A long-term lease should be avoided whenever possible. They may seem like a more secure bet, but the potential downsides of gambling on long-term lease outweigh anything to be gained.

Life’s unpredictable nature dictates maintaining flexibility to account for risk and navigate unforeseen circumstances. Best case scenario with a long-term lease is everything going perfectly, but you could just as easily find yourself stuck in one of these long-term contracts with no way out.

Because it’s important to be able to adapt to an ever changing environment, long-term leases are too rigid to merit serious consideration.

Contents

A Long Term Lease Is Just A Long Term Contract

Before we start, let’s agree on the fact that long-term leases are the exact same thing as long term contracts. As such, I will use these terms interchangeably.

The distinguishing feature that gives a lease its name is that the contract in question grants usage rights for an item for a set period of time in exchange for payment.

For the purposes of this article, the item in question is a property. And the binding agreement between tenant and landlord, aka the “lease”, is simply a contract that holds both parties to the terms within.

I’d Rather Pay More For Short Term Leases

The impetus of this article came about as I weighed the pros and cons of paying up front for a full year of Spanish language classes vs paying month to month. In spite of being offered a 15% discount for the full year, I decided to pay monthly because I determined it offered a lot more upside.

Said differently, I chose to pay 15% more for the shorter term commitment. And yet another way to look at this is that the longer term agreement had to offer the discount because I would have given up a lot of benefits offered with the month to month option.

Everything has a tradeoff. So what benefits would I have lost by signing the long- term lease? Let’s dive into those next.

Case Study On Why Long Term Leases Suck

This post will feature a perfect case study showing the dangers of signing a long term lease.

About 2 years ago, my sister, who was renting at the time in the Tampa Bay Area, received a lease renewal notice informing her that her rent would be increasing by 33% from $1800 to $2400 after a single year of renting.

I tried to get my hands on the actual document so you can see it with your own eyes, but she apparently shredded it just a few weeks ago.

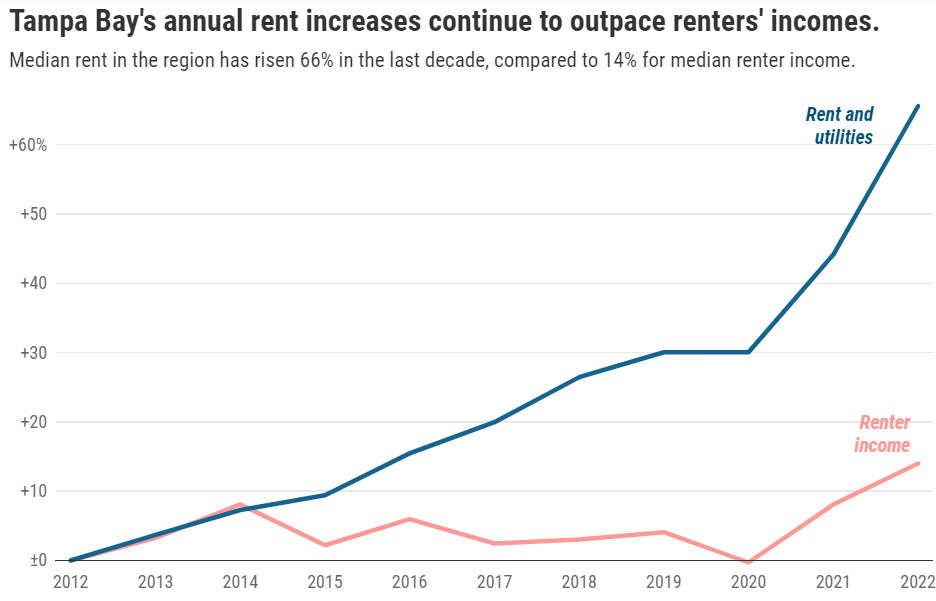

As a fallback, I’ll drop in a link and chart from the Tampa Bay times that shows what’s been happening to rents in the area over the last decade In short, they saw a 25% increase in rents during 2022 alone thanks primarily to mass migration.

Bewildered, and feeling powerless by the news, my sister decided her family would move to a cheaper house in a nearby area of town and sign a 2 year lease to ensure they would be protected from what had just happened – at least for a longer while.

Unfortunately, while good intentioned, her plan failed as she quickly learned that there are major downsides to long-term leases. And with 11 months still to go, she is now a firm believer in the principle that you should never sign a long-term lease.

You Lose Leverage And Power With Long Term Leases

One of the first signs of trouble for my sister and her family was that the house wasn’t quite ready.

While it looked good on the surface, it quickly became apparent that the builder of this brand new home completed the job with shoddy construction. The questionable items ranged from simple to major such as falling backsplash tiles in the kitchen to pooling water near electrical outlets in the dining room. There were also concerns of mold that had to be addressed.

Interestingly, raising these issues with the managing company resulted in the company dragging their feet, going ghost, and doing practically nothing until my sister sent over a scathing letter demanding action that I helped her draft.

It’s not surprising that this would happen. My sister was on the hook for 2 long years, so what incentive did the owner have to respond swiftly? It comes down to a matter of incentives. And unfortunately, the owner had all the power since they already had my sister locked up in the long-term lease.

Next let me draw a comparison to show why such an occurrence can be expected with long-term leases..

The Contract Year Phenomenon: Proof That Long-Term Leases Cause Parties To Lose Motivation

One of the best pieces of evidence against the usefulness of long-term leases can be seen from examining the productivity of star athletes before and after contract years.

In what is known as the contract year phenomenon, it is widely observed that the performance of top athletes peaks in the year right before free agency. Then, ironically, the performance of these same athletes falls the very next year after the long term contract (think long term lease) is signed.

Free agency is a period of time in which athletes become eligible to sign new and often lucrative long term contracts, so they are obviously motivated to show their value before it starts. After the deal is inked, their motivation drops because they no longer have the incentive to perform.

Don’t take it from me though, here is NBA legend Kobe Bryant discussing his first hand experience with this phenomenon:

It’s human nature to take things for granted once we have them and landlords are no exception. As with star athletes, they could lose motivation to perform when they know they have tenants locked in a long term lease.

Knowing this, we should only sign short-term leases to ensure we avoid the unmotivated landlord phenomenon.

Life Changes Too Often To Make Long Term Leases Viable

Another thing that happened to my sister that shows yet another limitation of long term leases is that her husband changed jobs about 3 months after signing the long term contract.

A major point for them choosing this particular place was that it was a relatively short commute from his job. Then his commute more than doubled due to the job change. He now has to drive a minimum of 45 minutes depending on traffic.

With a shorter term, let’s say 1 year, they would have only had to endure this long commute for 9 months before moving to a more convenient location. However, because they are locked into a long-term lease, they’re stuck for a total of 21 months.

You Can’t Predict The Future, So Why Commit To A Long Term Lease?

Imagine that you lock yourself into a long-term lease of, say, 5 years. Now let’s think of all the ways life can change over that time. Here are a few that are top of mind:

- You have 2 kids and need a bigger space.

- You are offered a dream job in another town.

- You lose your job, struggle to find work, and need to move back in with your parents.

- The quality of the neighborhood goes down.

- There is a breakup or divorce.

- The political climate of the country compels you to want to move abroad.

- You find better rent prices in other parts of town.

Waiting a year or less to adapt to any of these changes would be palatable. But being stuck in place for several years because of a long term lease could really suck. As such, losing the ability to adapt to future changes is a key reason why you should never sign a long-term lease.

Some of you may argue that it would be no different than if one were to own. And this is true.

As I’ve mentioned previously, the lock-in and loss of flexibility are major drawbacks of homeownership in the rent vs. buy debate. Homeowners presumably make a conscious choice to sacrifice flexibility in exchange for the benefits of owning.

However, as illustrated by my sister’s situation, it doesn’t make sense for renters to further limit their ability to adapt by committing to a long-term lease.

What You Gain From Long Term Leases (or use relevant keyword).. possible benefits

Long Term Leases Increase Your Risk Profile

On the surface, it may seem that a long term lease could help offset some risk. My sister, for example, signed her 2 year lease as a strategy to mitigate the risk of extreme price increases.

Meanwhile, without realizing it, she increased her household risk by adding a longer-term liability to the family’s balance sheet.

The problem here is that a liability such as a long-term lease is a claim on future earnings. This means we must ensure our future earnings are enough to cover the costs because they are owed regardless of what our personal futures hold.

Whether we like it or not, we are on the hook to meet this obligation. Meanwhile, we lack certainty that we’ll always be able to cover it. Because of this, long-term leases are liabilities that should be avoided whenever possible.

Landlords Should Also Avoid Long Term Leases

In the real estate investment space there are some who claim long term leases create a triple win for residents, owners, and property managers via enhanced stability and predictability for each party.

The article linked above at least tries to echo my sentiment that long term leases create liabilities, but it glosses over the issue because the authors seem to be partial toward them, likely because they’ve found them profitable.

Be that as it may, the stability, predictability, and reduced vacancy rates that long term leases offer can easily be offset by bad tenants and rising prices that landlords can miss out on.

Just imagine if my sister was a nightmare tenant or if prices in her area rose significantly – or both. In these cases, her landlord is stuck with these problems for a period longer than necessary and essentially loses out in the overall deal.

Cases Where A Long-Term Lease Makes Sense

Commonly cited reasons for opting for a long term lease such as stability and predictability aren’t worth the risks, so I had to dig deep to come up with a few scenarios where they could make sense. Here are a few outside of the box scenarios that could warrant a long term lease:

You Can Match The Long Term Lease To Another Life Event

I recently had a colleague who opted to live in a miserable small town near company headquarters as a strategic move to put her two children through college.

She was from Hawaii but moved to a backwoods part of the American south because she found a great job in the same town her kids went to university. And by moving to this town for a few years, she is able to provide a home for her children and support them as they complete their studies.

It hardly makes sense for her to buy in this situation, but a long term lease would be an amazing option since she could match it to her youngest child’s graduation date. She currently has 3 more years of sacrifice before this happens. Then she will retire and move back to paradise in Hawaii.

In the meantime, why not at least lock in a long term lease with favorable terms?

The Long Term Lease Forces You To Settle Down

In the last decade alone I’ve lived in more than a dozen homes across a handful of cities. I’ve also never lived in a single unit for more than a year. In other words, I’ve moved around a lot.

With all of this “instability”, a long term lease could possibly be a good strategy to force myself to lock in a bit and commit to a place. This decision would definitely come with all the risks outlined above, but perhaps the benefits could be worth it.

You Can Afford To Take On More Risk

Given the right financial situation, one could perhaps roll the dice on a long term lease and just pay the price of failure in the event things don’t work out.

Let’s say for example you were to find a special deal in terms of monthly rent price and wanted to lock it in for a longer duration with a long term lease. Maybe you are sitting on a huge lump sum of cash and are willing to part ways with some of it if you ultimately need to break the lease.

You could feasibly take this risk because things may just work out. And if they don’t, you pay up and chalk the situation up to a gamble that you lost.

Final Verdict: You’ll Minimize Regret With A Shorter-Term Lease

A deal is a deal. And once you are locked into a long term lease, you are locked in unless the other party decides to let you out.

It’s not a question of whether long term leases offer some benefits. It’s a matter of whether these benefits outweigh the costs. For me, I value flexibility and minimal risk which makes long term leases obsolete in my eyes.

If we only focus on the upside, then a long term lease is a no brainer. But I would surely have a lot of regret if I signed one and things didn’t work out. Because of this, I suggest that we skip the long term lease and keep our leverage by opting for short term leases – even if they cost more.