If you are like me, you like to control your own destiny. Unfortunately, recent return to office policies remind us that we as employees have very little say in how our work gets done.

It’s understandable to be upset about return to office policies. I know I am. But let’s not let them defeat us.

Instead, how about we use return to office policies as additional fuel to propel us even faster toward financial independence so we can eventually call our own shots?

Contents

Return To Office Policies Remind Us Of How Little Power We Have

I suspect most employees would resist return to office policies if they could. Some reports project that upwards of 98% percent of employees are in favor of remote work. With so many employees strongly in favor of working from home, current return to office trends show that what we want matters very little.

Given this, I think the best way to fight return to office mandates and take power back in general is to manage our money in a way that gives us the most freedom. Specifically, I think we should all strive for partial and total financial freedom.

In doing so, we create the maximum amount of options for ourselves. We also become more capable of demanding what we want without fear of repercussions.

Aim For Partial Financial Freedom To Fight Return To Office

We often think of financial freedom as a far in the future place to arrive at after decades of laboring away under the thumbs of our mighty CEOs. We’ve been led to believe we must be rich or at least have 25x annual expenses before we can finally be free.

Certainly, it’s true that we must build hefty nest eggs to become financially free. And yes, saving 25x annual expenses is a good target to start with. But what if I told you we can enjoy almost all of the benefits of financial freedom before we actually get there?

Specifically, by making certain lifestyle choices during our wealth building years, we are able to live in a manner that grants us a ton of freedom and buffers us from draconian work mandates such as the current slew of return to office policies.

Let me present two contrasting lifestyle designs to show you how.

Average Dependent Lifestyle

Let’s suppose for a moment we took an average couple, with an average lifestyle, in an average American city. Because they are average, they live a pretty good life consisting of the trappings we would expect in the average American’s life.

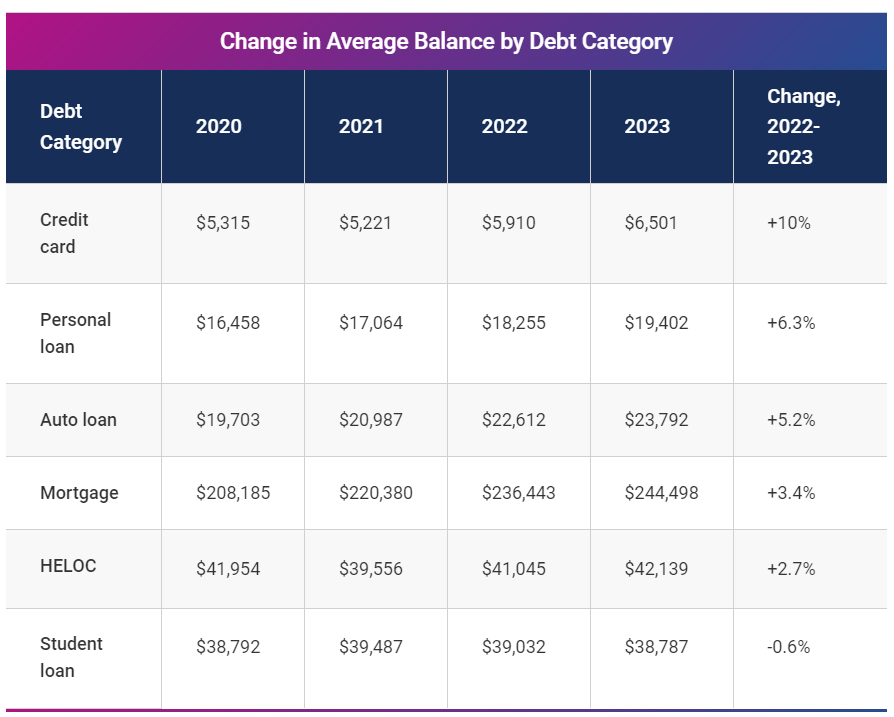

Considering the averages – this couple has an average mortgage balance of $244,498, an average amount of student loans at $38,787, average cars with balances of $23,792 costing an average car payment of $726 per month, and an average amount of credit card debt of $6,501.

They also spend and save like average with an average personal savings rate of 3.2%, meaning they spend 96.8% of everything they earn.

They’ve enjoyed working remotely since the pandemic started. But unfortunately, that party is about to end as they’ve received notice of a new return to office policy calling them into the office at the end of the month.

With little money and high debts, they are dependent on their jobs to stay afloat. Therefore, they must comply and return to the workplace whether they’d like to or not.

Not So Average Semi-Financially Free Lifestyle

The average couple above has neighbors who live one house over. On the surface, these neighbors appear to also be average aside from the fact that they drive cars that aren’t quite as nice as the rest of the block.

This is because those neighbors bought used cars and paid cash for them. It’s now several years later and the cars don’t shine quite like they used to.

Beyond the cars, this couple also differs quite a bit from their average neighbors as they’ve chosen to rent their home because they know renting is cheaper and enables them to live in an identical house as their average neighbors for 25% less each month. They also save by not having to pay taxes and maintenance like most people on their street.

They aggressively paid off their student loans years ago and have avoided credit cards in lieu of cash. Further they usually cook at home rather than eat out, and travel very little because traveling sucks.

All in all, this couple has a lifestyle very similar to their average counterparts – while saving closer to 50% each month. As a result, they’ve built up a huge fuck you fund for days just as this when their bosses also tried to call them back into the office.

Semi-Financial Freedom Enables You To Resist Return To Office Policies

As you can hopefully see, the situations of the couples above couldn’t be more different.

The average couple’s lifestyle of high spending, low margin, and debt makes them dependent on their jobs to stay afloat. Because of this, they must tow the line at work by accepting return to office policies or risk suffer repercussions such as termination which they are incapable of withstanding.

Meanwhile, the not so average couple lives an equivalent lifestyle without the total dependency on their incomes thanks to having no debt, low expenses, and a huge cash buffer. Being renters is yet another advantage because they have fewer physical possessions holding them back. Thanks to this, they are able to move around more freely which opens the entire country as a job market.

Upon being commanded back to work, the average couple must go while their not so average neighbors decide to hunker down for a bit to enjoy life while they look for new remote opportunities.

Strive For Partial Financial Freedom

Soon, I’ll be releasing a post discussing the levels of financial freedom. In drafting that article, I’ve struggled to clearly articulate the difference between the stages we move through before we hit full on financial freedom.

Thankfully, writing this article helped as I think it captures the difference between the dependent level and the partially free levels of financial freedom.

From a lifestyle perspective, the dependent person lives a consumption based lifestyle funded on debt, marked by low savings, and a reliance on a steady stream of income to keep the ship afloat.

Meanwhile, a partially free person lives a production based lifestyle funded with cash, high savings and investments, with a reliance on a steady stream of income that contributes to progressively greater levels of margin, wealth, and freedom.

Return to Office or Financial Freedom?

The peak of the personal finance journey is total financial freedom. This is the state where we have the ability to pursue our desired lifestyles without being constrained by financial limitations. It means being able to choose how we spend our time and enables us to say no to things we don’t want to do.

Returning to the office is one such thing many of us would like to not have to do, but most of us have to return because we really don’t have a choice.

Be that as it may, having achieved partial financial independence in my own live gives me confidence to stand my ground against returning to the office. I’ve recently left one employer and turned down a big money role at another because both wanted me in the office on a hybrid basis.

I know the availability of remote only jobs is quickly drying up. But for now I will use my strong financial position to my advantage until life throws me know variables to deal with.