I have one promise for you: this post contains no gimmicks. It’s just a straightforward guide to help you save your first $100K.

Instead of theory, I will outline the exact steps I took to reach the $100k savings milestone, starting from negative $242,000 in debt. I can’t promise it will be easy or quick, but if I could save $100k, so can you.

Consider this post as a reference guide that you can return to later as you keep making progress.

Let’s dive in.

How Saving $100,000 Can Change Your Life

There are many good reasons for saving $100k. Here are 10 that should motivate you to consider embarking upon this worthwhile journey:

- Financial security. Confidence knowing you can handle most whatever comes your way.

- A lot of utility. Having money can always be useful – especially if you use it in intelligent ways.

- Lowers stress. A great way to reduce your overall levels of stress is to save a large sum of money which you can rely on in times of need.

- Gives you more options. Whether it be buying a house, a car, or relocating – savings $100k can increase your options and reduce pressure.

- Home down payment. $100k is more than enough to cover a 20% down payment on today’s median priced home which costs around $400,000.

- Cash for kids’ college. Especially if your children go to an affordable school, $100k can go a long way.

- Freedom to travel or take time off. Just as I’m doing with my year-long sabbatical. Saving $100k can give you the freedom to live the life you’ve always dreamed of.

- Funds to start a business. Could provide the means to start that business you’ve always wanted to launch.

- Faster wealth building. What opportunities can you invest in with $100k that will accelerate your wealth building journey?

- Closer to financial independence. If financial independence is your goal, saving $100k gives you validation that you’re on the right track. Just keep going!

How To Save $100k

Let’s jump right into a discussion of the steps you can take to save $100k. The recommendations that follow have been fully vetted and proven effective as they are the exact steps I took to do it myself. Let’s go!

1) Adopt A Savings Mindset

The first thing you have to do to save $100k is adopt the right mindset for saving $100k.

Remember, this is not some get rich quick scheme and it’s not going to be easy. To get there you’ll have to dig deep to summon motivation, determination, and dogged perseverance.

As I look back on my journey to $100k, here are the most important mindset factors that helped me achieve success.

Be Staunchly Disciplined

Don’t worry about being perfect. Instead, be disciplined which is all about consistently doing the habits that lead you to success. In terms of saving $100k, those habits are consistently putting money aside, avoiding overspending / frivolous spending, and not giving in to FOMO.

Another important, yet overlooked facet of discipline is getting back on track if you fall off course.

Something about missing a few days or weeks of consistency can make us lose our motivation to continue. If this happens, you’ll have to muster up the willpower to keep going no matter how far off track you find yourself.

Have Monk Like Patience

I can tell you from first hand experience that saving $100k will probably be a mighty test of your patience.

I remember moments in 2020 where I wanted to give up because I felt like I’d never get there. I had already squeezed every drop of savings I possibly could from my budget and was even working a second job to accelerate my progress. Still, things were moving too slow.

But to keep going was my only option; and I eventually made it.

That entire experience taught me a valuable lesson: be patient. If you are doing the right things consistently, you will get there, so there is not point in stressing or making yourself miserable in the process.

Say it with me: be patient!

Keep An Eye For The Journey, Not The Destination

A great way to be more patient and to make the entire experience of saving $100k more enjoyable is to keep an eye for the journey. What does keep an eye for the journey mean? It means to remain focused on the process rather than the end result.

You can spend all of your time staring at your savings account as it slowly adds up. Or, you can get on with enjoying the rest of your life while methodically improving your money skills, focusing on earning more, and planning for the future.

Constantly looking at the savings account will only make you miserable. Meanwhile, focusing on each step of the journey can actually be rewarding because it gives you a constant sense of progress.

2) Establish A Place To Keep Your $100K

If you’re going to save $100k, you will need a place to keep it. For this, you should establish a standalone high yield savings account or brokerage account.

A high-yield savings account is for safe, accessible savings, while a brokerage account is for investing in the market. Both offer returns, but brokerage account returns may be higher – albeit with increased risk. Meanwhile, high yield savings accounts provide guaranteed returns at lower fixed rates.

Regardless of which you choose, this account needs to be separate from your normal checking accounts or any accounts from which you normally spend from as we want to keep our money safe from bad guys, and also ourselves because we’re often our worst financial enemies.

Also, once established, it is important that you automate your contributions to this account to avoid the battle of willpower it takes to save versus spend.

Most high yield savings are identical, but you should shop around for the best initial rate. Brokerage accounts may differ slightly in terms and offerings, so you’ll also want to shop around for those.

Check out these helpful links if you’d like to learn about both account types before making your selection:

3) Create A Realistic Budget

This is where the fun of saving $100k starts as you will begin to direct funds toward your goal. Take the following steps to make a budget that helps blaze your path toward saving $100k.

How Much Do You Make?

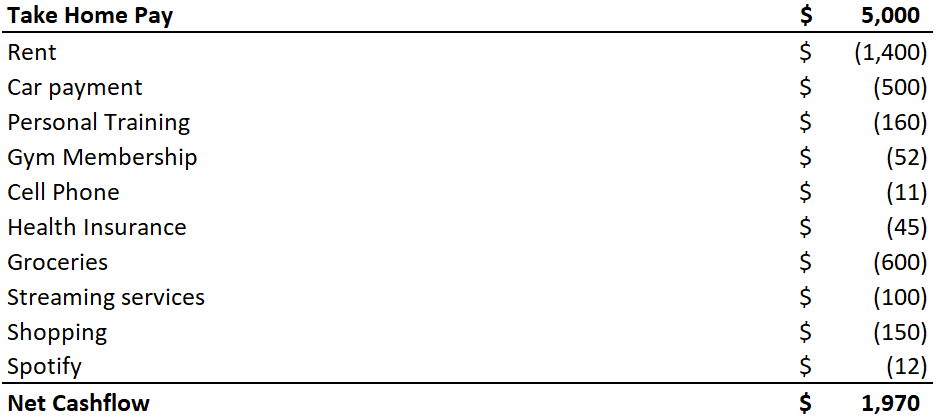

The first step to creating a budget is jotting down your income. Not your base salary, but the amount you actually take home on your paychecks each month. If you aren’t sure of this number, find your most recent pay stubs and jot down your monthly after tax income.

How Much Are Your Bills?

Each month, you have a slew of bills and financial obligations that wage war on your finances. You want to get these out on the table and see all of them for what they are.

Review your bank and credit card statements to identify all of the bills you have each month. Jot those down along with their cost under your income.

How Much Is Your Discretionary Spending?

Your spending doesn’t stop at just your bills. Next, jot down the discretionary spending you typically do each month for things like eating out, shopping, entertainment, etc.

If you don’t know the numbers, review your statements or your automated tracking system to see where your money normally goes.

How Much Cash Can You Save Each Month?

Congratulations! You now have a simple budget that should allow you to see how much you can save toward your goal of getting to $100k. Simply take your monthly income and subtract your bills and discretionary to see what’s left.

4) How Can You Create More Money For Saving $100k?

If you find you don’t have a lot of room for additional savings, it’s time to make some changes to the way you are managing your money. $100k savings is not some goal you accidentally stumble upon. Instead, it takes focused and intentional action like the ones mentioned next.

Essentially, your goal is to widen the gap between your income and spending. This is known as your personal financial margin. The following list are things I did to increase my financial margin:

- Increase your income. I methodically raised my income from $50k in 2018 to more than $200k in 2023. I worked second jobs, asked for promotions, and even changed companies. You will have to be intentional, patient, and strategic with this – but it can be done.

- Slash expenses. Along with raising your income, you will also need to slash your bills and expenses to create the widest margin possible. I did this by downgrading apartments, driving an affordable car, going with prepaid phone service, and cutting out subscriptions. Look at the bills section of your budget and ask yourself which items can be reduced or eliminated? You may also want to consider implementing some extreme savings.

- Control your discretionary spending. This is probably the hardest one to do because there are no mechanical steps involved. Instead, we must look at the person in the mirror and get him/her under control. Some things you can try are no eating out & no drinking challenges while also learning about other ways to control your spending.

- Sell what you can. Not so much a budgeting strategy. But you should also sell as many of the things you don’t need as you can. If you haven’t used something in several months, you probably don’t really need it.

4) Starting Your $100k Savings

Whew, that was a lot!

I told you it wouldn’t be easy. But if you’ve made it this far, you’re probably in the top 15% of all households considering most people struggle to manage their money. Hat tip to you!

Your savings account is ready. You’ve established automated deposits. And you’re actively working to increase your financial margin. So, there must be nothing left to do aside from “set it and forget it”, right?

Well, sorta.

Yes, you can sit back and watch your savings grow. But you’ll want to first direct your savings towards some financial housekeeping which includes 2 critically important items as follows.

Start An Emergency Fund

Nothing will bust your journey to $100k like a good ol fashioned emergency. For me it was being laid-off. Who knows what it will be for you, but it’s almost guaranteed something unforeseen will happen in the time it takes you to build your savings.

For that reason, you are going to want to use the first portion of your savings as your emergency fund. I started with $1,000 as Dave Ramsey recommends and built it further over time. If you have debt, then you should do the same. But if you have no debt, go ahead and aim for a 6 month rainy day fund.

Pay Off Debt After Emergency Fund

After your emergency fund is in place, all savings and additional funds should be used to pay off all non-mortgage debt.

It doesn’t make much sense to save up a large sum of money while remaining in debt. The goal is to help you feel more free. And to get the full benefits of having $100k, you’ll want to rid yourself of any debt holding you back.

I started my journey to save $100k being $242k in debt. I then followed the exact steps above to clear that debt.

Build $100K Savings After Clearing Debt

It took me 5 years to do, but once my debt was gone, saving $100k was pretty easy because the necessary habits were in place.

Once you get to this point, you simply continue doing the things that got you to the point of being debt free with an emergency fund, and you’ll get there too.

How Long It Will Take To Save $100,000?

Here’s how to get a rough estimate for how long it will likely take you to get to the $100k milestone.

Taking the final monthly savings figure from your refined budget above, divide that number into $100,000 to get the number of months it will take.

For example, assuming you can save an extra $1,000 per month, the math would be $100,000 / $1,000 = 100 months. You can then divide the month figure by 12 to get the number of years which in this case would be 100/12 = 8.3 years.

Don’t forget that you’ll be saving your money in interest bearing savings or brokerage accounts. Therefore, it will grow a bit faster than your estimate. But, from experience, something always comes up that makes things take longer than expected. Because of this, I recommend that you increase your time estimate by 15-20% to get a more realistic picture.

Enjoy life, But Don’t Use Your $100k Savings To Do It

At times, you may be tempted to use your savings to splurge a little. But don’t.

Instead, plan your trips and other activities using cash flow into a separate savings bucket. Even if you have to reduce your $100k contributions by a bit, it is better to do this than to raid your savings.

Saving $100k takes discipline and you want to avoid the habit of undoing all of the hard work you’ve put in before you reach your goal.

In short, have fun – just don’t do it with your $100k savings.

Is There A Better Way To Save $100K?

As I promised at the start, there are no gimmicks involved in this plan for saving $100k. That said, I can’t help be wonder if there is a better way?

I’d love to hear from readers on how they went about / would go about saving $100k. Is there something I missed in my approach? Could I had made things easier?

Drop me a line in the comments and let me know your thoughts!

2 Responses

Great content, saving in general is a very useful skill which I guess became rarer nowadays. Especially I like the part in which you describe discipline and not spending money on useless things. I would also mention investing as a form of saving money, which in “long-term” can result not only in maintaining the value of capital, but can also bring a nice surplus. Of course if it’s a right investment ;).

Hi Fryderyk! Thanks so much for the wise comment. Investing is definitely a solid, if not the best for of investing, because as you said – it enables you to maintain the value of capital, outpace inflation (hopefully), and build wealth. You have any investing tips that you can share?