Have you ever wondered how you’re doing along your journey toward financial freedom? This post should help. I’ll present the 5 levels of financial freedom so you can gauge exactly where you’re at.

Its a long road achieve financial freedom. We must diligently manage our money and emotions, while making all the right decisions. Adding to the challenge is the fact that life throws us all kinds of curve balls that can easily distract us.

Because of this, it is important that we know the levels of financial freedom so we can keep track of our progress. This will help guide our decisions and motivate us to keep going.

Contents

The Definition Of Financial Freedom

Financial freedom is achieved when an individual, by way of investment, cash, or other means (such as a trust fund or business), is able to fund their lifestyle without the necessity of work.

This of course doesn’t mean a person won’t work or has to retire once they achieve financial freedom. It simply boils down to whether a person is compelled to go to work or not.

With this definition leading the way, let’s dive into the 5 levels of financial freedom that we progress through along the way.

The 5 Levels Of Financial Freedom

The levels of financial freedom presented in this post move from least to most aspirational. The 5 levels of financial freedom are:

- Survival Mode

- Financial Dependence

- Semi-Financial Freedom

- Financial Freedom

- Abundantly Rich

Figuring out your level of financial beneficial. Rather than getting caught with comparison to other people, we can measure ourselves day by day. Striving to elevate ourselves to each subsequent level will ensure we find success given enough time.

Level 1 Of Financial Freedom: Survival Mode

The lowest level of financial freedom is survival mode. It’s referred to as such because finding yourself in this level would mean you are already drowning with your finances. As such, we should consider being at this level a financial emergency and do everything in our power to get out.

I spent the majority of my adulthood in survival mode, so I know it all too well.

Let’s review the factors that could indicate that someone is in the survival mode stage of financial independence.

1) You Are Unable To Meet Basic Needs

The basic needs to thrive today are food, shelter, essential transportation, health care, toiletries, wifi, and basic phone service. Lacking the means to acquire any of these on a regular basis could indicate that you are in dire straits with your finances.

2) Expenses Exceed Income

When I went broke in 2018, not being able to cover my monthly expenses each month was the the clearest sign I was in survival mode. I’m not sure what I would have done if my then girlfriend wasn’t there to loan me the $200 – $500 difference.

That ordeal taught me some valuable lessons about money management and debt that I’ve heeded ever since. I made at least $60,000 in 2017, but was surviving paycheck to paycheck with nothing left. Then it all came crashing down when I took a pay cut.

You may be one of the millions of Americans who are currently using credit cards to cover basic expenses. Or, perhaps you are one of the 42% of six figure households delinquent on buy now, pay later loans. Whatever your circumstance, spending more than you earn each month is a glaring sign that you are indeed in survival mode.

3) Living Paycheck To Paycheck

Perhaps you can make ends meet while still being one of the estimated 70% of households living paycheck to paycheck. It can be easy to get stuck in this position as it can lure you into thinking you are doing good enough.

In reality, not having anything left at the end of the month means you are treading water. In these instances, it can take a single accident to expose just how precarious of a financial situation you are truly in.

4) Drowning In Debt

Few statements have been more true about debt than when Moliere said they are like children who are begot with pleasure, but brought forth with pain.

This statement highlights the painful reality that debt can seem like a good idea when acquiring it, while putting us in harm’s way later. I found this out the hard way when I accumulated more than $60,000 in credit card and personal loan debt.

Even if you are “managing” your debts each month, you could still be in survival mode. This is especially true if you need everything in your life to go perfectly in order for you to stay ahead of the danger.

4) Extreme Financial Stress

As undesirable as stress may be, it could serve us well by indicating that something isn’t right with our lives. To that end, having financial stress could be an indicator that you are in survival mode for one reason or another.

Level 2 Of Financial Freedom: Financially Dependent

This is the most nuanced level of financial freedom. It also happens to be the financial freedom level with the greatest share of people. And unfortunately, it’s the one where most people get stuck living out the American dream.

As you’ll see in a moment, this level of financial freedom is occupied by individuals and households covering all strata of the financial spectrum – from rich to poor.

Let’s dive into the things that makes someone financially dependent.

Consumption Based Lifestyle Funded By Income

Regardless of income level, those in the financially dependent level of financial freedom rely on a steady stream of employment income to make their lifestyles flow. This could be the teacher in Florida making $50,000 or the Silicon Valley engineer earning $200,000.

The primary indicator of a person being financially dependent is their reliance on paychecks to maintain their lifestyle. In these instances, individuals are essentially consumers whose financial profile is based on an earn-spend cycle requiring the constant input of labor generated income.

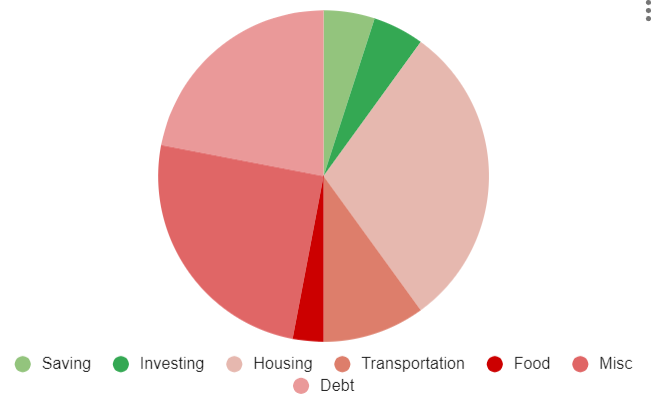

Here is a depiction of a consumption based budget that would place someone in this level of financial freedom. Specific numbers aren’t important – but we can see that the ratio of net savings and investments as shown in green, pale in comparison to their outflows in red.

Level 2 Of Financial Freedom Example: Couple Earning $200,000

Before going further, I’d like to present an excellent example of what it looks like to be in level 2 of financial freedom.

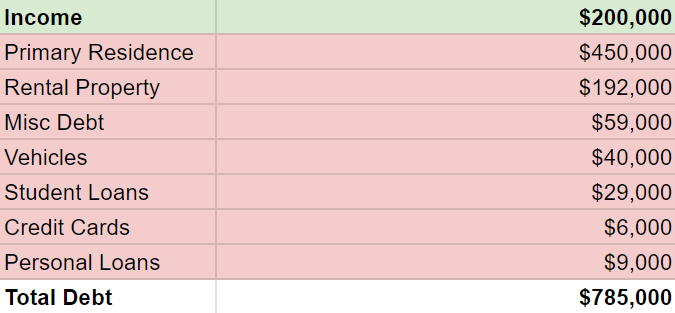

By common standards, the couple from the following video is doing quite well. They earn a top 5% income of $200,000 a year and have multiple properties and cars. They seem to have the lifestyle most people want, and given their obviously high standard of living, I am sure they are the envy of many around them.

In spite of doing so well, this couple fall into level 2 of financial freedom because of the structure of their finances in terms of debt, savings, and cashflows. I’ll discuss more on these factors in a moment, but for now examine a breakdown of their financial profile for context.

Average Lifestyle Of Debt, Expenses, And Low Personal Savings

What makes this level of financial freedom so nuanced is that, like the couple above, you can be doing quite well in life while still being financially dependent on your source of income. Because of this, it is important to note that your level of financial freedom is independent of how much you earn.

In my post on fighting return to office, I used the following description of a well off couple living a good life while still being financially dependent on their jobs for survival:

“Let’s suppose for a moment we took an average couple, with an average lifestyle, in an average American city. Because they are average, they live a pretty good life consisting of the trappings we would expect in the average American’s life.”

Considering the averages – a typical household has an income of $75,000 with an average mortgage balance of $244,498, an average amount of student loans at $38,787, average cars with balances of $23,792 costing an average car payment of $726 per month, and an average amount of credit card debt of $6,501.

Unfortunately, this also means that the average savings rate in the U.S. is just 3.2%.

Doing All The Right Things

Most people seem to be doing all the right things with their money. They’ve gone to college and landed good jobs. They’ve bought a house which they’ve been diligently paying off. They are even investing.

...But They Must Go To Work Or Else

The consequence of being average and doing all of the right things as outlined above is a lifestyle that makes us dependent on work.

Most people simply cannot afford to miss a beat with their work incomes because of the slew of bills and obligations attached to their finances. Each month brings forth a new round of outflows needed to fund the lifestyles.

As the name of this level of financial freedom suggests, they are dependent on work to keep the ship afloat.

A Long Road To Financial Freedom

The final piece of the puzzle here is the time it takes someone in level 2 to actually reach financial freedom.

Sadly, current retire data is showing that many people will never be financially free as upwards of 91% of retirees are dependent on social security. As for the other 9%, the average retirement age seems to be somewhere between 62 – 65 years old.

This means that most people will be dependent on their jobs for 40+ years while others of us are steadily carving a path to retire in half that time or less.

Let’s talk about that second group next..

Level 3 Of Financial Freedom: Semi-Financially Free

Level 3 of financial freedom represents the semi-financial freedom stage.

In this level of financial freedom, we’ve moved past the consumption focused earn-spend cycle to an earn-produce cycle focused on building wealth and freedom.

Like those in level 2, individuals at this stage are still dependent on their jobs. The difference here is that income earned through work is transformed into productive assets that work harder and harder for us as they steadily accumulate.

In the earn-produce cycle, you are no longer a consumer whose work activities are done for the primary purpose of consumption. Instead, you work to earn an income that is used to build a financial base that will enable you to purchase your freedom in a relatively short amount of time.

Here are the factors that would indicate someone is in this level of financial freedom:

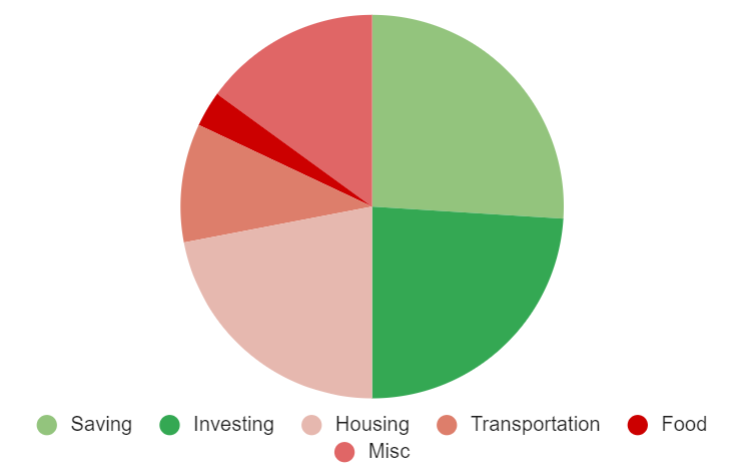

Production Based Lifestyle Fueled By Income

This level is called semi-financial freedom because individuals here manage their money in ways that accelerate them toward financial freedom.

I think it’s at the 40% savings rate that we cross into level 3 of financial freedom. Consistently saving 40 – 60% of your income would enable you to retire in roughly 12 – 20 years as opposed to the 40 plus years for those who stay stuck in level 2.

That said, saving such a large portion of our income for such a long period of time is not easy. It takes many years of dedicated frugality, which we will discuss next.

Dedicated Frugality

Frugality is required to save 40% or more of your income on a consistent basis. To get to 40% savings or beyond requires sacrifices in your choices related to housing, transportation, food and more.

Here is an example of a budget breakdown of someone in level 3 of financial freedom. Again, specific numbers don’t matter, but notice how a significant portion of their monthly income goes towards saving and investing as opposed to lifestyle and consumption.

Level 3 of financial freedom is the hardest to achieve and maintain as it requires you to live a much different lifestyle than most people. It’s extremely challenging to stay focused, organized, and disciplined for so long.

I believe this is why so many people bypass level 3 altogether. Instead, they spend most of their working years in level 2 before transitioning to traditional retirement at level 4.

Flexibility: Lower Dependence On Your Job

All of the hard work involved with level 3 of financial freedom produces flexibility. Specifically, the high savings rate leads to a rapidly increasing financial cushion that ultimately gives us options in how we live our lives.

For example, those in the semi-financially free level may decide to do things such as take an extended sabbatical, accept a lower paying role, or refuse to return to office when necessity calls.

Of course, you can’t go completely rogue quite yet. But being at this level of financial freedom starts to really open up your options.

Level 3 Of Financial Freedom Example: Single Person Earning $200,000

Because I made a good bit more than $200,000 in 2023, I can conveniently serve as comparison to the couple mentioned above.

For starters, I have no debt which means I’m able to save and invest a much larger share of my earnings. Specifically, my savings rate fluctuated between 65 – 75% last year in spite of excessive restaurant spending and close to a dozen international trips.

As a result of high savings, I’ve been able to quickly build is a six figure nest egg that is slowly positioning me to be able retire in under 10 years. Being at this level of financial freedom also enables me to spend relatively guilt free and boldly turn down jobs offering $160,000.

Best of all for me is that being at the semi-financially free level of financial freedom is already giving more choices in life.

For instance, I’m planning to make my second career pivot in the near future which would mean facing a hefty pay cut. Fortunately, I’m semi-financially free which means I can make choices that aren’t bound by the constraint of needing money to survive.

Being at level 3 of financial freedom is awesome because it allows us to focus more on enjoying life and the work we do even if it means less money. Time is so precious and those of us in this level of financial freedom can maximize it.

Level 4 Of Financial Freedom: Financially Free

The ultimate destination you should seek is the fourth level of financial freedom. This is where you actually become financially free as you are able to live exclusively off the income provided by your investments.

To get here means you’ve either committed yourself to level 3 of financial freedom for an extended period of time of up to 20 years. Or, you took the normal route and stayed at level 2 until you were able to retire in your later years.

It could be a challenge to determine how much you will need to be financially free. Thankfully, the personal finance space has produced some handy methods to help get us started. I suggest you use these to establish your savings goal to achieve financial freedom.

The 4% Rule Of Financial Freedom

The longest standing method for determining your financial freedom number is using the 4% rule. Simply put, the 4% rule states that you can safely withdraw up to 4% of your retirement nest egg each year without ever depleting your funds.

If you don’t know where to start with financial freedom goal setting, you can use this rule as a guide. It can help you determine an initial target for how much you will need to consider yourself financially free based on your desired lifestyle. For example, I would need to save $1,000,000 if my goal was to live off $40,000 per year.

In recent times, the 4% rule has been challenged as outdated because the rule was invented in the 90s, based on the 10-year bond yield at the time. This post by the Financial Samurai explains it well.

Shortcomings aside, I believe the 4% rule is a good starting point for most. Considering the median retirement balance in the U.S. is only $87,000, hitting the 4% rule would be a major improvement across the retirement landscape.

Once started, you can then refine your target as you take in more information.

Level 5 Of Financial Freedom: Abundantly Rich

The final level of financial freedom is the abundantly rich stage. Unlike those in the financially free stage, folks who are abundantly rich should never need to worry about money as they feasibly have enough to never run out (within reason of course).

While there is no exact number that constitutes being rich, I personally wouldn’t feel like I’m there until I’ve amassed a semi-liquid nest egg of at least $10,000,000. Anything less than that would make me feel that I could still blow it.

I don’t spend much time thinking about this level of financial freedom because of how far out of reach it could seem. Instead, I focus on realistic goals such as achieving financial freedom at level 4.

Aside from material trappings, I don’t believe quality of life is much different for those who are financially free and those who are abundantly rich.

Still, some of you may be in a position to become rich – to which I tip my hat to you. Folks like you make the world turn with the things you’ve produced and created.

By the same token, many others of you may dream of becoming rich. I think this is a good thing and implore you to get to work on doing what it will take.

But also rest assured that targeting level 4 of financial freedom is a solid goal that is certainly more achievable.

What Does Your Version Of Financial Freedom Look Like?

Financial freedom and retirement will look different for each of us. For instance, I’ll use the time afforded to me from financial freedom to double down on my fitness activities and creative pursuits. I don’t foresee myself ever ceasing to be productive. But I do look forward to deeper work on my own passions.

Others may use the time afforded by financial freedom to travel the world or start the business you’ve always dreamed of. Some may even continue to work because they like the camaraderie of being in an office.

The possibilities of financial freedom are limitless and will give us the privilege to choose how we spend it. But we must work out way through the levels of financial freedom to get there.

I’d like to know what you plan to do or dream of doing when you’ve earned yourself the right to decide how you will spend your precious time?

Thinking about this and sharing could be a great time to give yourself some inspiration!

Drop me a comment below.