Financial orders of operations represent the sequence of steps we follow with our money throughout our financial journeys. Without realizing it, many of us adopt default financial order of operations that fail to produce good results.

That said, what if starting from the moment we were born, we were gifted with a set of precise financial steps to follow that would virtually guarantee us a life of abundance, happiness, and financial freedom?

I certainly wish I had a better roadmap earlier.

But I’m also happy to now have experiences and wisdom that have enabled me to develop the Breaking Broke Financial Order of Operations – an organized set of focus areas and steps that will help you live a life of abundance and freedom.

The progression of the Breaking Broke Financial Order of Operations are as follows:

- Principles – Health, Saving, No Debt

- Education And Skills

- Career You Enjoy

- Investing

- Marrying The Right Person And Family

- Income Maximization

- Legacy

If you are someone who values financial freedom and peace, keep reading because the Breaking Broke Financial Order of Operations are guaranteed to result in financial success.

Contents

Why Financial Orders Of Operations Are Important

Imagine you are hiking through an exotic jungle and you suddenly encounter a raging river. Thankfully, the ancient tribes that inhabited this land before you left a series of stepping stones to help you navigate across.

There is a sign at the crossing advising hikers to take one stone at a time in sequential order to ensure they make it to the other side safely. However, the close spacing of the stones tempts many hikers to skip steps at their peril.

As a metaphor, getting to the other side of the river in the wild is like executing a financial plan in real life. We know where we want to go, but getting there can be a challenge as we wrestle with self-discipline, temptation, distractions, pitfalls, bad actors, and catastrophe.

At the river, we were lucky to have those handy stepping stones which we simply needed to follow one step at a time to make it across the river safely. But in real life we aren’t always so lucky because there are no clearly defined “financial stepping stones” that can give us a safe path toward financial success.

This is why a financial order of operations is important – a good ones can serve as the stepping stones to take to navigate forward.

The Failure Of The Traditional Financial Order Of Operations

The early chapters of my life like were like everyone else’s as I moved along the comforting path of the traditional financial order of operations. Before the age of 30 I had multiple degrees and real estate properties which are aspirations of many.

I should have been content. But in spite of my good station in life, I lacked a sense of freedom, peace, and fulfillment. Not only was I trapped under a mountain of debt, I was reliant on income from a dreary job to service those debts.

Life felt bleak for me during those days because I naively followed the traditional financial order of operations, which are as follows:

- Debt Accumulation

- Education, But Not Skills

- Any Career That Pays

- A House, Plus Material Accumulation

- Marriage And Family

- Income Maximization

- Investing

- Debt Decumulation

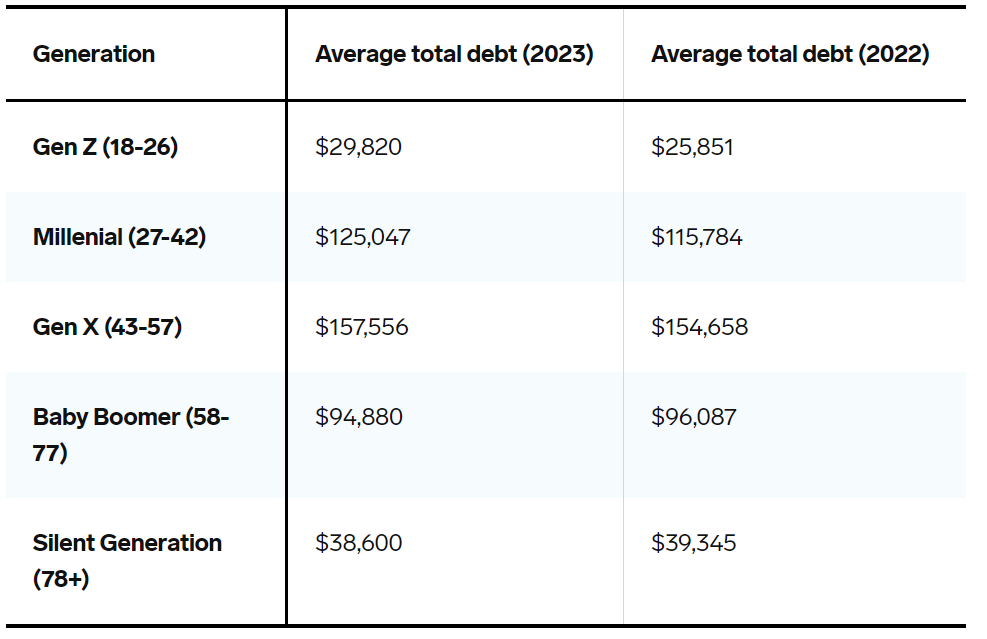

The easiest way to validate that this is an accurate representation of the traditional financial order of operations is by overlaying this progression with average debt statistics for various age groups as reported by Experian and the Fed – and summarized by Business Insider.

Here is what I mean:

The question here is what is happening at each generation that drives these debt trends? The answer is that most people are following the traditional financial order of operations as outlined above.

A Journey Through The Traditional Financial Order Of Operations

Next I’ll walk through this progression in detail by examining the financial journey of a typical 18 year old person who is fresh out of high school and looking to navigate the world.

We’ll follow their journey through life and through the traditional financial order of operations while connecting the dots back to the debt trends and other evidence showing these traditional stepping stones are producing less than desirable results.

1) Debt Accumulation

Sadly, most of our financial journeys start with debt.

Debt accumulation becomes the first step in the traditional financial order of operations as most of us are faced with the dilemma of how we will pay for college or purchase a vehicle to provide ourselves with transportation.

Because of steep educational costs, roughly 70% of bachelor degree recipients will complete their studies with education debt. It is also very early on that many of us hit the car lots in search of new vehicles which we will finance with debt.

Somewhere between ages 18 – 20, most of us took our first steps along the traditional financial order of operations. This is where many people put on the debt shackles that will be with them for the rest of their lives.

2) Education, But Not Skills

Here in the United States we’ve put a great emphasis on education, but not on skills. It is not uncommon to see students graduate college with degrees offering low returns on the time and cost investments it took to earn them.

This is the problem with the education at all cost mantra that we’ve adopted. It has led many students to simply go to college for the sake of earning a degree as opposed to earning marketable skills that will result in gainful employment opportunities.

The good news is that the unemployment rate for recent graduates is only 4.4%. The bad news is that many of these grads earn at low levels which makes it hard to thrive given high costs of living, debt, and a spendthrift culture.

Also included in the employment statistics are those who work part-time which paints a picture that is more rosier than it should be.

3) Any Career That Pays

Further indictment against the education at all costs mantra is that half of college graduates work in fields that don’t even require degrees. What’s more is that many graduates earn on par with the median high school graduate at $32,000 per year.

Income levels aside, employees across all strata are struggling when it comes to actual career satisfaction as studies reliably show that only about half of workers are satisfied with their jobs. I believe this is because we place a pretty significant emphasis on employment and compensation over purpose when it comes to deciding how we will spend our precious working years.

4) Material Accumulation

Very early in life the traditional financial order of operations makes us indebted and likely underemployed.

At a moment where we should be focusing on fixing our finances, most of us take the next step along the traditional financial order of operations by turning our attention towards material accumulation.

This is were most people spiral out of control thanks reckless spending on things such as restaurant meals, clothes, vehicles, primary residences, rental properties, and travel.

None of these expenses are cheap. Consequently, it’s at this stage in the traditional financial order of operations that people begin to accumulate significant debt in their mid-20s, continuing to do so through their late 40s, as shown in the trends above.

5) Marriage & Family

Amidst all of the other facets of life comes a desire for slowing down long enough to find a life partner and start a family. This of course isn’t the path taken by everyone, but definitely the majority.

The best time to get married and start a family is when you are truly ready. The traditional financial order of operations just makes this step more challenging than necessary as many people come into relationships with a lot of financial baggage. For instance, deciding whether to marry someone with six figures worth of debt is not an easy decision.

6) Income Maximization

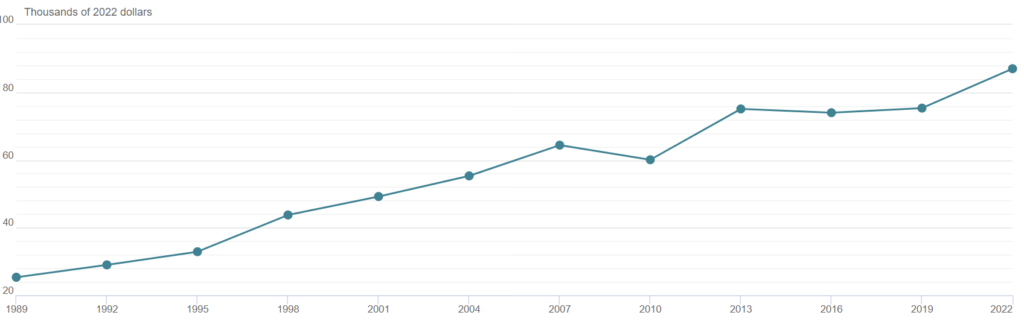

It is sometime in this later stage of the traditional financial order of operations that most us will become concerned with maximizing our incomes. For instance, the typical man will maximize his earning potential sometime between 45 – 62.

I believe most people who follow the traditional financial order of operations are motivated to maximize income at step 6 because they have a lot of catching up to do.

With an average personal savings rate lower than 4%, most people will look up way too late and realize that the traditional financial order of operations has failed them as they have very little to show for the many years of working.

7) Investing

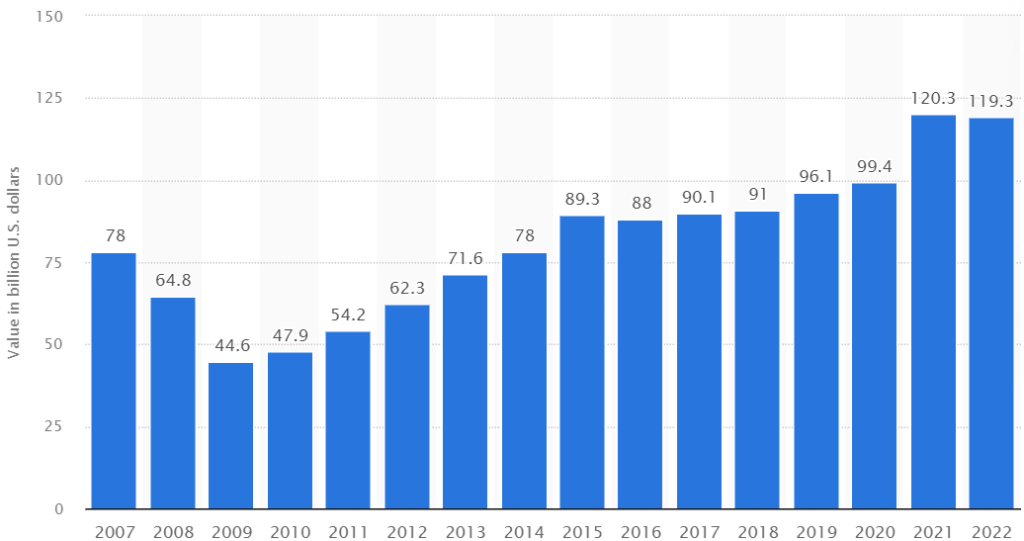

In 2022, the median retirement account balance for all households was just $87,000. This is clear indication that investing is generally an afterthought for the vast majority of people. Further evidence of this is the fact that only about half of U.S. households even have a retirement accounts.

Most people put off investing until way too late, or never get to it altogether. This results in a huge share of people retiring with social security being their primary source of income in their later years.

7) Debt Decumulation

After a lifetime of accumulating debt and material goods, we finally reach the end of the traditional financial order of operations.

We’ve worked hard for a long time and have done the best we can with our money. Thankfully, wisdom has finally shown us what is truly important in life.

We know that buying more stuff won’t make us happier, so we begin to seek freedom and happiness by emphasizing debt decumulation. As we can see in the debt trends above, most of us end in the very place we began – with a simplified lifestyle and very little debt.

Interesting huh?

The Breaking Broke Financial Order Of Operations

The traditional financial order of operations seem needlessly difficult. They also don’t work very well. Why spend the bulk of our lives indebted with money stress?

Thankfully, the Breaking Broke Financial Order Of Operations provides us a much better set of financial stepping stones. Even better is they give us nearly all of the same things the traditional path does minus the drawbacks.

Using the guidance provided by this financial order of operations helped me eliminate $240,000 worth of debt, save six figures in cash, and achieve the elusive third level of financial independence known as semi-financial freedom.

Let’s discuss this much needed improvement to the traditional Financial Order Of Operations.

1) Principles Of Health, Savings, and No Debt

The BB Financial Order of Operations starts with a set a principle. Here they are:

Health As A Principle

If I can instill only a single principle into my future children it would be that their health is the most important thing they’ll ever have.

I say this because life itself is predicated on good health. We can earn all of the money in the world and it would all be in vain if we are not healthy enough to enjoy it.

One of the greatest men I know is a leading medical doctor in his field and has earned a top 1% income for decades. Sadly, he’s been diagnosed with a serious form of cancer recently. I can guarantee that money is of no concern to him as he battles for his health.

Saving As A Principle

Saving a portion of every dollar earned is the next principle to embody in the BB Financial Order of Operations. Saving is important because it helps ensure your financial success and enhances your sense of peace and freedom.

Imagine for a moment that you’ve saved 10% of every dollar you’ve earned from day one. How much money would you have? You don’t even have to guess if simply calculate your lifetime earnings. Just multiply the result by 10% to see the amount you would have had before investment returns.

No Debt As A Principle

Before you slam your laptop closed or throw your phone across the room, hear me out..

Contrary to the default financial order of operations handed to us by our culture, it is very possible to live life without debt. Granted, it will take a huge amount of sacrifice to pull off – but the benefits of a debt-free lifestyle are more than worth it.

The sole purpose of taking on debt is to acquire things we either can’t afford or aren’t willing to pay for using our own money. But the irony is that acquiring things with debt comes with a bunch of strings attached that steal away our freedom while adding stress.

As a standalone principle, refusing to take on debt will ensure we have a life of maximum freedom even if you aren’t rich or retired. And when combined with the principles of optimizing health and saving money, you have a trifecta of principles that will give you a rich life regardless of how much money you make.

2) Education + Skills

With the principles of health, saving, and no debt embodied from the start, you will enter your mid-to-late teens positioned to win.

After principles, the second stepping stone in the BB Financial Order of Operations is education and skills which are important to focus on early since they will help establish a strong foundation.

Let’s break down each of these concepts separately:

Prioritizing Education

Education is a high priority in the BB financial order of operations because education is one of the most reliable pathways to a good life.

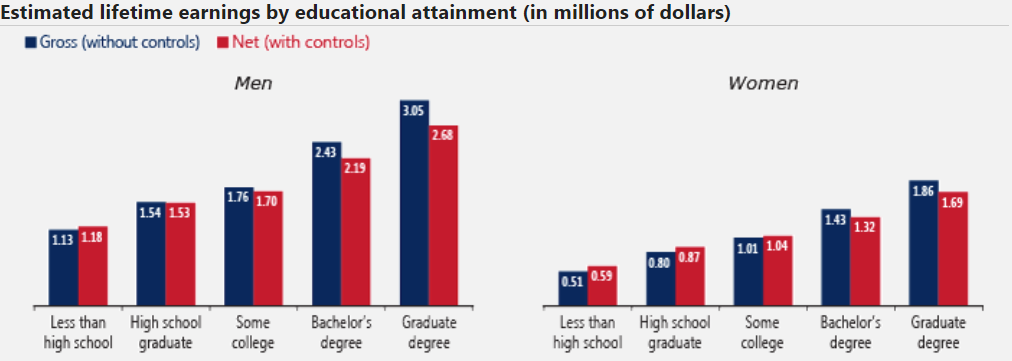

According to the Social Security Administration, men with bachelor’s degrees earn $900,000 more over their lifetimes compared to men with only high school diplomas. For women, the difference is $630,000. Similarly, men and women with graduate degrees out-earn their high school-educated counterparts by $1,500,000 and $1,100,000, respectively

This is not to say that college is for everyone. But this shows that education is generally a worthwhile the investment as a few years of dedication toward educational attainment can significantly raise one’s lifetime earning potential.

Prioritizing Skills

I made friends my senior year of college with a fellow classmate who was about 5 years older than the rest of us thanks to his prior stint in the Army.

I don’t remember his exact job in the service, but can recall that it had something to do with crunching numbers. Whatever it was, it was good enough experience to combine with his new economics degree for a job at Google paying $72,000 out the gate.

That was $72,000 in 2012 , which thanks to inflation, is akin to $98,000 today; a whole $30,000 more than the $68,000 today’s college graduates earn on average.

So, what sets this guy apart from the rest of us? It all came down to the fact that he had proven skills which he could put to use right away at Google.

From Undergrad To Google

With an estimated 54.3% of adults now completing college, educational attainment is clearly on the rise. It seems that many people are already prioritizing education.

That said, as encouraging as these trends may be, I suspect many people are missing the bigger picture by focusing solely on education without placing enough emphasis on skills.

Completing college is good. But spending tens of thousands of dollars and multiple years of our lives to acquire those degrees should provide a real financial payoff once our studies end.

You do this by being like my friend. Specifically, you prioritize acquiring skills that are valuable, in demand, and capable of fetching you a worthwhile return on the investment you made to get them.

3) Career You Enjoy

Next up in the BB Financial Order of Operations is a career you enjoy. The key in this step of the progression is to not only focus on landing in a career, but working over time to land in one you enjoy.

The good news here is that just over half (51%) of all workers report being highly satisfied with their jobs. The bad news is this means the other half are experiencing some dissatisfaction

As I’ve said before, life is both too long and too short to waste it doing things you don’t enjoy.

Even if you are stuck in your job at the moment, you can and should work to improve your job situation over time. It’ll take effort, but acquiring new skills or education can open new doors.

4) Investing

If you’ve followed the BB Financial Order of Operations to this point, you are debt-free, in good health, and engaged in well-compensated work that you enjoy.

It took a while to get here, but this is where I am now—and I can say that being in this position makes life really good. With just about all of the big things in life taken care of, I can sit back and simply enjoy life as I watch my savings grow.

Seeing my cash grow is good, but inflation has an insatiable appetite for stealing all of our money if we let it. This means we can’t just leave our money under the mattress, buried in your attic, or even in a low paying savings account forever.

That is to say, it’s imperative that we start investing to grow wealth as soon as possible. It is at this of the BB Financial Order of Operations to begin doing it.

Why Not Invest Earlier In the Financial Order Of Operations?

One of the most common questions in the personal finance world is whether it is better to pay off debt or invest? It seems that most people end up splitting the difference by doing both simultaneously.

As long as you are debt-free, it’s perfectly reasonable to move investing earlier in your financial order of operations. In fact, investing is well suited to occur in parallel with earlier steps assuming you have the extra money to spare.

In terms of investing while paying down debt – don’t do it.

It is far better to mobilize all of your financial resources to slay debt first because reducing debt is a form of investing that saves you negative interest.

Additionally, I must point out that investing in yourself should always take precedence over investing in financial instruments. Spending a few thousand dollars acquiring skills that can boost your lifetime earnings is a much better bet than putting that same money in risk based assets like stocks.

5) Marrying The Right Person & Starting A Family

Imagine for a moment you met a potential partner who is healthy, debt-free, happy with their work, and investing for retirement. Sounds like a unicorn, doesn’t it? Well, this is exactly who you can be well before the age of 30 if you follow the BB Financial Order of Operations from the start.

The thing to emphasize with this step of the BB Financial Order Of Operations is that you should prioritize finding not just any partner – but the right partner. This is important as reports show that lack of compatibility is responsible for 59% of first year divorces.

When screening for potential partners, consider several important factors, including shared values and interests, establishing trust and respect, physical chemistry, and familial support.

Slotting marriage and family at this point in the progression has many advantages. For one, being in a strong financial position minimizes the risk of money issues in your relationship and makes it easier to manage the expenses involved with raising children. There is also credible evidence that children raised by older parents have better long-term outcomes.

6) Income Maximization

Over the decades, we’ve seen dramatic shifts in when people get married. In 1950, for example, the average marriage age was around 20 and 23 for women and men respectively. Today, both sexes are waiting much longer with women averaging 28 and men 30 at the time of first marriage.

The reason for these shifts is undoubtedly complex, but practical experience tells me that many people are putting off marriage and family in the pursuit of money and success.

Income maximization, which we use as the primary marker of success, comes near the end of the BB Financial Order Of Operations because as Warren Buffet once said, eventually in life “you will not measure how well you’ve done with how much money you’ve got.” Instead, Buffet says that we will measure our success in the end by the amount of love in our lives.

To that end, income maximization should still be a part of your financial order of operations in life. It just shouldn’t take precedence over more important things in life like having strong relationships, finding purposeful work, and maintaining excellent health.

7) Legacy

A person who has lived out the financial order of operations presented here will enjoy a life that most people can only dream of. Just imagine how good life would be with a fulfilling career, no money stress, and a wholesome relationship.

At this point, there isn’t much left to accomplish from a financial perspective. You’ve consistently saved and invested, you’re maximizing your income, and money became an increasingly fleeting concern with each passing year.

At the final stage of the BB Financial Order of Operations, you should seek to cement all of the good you’ve done in your life by establishing a legacy that will endure well beyond your time here on earth.

There are many ways to do this, but at minimum you want to make sure you provide financial security to your loved ones by establishing a will and trust if appropriate and enabling them access to opportunities such as education or employment. Other things to do in this stage could be acquiring long term investments such as real estate or businesses that will continue to provide even when you are gone.

Beyond your family, you may want to use some of your hard earned money to make the world a better place. Donating to people in need and charities is always a great thing. Beyond money, you can also give some of your intellectual capital and time away for the betterment of others.

Why Doesn't The BB Financial Order Of Operations Include Buying A House?

You may have noticed that the BB Financial Order of Operations doesn’t mention buying a house.

In short, I didn’t specifically isolate buying a house because it is already covered under the principle of not taking on debt. Specifically, if you’d like to buy a house then you should simply save up to purchase one when you have the cash to do so.

Paying cash for a home may sound like a radical idea, but keep in mind that 34.1% of home purchased in 2023 were done with cash. Some even estimate that there will be an even larger share of cash purchases in 2024.

The Breaking Broke Financial Order Of Operations Are Real

The BB Financial Order Of Operations presented in this post may sound like theory while they are in fact very real.

They are so real that I’m living out these steps today after realizing the traditional financial order of operations weren’t producing good results. Similarly, if you’ve found that you aren’t happy with the results you’ve gotten from the traditional financial order of operations, then it may be time for a change.

For you to make that change starts with a new way of thinking and a commitment to doing something different. Take me as proof that with enough time and dedication, you can create a new reality for yourself just as I did after going broke in 2018.