It is easy to have misconceptions about money regardless of where we are along our financial journeys. Misconceptions about money often center around much of it we think we need or how having more of it will change our lives.

Financially speaking, I’m not yet rich – but I have been accumulating money at a pretty rapid rate as of late. This has given me an opportunity to explore and challenge many misconceptions that I, or others, have around money.

I’ve learned some pretty valuable lessons about the true identity of money and what it could really do for you. I’ll share those learnings in this article and show you that many commonly held beliefs about money are nothing more than misconceived notions.

Contents

Money Misconception #1: You Need More Of It

The most basic misconception about money is that we always need more of it.

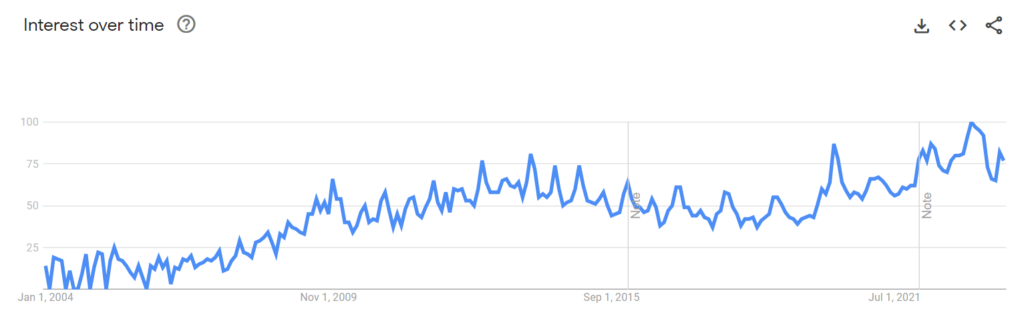

Interestingly, this notion is gaining more traction than it once did. Just take a look at the chart below showing Google search trends for the term “how to get more money”. This chart shows us that queries for this term have increased 600% since 2004.

I believe the internet and social media have been major culprits in perpetuating this misconception. Constantly seeing images portraying everyone getting rich makes us all think we need more money to keep up.

There is a lot of irony involved with this line of reasoning. When we are broke, it is easy for us to think that we need more money to make our lives better. At the same time, becoming richer often drums up greed within us that causes us to seek ever more money with no true end in sight.

The misconception that we need more money is problematic because of the way it influences our behavior. Let’s take a look at how this misconception could impact those who are on both ends of the financial spectrum.

I Wouldn’t Be Broke If I Had More Money

Those who are in less than ideal financial positions are likely to be misled by the misconception that more money is the solution. That is, they can easily default to thinking that their problems stem from a lack of money. If only they had more, their money problems would be resolved.

In reality, a lack of money is rarely the case.

While it is true that more money could be helpful, being broke often stems from how we manage the money we already have. Therefore, fixing our current money management issues is most often the fix for being broke – not getting more money.

Affluent And Accumulating More

On the other end of the spectrum, the affluent could also be misled by this notion about money in potentially devastating ways. That is, the chase for more money can lead the already well off to make increasingly greater sacrifices in the accumulation of more.

In my own life I’m finding that as I make more money, I work increasingly harder to accumulate even more while making sacrifices in other important areas.

Though this past September was my highest grossing month ever, the earnings came at a cost. I worked a marathon of 21 consecutive days in spite of being miserably sick for 14 of those days. I also published 2 articles of approximately 7,000 combined words and produced their accompanying podcast episodes.

As satisfied as I may be with the accomplishment, I’m not sure it was truly worth it as I am still not fully recovered some 2 weeks later. Burnout has certainly started to creep in and 1-2 new gray hairs could indicate that I may be pushing myself a bit too hard.

Examples like mine are common for success driven personality types.

We set goals and push hard to accomplish them. We hit our goals, and rather than stop, we continue to push harder for the next goal. And because money is often the final reward, we can become like the hamster in the wheel on a never ending chase for more.

Do You Really Need More?

Simply put, the misconception that we need more money exists across the full range of the financial spectrum.

The takeaway here is to examine your conception of money and whether you are stuck on the chase for more. If so, carefully consider the role of money in your life. In most cases, we will find that we likely have enough and could benefit from either managing it better or focusing on more important things in life.

Money Misconception #2: Money Will Make You Happier

Another common misconception about money is that having it leads to happiness. I can say from both a scientific and personal perspective that this simply isn’t true. I’ll go further and say that money could even make us less happy if we aren’t careful.

How might this be so? Let’s find out.

The Hedonic Treadmill

Psychologists and physiologists have extensively studied the expansive range of adaptations humans can undergo. For example, some people are well adapted to live in extremely hot climates. At the same time, others have adapted to the point of being able to thrive in the most frigid places on earth.

In the same way that humans are able to adapt to climates, we are able to adapt to financial situations that are both good and bad. For the purpose of examining the misconception that money will make us happy, we will consider how the adaptation phenomenon works against this notion.

Winning A Fortune Doesn’t Make You Happier

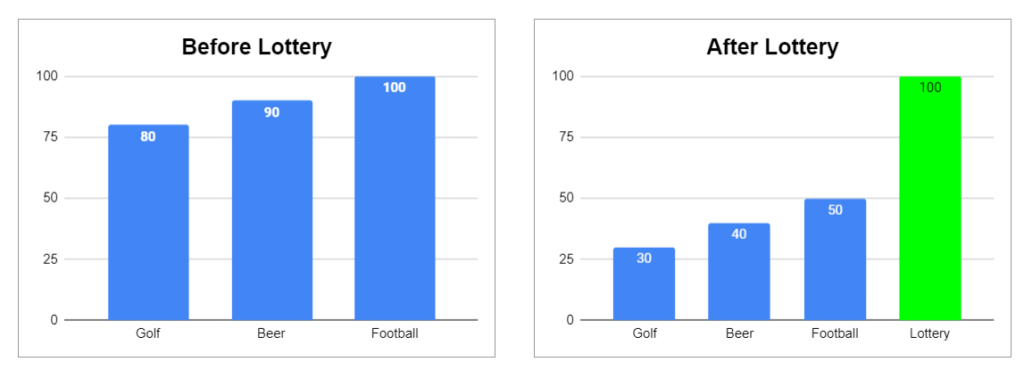

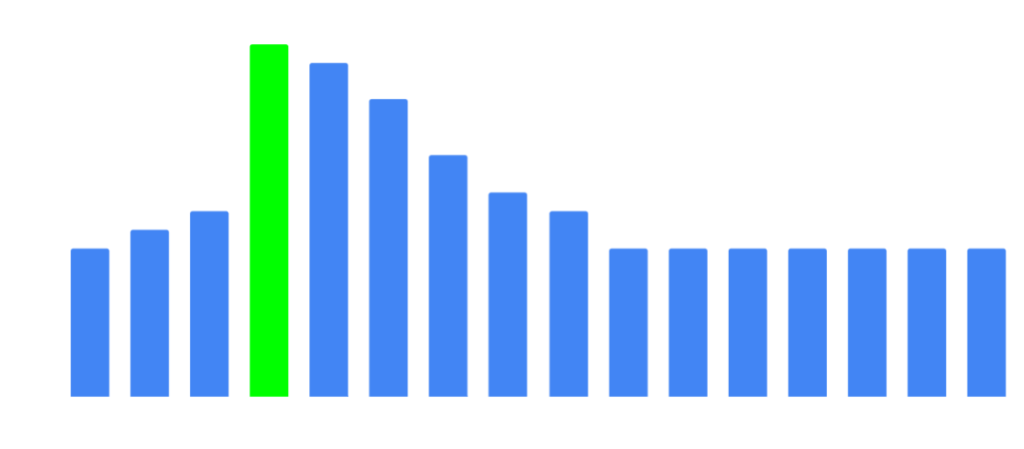

A 1978 study tracked a group of lottery winners who had won between $50,000 and $1,000,000 within the previous year. The study found that the group of people who won the lottery were essentially not any more happy than control groups of non lottery winners and paralyzed individuals. What could be driving this?

Adaptation level theory suggests that both contrast and habituation will operate to prevent the winning of a fortune from elevating happiness as much as might be expected. Contrast with the peak experience of winning should lessen the impact of ordinary pleasures, while habituation should eventually reduce the value of new pleasures made possible by winning. Study 1 compared a sample of 22 major lottery winners with 22 controls and also with a group of 29 paralyzed accident victims who had been interviewed previously. As predicted, lottery winners were not happier than controls and took significantly less pleasure from a series of mundane events. Study 2 indicated that these effects were not due to preexisting differences between people who buy or do not buy lottery tickets or between interviews that made or did not make the lottery salient. Paraplegics also demonstrated a contrast effect, not by enhancing minor pleasures but by idealizing their past, which did not help their present happiness.

Journal of Personality and Social Psychology

Contrast And Habituation Reduce The Pleasure Of More Money

What we see here is that there are 2 psychological processes that undermine our abilities to be happy when making more money.

The first is known as contrast which alludes to our tendency to experience lower levels of satisfaction with normal things after having peak experiences such as winning the lottery. The thrill of instantly winning millions could suddenly make the mundane activities of your old life much less enjoyable.

The second psychological process that helps dismantle the misconception that money makes us happy is habituation. Habituation simply refers to the diminishment of happiness experienced from new pleasures over time.

As for the lottery winners, they would certainly experience jolts of happiness as they use their newfound money to buy nicer homes, cars, and gadgets. However, they also showed diminished happiness with these new things over time.

Things The Rich Do To Make Themselves Happy

I’ve seen the impacts of the hedonic phenomena in real life as an old friend of mine became widely rich overnight.

One would think that gaining millions of dollars would make someone happier, but it seemed that the money had the opposite effect as my pal. He seemed to become more displeased with each successive year after earning the new fortune.

We also see other examples of this when we consider the things the uber rich among us do to keep themselves stimulated. An obvious example of note would be the recent Titan submarine mission that resulted in the deaths of 4 men who were worth nearly $3,000,000,000 combined.

With so much money and power, these gentlemen were unlikely to be stimulated by normal things such as driving a little above the speed limit or the occasional weekend trip to the beach. Therefore, taking on feats that are nearly impossible to accomplish would have to do.

Money Misconception #3: Money Will Solve All Of Your Problems

No matter the amount of money, we all have problems in life. As such, it could be tempting to look towards our money as the solution to our problems. And while it is true that money can solve certain problems, money rarely fixes the root cause of most problems.

I’ve already shown that money won’t be a long term fix for any happiness problems you may experience. In the same manner, we will examine a few other problems common to most of us and consider whether money can be the true solution.

You Are Too Busy, So You Pay For Convenience

Between work, family, and being social – our schedules can fill up pretty quickly leaving little room for all of the small things. After our schedules become completely booked, things such as cleaning our homes and cooking meals could be easily outsourced for other people to take care of.

In this manner, money is superficially the solution that we use to solve our busyness problem.

Outsourcing and paying the convenience tax doesn’t actually solve the problems though. In fact, using the money in this manner enables and exacerbates the problem further since it would allow us to stay in a state of busyness longer than we likely should.

A true solution to being too busy would be to scale back on your commitments to take back more of your own time.

Ironically, this is actually a better financial strategy since it would also free you to do all of the things you currently outsource to others. No longer would you need people to clean your home, walk your dog, or cook your meals if you were to cut back on all of the things putting a squeeze on your precious time.

You Have Poor Health Because You Don’t Have Enough Money

“If only I had money, I could pay for a gym membership and lose weight”. “Healthy eating is expensive”. “I can’t take off work to see the doctor because I need the money”.

All things that I’ve heard and would like to call fallacy on.

What we really see in these comments is excuses or misconceptions that money is the solution to good health. In reality, this is absolutely never the case as good health is something that can be had for very little (if any) money at all.

No one needs a gym membership to do a basic at home workout with some dumbbells, compound exercises, and outdoor cardio. It is also pretty cheap to eat a basic diet of chicken, rice, beans, and on sale vegetables. Not having enough money to take off work is more likely a function of poor money management and less a function of not having enough.

Your Relationship Problems Come Down To Money

We know that financial problems rank near the top of reported causes of divorce. Hearing this may lead one to believe that money could be the solution. If our relationship problems center around money, then focusing on money should theoretically solve our issues.

This is a misconception about money because relationship problems that involve money are still unlikely to actually be about money.

Instead, problems centered around money in relationships often have more to do with power imbalances, communication issues, lack of trust or teamwork, or money mismanagement. All of these have more to do with the people involved than they do money.

Fixing your skills in these areas will produce improvements to the money issues you think are causing you issues. In essence, money issues in relationships are usually just symptoms of deeper issues.

Money Misconception #4: Money Will Make You More Attractive

This misconception about money is quite nuanced, so let’s break things down on a per gender basis. I’ll start by discussing how this misconception ties into male attraction before turning our attention to how it impacts women.

Does Money Make Your More Attractive?

No one could ever argue against the correlation between the quantity of a man’s money and his dating options. Still, this begs the question of what actually enables a man with money to attract his dating options.

Is it him or is it his money?

Throughout my life I’ve been able to attract a quality set of female partners. My dating history includes a sultry collegiate track runner, a leggy amateur model, and a woman who was a finalist on The Bachelor.

I don’t intend to pat myself on the back here. Instead, I share to highlight the fact that I was able to attract all of these women well before I earned a six figure income or more than most men my age.

These experiences have led me to conclude that attracting women goes deeper than simply how much a man makes.

I’d like to believe these women found me attractive because of my charisma, intellect, ability to communicate, and my external appearance which I take care to maintain. I doubt any of them were drawn to me because of my rusty ol’ Corolla or studio apartment.

They clearly didn’t hold these modest trappings against me either.

The Science On Female Attraction

A series of studies on people’s preferences for “mate resources” found that women do actually find men with money more attractive. At the same time, these studies found that women were significantly more attracted to men who earned their money over men who inherited their money.

These results suggest that rather than being attracted to men solely for money, women are likely attracted to certain qualities in men that enable them to make money. Qualities such as intelligence, work ethic, and creativity are valued by women.

I find these results to align with my personal experience as I was able to consistently attract high quality dates well before I made a top income.

Do Men Find Women With Money More Attractive?

From personal experience, I believe they do. All else being equal, I would opt for a relationship with a woman who has money over one who doesn’t.

Be that as it may, I don’t believe most men intentionally seek out or place significant importance on finding women with money. Other qualities such as beauty, kindness, and agreeableness are highly valued by men more so than money.

Incidentally, the study mentioned above also found that men had slightly higher preferences for women who earned their money. This suggests that men also value certain qualities in women that would enable them to be able to generate an income more than simply having money.

Money Misconception #5: Money Makes You Better Than Others

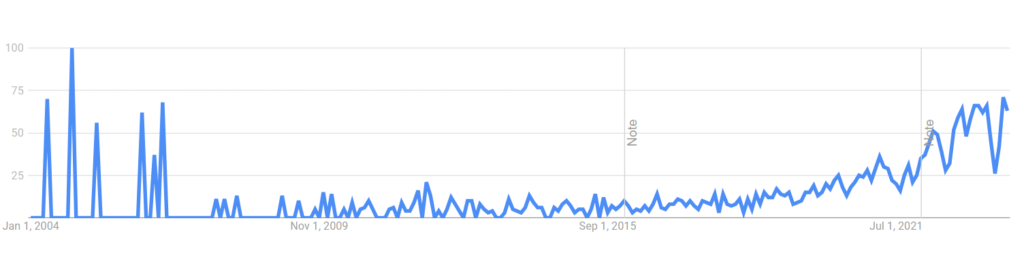

Search trends for the term “does money make you better” show some really discouraging results. Overall interest in this topic appears to have been pretty low from 2004 and 2019. Then, starting rat the end of 2019, we see a sudden uptick in the interest in this query to the magnitude of +1300% over a few years.

I find this very sad to see. It tells me that a lot of people are feeling pressure to compete and keep up with others. Some are making money and are probably not sure how to quantify their success. Others are probably seeing those around them appear to do well with money, and are feeling left behind.

As mentioned earlier, I think these trends are being fueled by social media and the internet. It makes me wonder if we would all be better with a significant digital detox.

Money Doesn't Make Your Better Than Others

Simply put, money doesn’t make you better than others.

We see numerous examples almost weekly of the rich and famous living and doing things that are more deplorable than many of us will ever dream. There are also some pretty normal people doing some of those same deplorable things.

At the same time, there are other examples of people with money living life in ways that would make most of us feel shame for not being better. Same goes for a lot of everyday people walking around.

One of the best people I know was a former teacher colleague named Mr. Baker.

I doubt Mr. Baker ever made more than $50,000 during the years I worked with him. Regardless of income, I can honestly say that he was one of the kindest, most pure hearted, and hard working people I ever met. Mr. Baker was a teacher who worked in the ESE unit and he went to the greatest lengths to do an excellent job for the students he served.

It is the Mr. Bakers of the world that are the best people, not those who we think are better for nothing more than their money.

I think it’s time to put this misconception to bed because I’m certain that it is making many people far less happier than they would otherwise be. It is also causing a lot of us to chase money in an effort to compete and outdo those we perceive to be our competitors. So toxic.

Earn Money For The Right Reasons

As you progress along your financial journey, I urge you to pay attention to your thoughts around money and ensure they are ones that serve you well.

Proper notions about money can go a long way in enhancing our sense of wellbeing and peace. On the other hand, we want to avoid toxic misconceptions around money that motivate us to chase it for the wrong reasons.

I hope that we can all breathe a little easier now that we’ve dismantled these five misconceptions about money. Further, it is my hope we can all make as much money as needed to have enough for deeply fulfilling and rich lives.