firms. Features vary, but they commonly offer interest returns, debit card and check access, and also allow you to easily shuttle funds into investment accounts.

- Specialty Savings Accounts: Tailored to a specific demographic or designed to serve a distinct purpose. For example, a student savings account is geared specifically toward young students who are just starting out. Other accounts under this umbrella would be custodial accounts and accounts designed forz very young children.

- Retirement Savings Accounts: Technically, both Traditional and Roth IRAs would be considered savings accounts. You deposit money in both and watch it grow with time.

- Health Savings Accounts: Health Savings Accounts and Flexible Spending Accounts are two types of savings accounts designed to help you save for healthcare costs. These could be valuable for those planning for families or retirement.

How Savings Accounts Earn Money

Before we answer the question of which savings account earns us the least amount of money, we must discuss how savings accounts actually earn money in the first place. Here’s a quick breakdown:

In simplest terms, banks take the money we deposit and lend it back out to other people. Of course, banks charge those other people interest on those loans. They then use the earnings from those loans to pay us the interest promised on our savings accounts.

It Is Also Important To Know And Understand APY

And speaking of the interest promised on our savings accounts. That figure is known as the account’s annual percentage yield or APY for short.

This is the number that most of us care about when considering savings accounts because it tells us how much we can earn on the money we deposit.

APYs are expressed as a percentage and tell us how much interest we can expect to earn from our savings accounts in a given period. Thankfully all savings accounts compound interest earned, but there is no set period of time this interest is accrued.

The most common compounding periods are annually, quarterly, monthly, or daily. Ideally, we’d love to see our accounts compound daily because more frequent compounding means more money all else being equal.

As a final note, it is also important to know that the APY on many savings accounts can fluctuate based on the Federal Reserve’s Federal Funds Rate.

Why Traditional Savings Accounts Earn The Least Money

As established at the start, traditional savings account will earn you the least amount of money. But why is this the case?

For starters, traditional savings accounts usually have the lowest APY of all savings account options. Traditional brick and mortar banks are able to get away with offering such low returns on these accounts because in return they give customers convenience, accessibility, and other personalized services not commonly found with higher yielding account types.

The extras that come along with these savings accounts cost banks to offer. As a result, they pass along those costs to customers in the form of lower returns.

Low Earning Savings Accounts Destroy Wealth

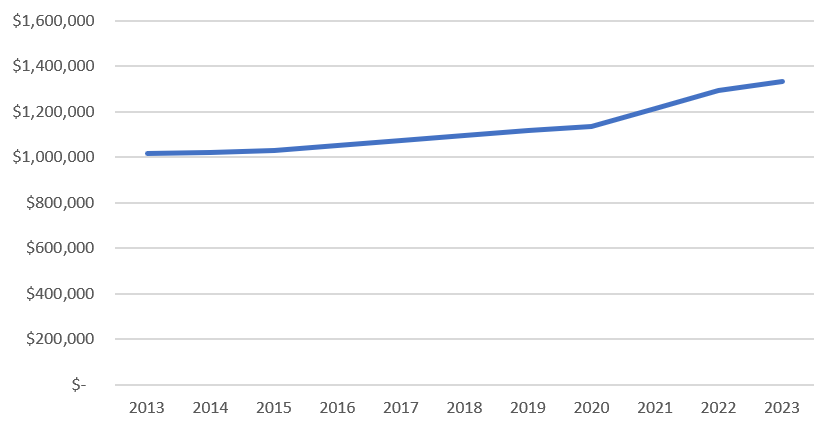

Take a look at this chart. It depicts inflation over a 10 year period from 2013 – 2023 by way of what is known as the Consumer Price Index or CPI for short.

In simple terms, the CPI represents the price of a basket of goods and services that we could purchase. It doesn’t really matter which goods and services, so let’s think of it as representing the price we’d have to pay to purchase eggs, milk, and hair cuts in a given year.

The price of the same exact goods and services are measured year over year and we can see if they went up or down. This tells us what is happening with inflation. And as you can see, inflation almost always rises.

Lost Wealth In A Low Interest Savings Account Thanks To Inflation

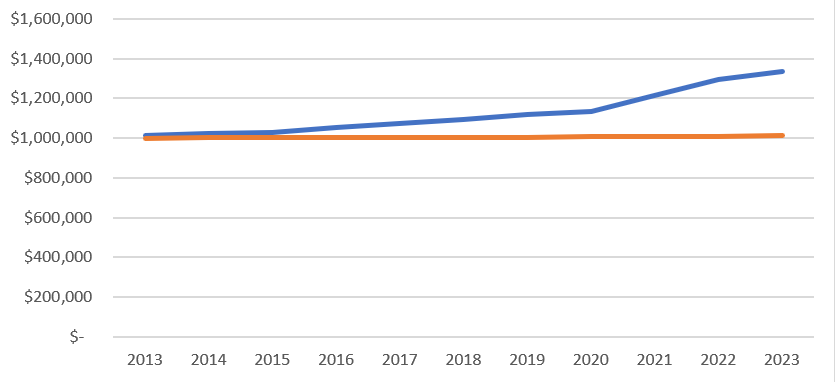

Now let’s assume we had $1,000,000 to invest over this 10 year period and dropped our money in a low earning, traditional savings account starting in 2013. What would happen?

The account would need to at least grow at the exact rate of inflation each year in order for us not to lose wealth. Based on average inflation data reported by the Bureau Of Labor Statistics, that growth would need to look something like this.

Notice that the trend mirrors the CPI trend from the chart above.

Unfortunately, there is a gap between what needs to happen and what would have actually happened.

Placing $1,000,000 in a traditional, low earning savings account would have resulted in eroded wealth thanks to inflation.

I’ve taken the same values from the above graph and overlayed them with another savings account that grew at the rate of the average traditional savings account for each year from 2013 – 2023.

The orange line represents real savings account earnings based on average savings accounts rates from 2013 – 2023. The blue line is taken from the first chart and shows how much the account needed to grow to keep pace with inflation. The gap between both lines represents losses since inflation outpaced the earnings of traditional savings accounts.

Why Would Anyone Choose The Lowest Earning Savings Account

So, if traditional savings accounts are the lowest earning savings account type – why would anyone ever opt for one over higher returning options?

To answer the question we will review a few case studies. In these examples we will assume that we have a lump sum of $1,000 dollars which we need to drop into a savings account. All of the savings account options are on the table, so the best route to take may not be so clear.

Here are a few ways we could land on going with a low earning, traditional savings account.

Scenario 1: Choosing The Lowest Earning Savings Account For Convenience and Brand Loyalty

With our $1,000 in hand we have a few options for selecting a savings account.

The most obvious place to start would be the nearest branch of our local bank. We already have our checking accounts there and have been loyal customers since our parents opened our first bank account at age 12.

We’ve never had any major problems with our bank, so why reinvent the wheel with our new savings account?

We also have the option of going online to find a higher yielding savings account, but the issue with this route is that we now have to sort through and understand all of the options which does not bode well for our busy lives.

Still, we at least do a quick search with our phones and find that most of the banks offering higher earning savings accounts seem to be a bit “shady”. We are scarred by the recent bank failures and want to protect our money.

We like the familiarity of our name brand bank and are not aware that most of the more obscure options are still FDIC insured on deposits up to $250,000. There’s safety in numbers, so we go with the local bank for the convenience and familiarity. Cheers to brand loyalty!

Scenario 2: Choosing The Lowest Earning Savings Account For Only A Short Duration

In this next scenario we only need a place to park our money for the short duration of 6 – 12 months as we save up for a big purchase. We could keep the money in cash, but we have self control issues and figure a savings account would be a barrier to spending.

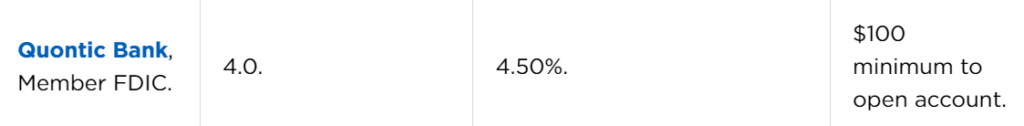

We research our options and find an online high yield savings account offering 4.60%. At the same time, CDs offer 5.66% with a 1 year term. And finally, our local branch offers a traditional savings account with an APY of 0.55% which aligns with the national average for such accounts.

After ruling out the CD because of the fixed term we are left to choose between the online high yield savings account and the traditional savings account at our local branch.

Our decision?

We go with the traditional savings account because we read the fine print and realize that the higher yielding account only compounds quarterly. This means that interest would only compound 2 – 4 times during the time we have the account . Here is a breakdown of the actual numbers:

- $1000 In Online High Yield Savings Account at 4.66% After 12 Months (Compounded Quarterly) = $1,046.80

- $1000 In Traditional Savings Account at 0.55% Account After 12 Months (Compounded Monthly) = $1,005.51

- Net Difference = $41.29

Sure, we will never scoff at our savings accounts earning extra money. But when we consider that we may need to withdraw the money sooner than 12 months, we conclude that the added hassle of opening an online account and setting up transfers between accounts is just not worth the time.

Better Alternatives To Low Earning Savings Accounts

As shown above, low earnings savings accounts can provide value in certain situations. But what if we want to put our money to work much harder so we can have freedom sooner? I think these are all better options:

- Stock Investing: The stock market has historically returned 9.81%. Though it comes with more risk, this is a much better way to actually beat inflation which you will likely never do with a savings account.

- Real Estate: From 1992 – 2022 real estate prices appreciated by an average of 5.4%. This leads me to conclude that real estate isn’t quite the investment it’s kicked up to be. But still, real estate easily beats out the returns of most savings accounts while also giving you a real asset that provides utility.

- Debt Reduction: Instead of putting money in a low earning savings account, why not pay off debt? Paying off debt not only saves you money thanks to principle reduction, it also enhances your sense of freedom.

- Starting A Business: Starting a business is risky and takes a lot of work. That said, we only live once. I’d rather try my luck with starting a business of my dreams instead of going with the safety of a low earning savings account.

Conclusion On The Lowest Earning Savings Account

Our long term financial success depends on us maximizing every dollar, which means we must know which savings accounts to leverage for maximum returns and which to steer clear of thanks to low earnings.

In most cases you may want to avoid traditional savings accounts since they will earn you the least money – but there are still scenarios where one could provide some value.

At the end of the day, we must analyze the details of each situation we find ourselves in to determine what’s best. Afterall, the last thing we want to do is make suboptimal financial decisions or outright lose money.