I’m about to show you the most powerful financial exercise you could ever do. I recently completed this exercise for myself and I’m excited to share it with you because of the potential it offers.

By completing this exercise and grasping the underlying concepts, you will gain a clear picture of how all of your financial moves, both past and future, link together to determine where you are today and your financial future.

On the surface, I’ll simply guide you to calculate your total lifetime earnings. This is a valuable to have on its own, but as you’ll see, this single action sets you up for complete financial mastery. I wish these sorts of things were taught in school!

We’ll dive into the technical details soon, but first we need to have a full grasp on the most important underlying concept.

Contents

The Circular Flow Of Money

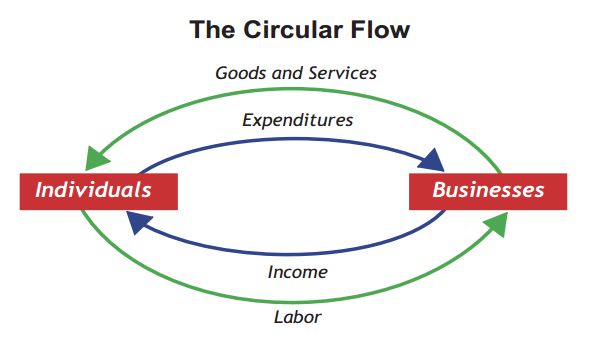

There is a concept in economics known as the circular flow of money which essentially states that money flows between producers and consumers in a never ending cycle.

I like to think of it as a metaphorical vacuum where all people and business exist along with money. There is a fixed amount of money in this vacuum. All of the world’s money literally exists somewhere and is never lost. Typically some is held by people (consumers) and some held by businesses (producers).

Both groups want to get their hands on as much money as possible.

To do so, people go to work at businesses to earn money. At the same time, businesses sell products and services to other people which they call customers. And of course, some people create their own companies as a way to earn even more money.

Without companies, there can be no jobs. And without people, there can be companies. Without either there can be no customers because there would technically be no money to earn or spend.

Each actor is dependent on the other and they combine at scale to form the global economy.

Circular Flow Example

As a simple example, let’s take the process of buying groceries since it’s one we all can relate to.

In order for Joe to buy groceries he must give the store his money. Unfortunately, money doesn’t grow on trees which means Joe must go to work at his accounting firm to earn it. At work, Joe delivers value to his company and is rewarded with income. He then take this income to the local grocer to exchange it for some groceries.

Meanwhile, the grocer is in business to make a profit – or else it would close. But it doesn’t just operate itself. In fact, it employs Pam the cashier to ring up customers like Joe. Because Pam delivers excellent customer service, customers like Joe happily overpay a bit for groceries so the company can profit and remain in operation. Meanwhile, Pam is paid an income for her efforts which she also uses to buy groceries and cell phone service.

Of course, the cell phone carrier doesn’t just operate itself and needs to make a profit. Therefore, they charge customers enough to remain profitable while paying employees such as Mike whom they’ve hired to maintain their towers.

Mike is a single guy who loves to travel. As such, he spends all of the income earned from his job at the phone carrier on flights and hotels. And of course, hotels and airlines are in business to make profits…

Shall I continue?

Hopefully you get the point by now. And if not, please re-read this entire section until it sticks because this concept is what makes the entire exercise so powerful.

Now let’s get on with the tactical steps of calculating lifetime earnings, and all of the other metrics we will derive in the process.

Calculating Your Lifetime Earnings

For this step, all you need to do is track down all of your tax returns for the entirety of your career.

This is actually the first benefit of this exercise because it forces you to focus on your organization. If you have them handy, congrats you are organized. If not, cheers you get to work on it.

With returns in hand, your next step is to add them up year by year to get a total of your earnings over your entire career.

I suggest using a spreadsheet to do this so you can keep a running tally for the rest of your life. Once you stand it up the first time, you can easily make future adjustments.

If you don’t have tax returns, request them from your filing provider or get your tax transcripts from the IRS here.

Then, as an optional step, consider adding up the approximate amount of money you made pre adulthood. For example, I included a rough estimate for the 8 years of pre professional work at my high school hardware store job, college summer camp job, and other miscellaneous jobs as a single line item totaling $100,000.

My $827,000 Lifetime Earnings

If you are a money nerd like me, you should be really excited because you now have your “number”. That is, have a trackable financial metric that you can leverage to guide your decisions and actions going forward.

As for me, I’ve made $726,000 in my roughly 12 year professional career beginning August 2012. Adding in the pre-professional earnings and I’ve made about $827,000 total in my entire working career starting in 2005.

Calculating Your Average Annual Income

Now that you know how much you’ve made, you can easily calculate your average annual income using the following equation:

Total career earnings / number of working years = average career earnings

For example, my average career earnings breakdown as follows:

$827,000 / 19yrs = $43,526 per year

Analyzing The Results Of Your Average Career Earnings

I found the results of my average career earnings to be quite shocking given how low they seem.

At the same time, they do make sense given I’m still relatively early in my career. Most of my earnings years consist of lower earnings and I’ve only been making six figures for 2.5 years. Most men don’t see peak earnings until after age 50, so I seem to be right on time with higher earning days ahead.

A deeper discussion of average career earnings deserves its own post. In the meantime, I urge you to give your career earnings a bit of deeper reflection.

Calculating Your Lifetime Savings Rate

Yet another powerful metric we can derive from this exercise is a calculation of our lifetime savings rate as follows:

Current Net Worth / Lifetime Earnings = Lifetime Savings Rate

I won’t reveal my net worth here, but will give an example of how this shakes out.

Let’s imagine Joe from above has a lifetime earnings of $2,000,000 dollars from a 20 year career as an accountant. Joe has a 401k worth $500,000, with a paid off $400,000 house. He doesn’t have any other assets and also has no debt. Therefore, his net worth is $900,000.

Using the equation above, Joe’s lifetime savings rate breaks down as follows:

$900,000 / 2,000,000 = 45% savings rate.

Not bad at all, Joe!

Analyzing The Results Of Your Lifetime Savings Rate

Typically in the personal finance realm we calculate savings rates on an annual or monthly basis. But in reality, they fluctuate over the short run, of say, a single day. And over the long run of our entire existence.

Calculating your savings rate down to the day is impractical and likely not very useful, but measuring it in totality has a lot of utility for several reasons.

For starters, many would say that savings rates are the most important financial metric since they reveal how well you actually keep the money you earn. In addition to that, your savings rate also helps predict how quickly you can reach retirement and how well you will do when you get there.

Most Americans have savings rates of less than 10%. Estimates also show that the median retirement balance is only $87,000.

Unfortunately, all of this means that most people are far behind where they should be for their age. More attention should be paid to saving so we can retire on time and in style.

Click here for a deeper dive into savings rates and here for ways to save more money.

Calculating Your Lifetime & Average Spending

The final important metric to derive from this exercise is your total and average lifetime spending. Again, this is easy to do since you’ve already calculated your lifetime earnings. Here is the process:

Step 1: Total earnings – current net worth = the amount you’ve spent in your lifetime

Step 2: The total amount you’ve spent in your lifetime / number of years worked = average annual spending

…for monthly

Step 3: The total amount you’ve spent in your lifetime / number of months worked

**to calculate months worked multiply numbers of yrs worked x 12.

For thoroughness, here’s an example using Joes numbers:

Step 1: 2,000,000 career earnings – 900,000 net worth = 1,100,000 total spending

Step 2: 1,100,000 / 20 years = $55,000 average annual spending

Step 3: 1,100,000 / 240 months = $4,583 average monthly spending

Wow, Joe’s monthly spending tells me he’s lived quite well!

Analyzing Your Lifetime Spending

Right away you can use these numbers to assess your true nature of your spending behavior. It’s easy to get caught up in the day to day, but these numbers really give you insight into the bigger picture.

Is your annual spending higher or lower than you expected? How do these numbers compare to your average annual and monthly earnings? If they are close to, or higher than your earnings, you’re spending too much and have some work to do. Your savings rate will also reflect this.

I think it’s best to have a more in depth discussion on lifetime spending which can be found here.

Where Is All Your Money?

By completing this exercise you’ve probably seen that you have earned a lot of money if your lifetime. But for most of us, the majority of it is now gone.

So that begs me to ask the question: where is your money?

As discussed in the circular flow lesson, the money you made didn’t magically disappear. Nor is it lost in your house like that one missing sock we all have. But it’s still gone.

All the money we’ve earned exists somewhere. Yet, the majority of us have so little of the money we’ve worked so hard to earn for ourselves. We’ve spent it, squandered it, or had it stolen.

But it didn’t disappear.

Winning The Money Game

It could be useful to think about money as a game. In the circular flow of money, there are both winners and losers.

The winners are the people and businesses who can keep as much money extracted from the system as they can for themselves. Businesses do this by meeting customer needs and increasing margins. Individuals do it by saving and investing while controlling spending.

In other words, the winners build wealth.

Meanwhile, the losers are those who extract money, at any amount, while failing to keep much of it. These are called broke people.

So again I ask, where is all your money?

And I follow that with an urge for you to figure it out. Do this by reflecting on how you’ve lived and what you’ve valued thus far

After that, I urge you to start to develop the principles, strategies, tactics, and habits that will help you do better going forward.

That’s what this blog aims to do as I seek to give you the wisdom, insight, and advice needed to become a winner in the game. Just about everything I discuss are real life topics that I’m sharing with you from experience since I used to be a loser in the money game and am slowly becoming a winner.

Where To Go From Here?

For starters, complete the exercise presented in this article. And read the other linked posts. Doing so will help.

That should equip you with understanding that all of the individual financial decisions you’ve ever made have combined to contribute to where you are today. It should also empower you with the knowledge that each decision you will make going forward can help build a solid future. What can be more motivating than that?

We will ultimately have to decide what actions and decisions are best for us. But hopefully the insight gained here can have a positive influence on the direction you take.