Why Credit Cards Are Bad For The Economy

We all love our credit cards. Many financial gurus even tout the plethora of wonderful benefits that come along with them. But what’s often buried in the discussion on credit cards is all of the ways they are bad for the economy and consumers alike.

This article will shed light on that issue by covering 5 objective reasons why credit cards are bad for the economy and the everyday person.

Contents

My Rewards Card Adventure

I remember my first $10,000 of credit card debt like it was yesterday. I was a young and impressionable 23 year old fresh out of college and finally into the real world. At the same time, I was broke with $30,000 in student loan debt and a beginner’s teacher salary of only $32,000 per year.

Looking back, the optimal financial move in those days would have been to buckle down and pay off my student loans as quickly as possible. But, hindsight is always clearer because I actually chose to live it up. I felt that I deserved an opportunity to enjoy the fruits of my new found station in life, so that’s what I did.

Around the same time, my best friend inspired me to get into the credit card points game which he had already mastered. Tempted by the lure of free vacations, I jumped head first into the credit card points game and found wonders on the other side.

I opened a travel credit card and did everything in my power to spend enough to hit the bonus limit so I could get my points. Luckily, I succeeded and the only thing left was to decide where I would take my free vacation.

Yeh Mon! An Almost Free Trip To Jamaica

Jamaica won out as the destination. I chose Jamaica because it was one of the few places that was actually cheap enough to even mostly cover with my travel rewards. Jamaica is also a beautiful country so it felt like a win.

In all, the trip felt amazing knowing that the majority of it was paid for thanks to the benevolence of my credit card issuer.

It all sounded too good to be true before I started out, but I was pleasantly surprised that it actually worked. I simply spent a certain amount on my credit card and was rewarded with a free trip to an exotic location. No harm there right?

The Hidden Costs Of Credit Cards

As it turns out, there was quite a bit of harm involved in the situation. Little did I know was that I was contributing to a credit card system that imposes damaging effects on the U.S. economy and consumers.

These negative impacts are mostly hidden. They are also never really spoken about in mainstream personal finance channels. Instead, most personal finance advice focuses on the best credit cards, the highest bonuses, and ways to optimize travel returns.

Still, someone has to shed light so people have the full picture. And from there they can make an informed decision about what’s best for them. So without further ado, I’ll shed light on the hidden costs of credit cards and what makes them bad for the economy and consumers.

Credit Cards Are Bad Because They Make Everything More Expensive

Fees fees fees! Credit cards are all about the fees. I mentioned in my last article that rewards credit cards are designed to trap consumers in a spiral of fees and debt. The fees are so substantial that they result in billion dollar returns for credit card companies.

Unfortunately, this reality means that there are no winners outside of credit card companies because merchants and consumers both are afflicted.

For starters, merchants are charged 2-3% by credit card companies for every transaction that takes place with a credit card. And as a result, the merchant sees a smaller profit from each transaction.

Predictably, merchants don’t appreciate the fact that credit card companies have their hands in their pockets. So what is any prudent merchant to do? That’s right, they pass these fees along to consumers in the form of higher prices for everything that we purchase.

It’s the classic case of the powerful taking from the weak and the rich from the poor. Or as so eloquently said in more urban circles – this is the literal big bank taking from the little bank.

The Lifetime Costs Of Credit Cards

One to three percent may not sound significant, but imagine these costs over a lifetime of spending. The average person spends roughly $60,000 per year. Therefore, the total costs from credit cards could feasibly be in the ballpark of $50,000 – $100,000 over a lifetime.

Suddenly, the magic money of credit cards doesn’t appear as attractive as they once did. Realizing they actually leech a significant portion of our hard earned money is hard to swallow.

Credit Cards Are Bad For The Economy Because They Fuel Inflation

Inflation is a general increase in prices that arises by several potential economic mechanisms. Most notably of these is what is known as an increase in the supply of money. As such, the money supply can be increased in a number of ways as often seen with government stimulus or FED printing.

With inflation, many people feel a little bit richer because they have a bit more cash. The problem occurs when the increases in cash in the economy do not include more available goods for purchase. Suddenly, many people are bidding for what seems to be fewer products such as homes for sale. This then leads to higher prices as we have experienced in recent years.

But what does this all have to do with credit cards?

Ironically, credit cards put thousands of additional dollars in all of our pockets. This means that we all have some extra invisible cash to make purchases for things that we may not have otherwise been able to afford. As a result, prices rise due to increased demand for the same quantity of goods and services. Or simply, inflation occurs.

Credit Cards Are Bad For Small Businesses

We all love small businesses. That is until they charge us more than the big box retailers for the same exact products.

As it turns out, the reason the bigger companies charge lower prices is because they enjoy what is known as economies of scale. Economies of scale are simply the efficiencies gained from operating a large business.

Walmart is a great example of a business enjoying economies of scale. They are able to charge such low prices because they get the absolute best prices from suppliers. Additionally, they have a highly optimized supply chain network. This network saves them money and allows the to pass these savings along to customers.

Not surprisingly, very few small businesses win against giants such as Walmart. And unbeknownst to the every day person, credit cards make it even harder.

How Credit Cards Hurt Small Business Profits

Those pesky credit card fees are the reason. The U.S. notoriously has the highest credit card transaction fees in the world with an average of 2 – 2.25%.

That said, larger companies can absorb these fees and still charge lower prices to customers while generating profits. Sadly, small businesses can rarely afford to charge low prices, pay transaction fees, and make enough profit to stay open. In the long run, this contributes to many smaller operations shutting down while the big players continue to thrive.

If you’ve ever wondered why some merchants only take cash, this is why. Unfortunately, most small businesses simply can’t survive with this strategy as most consumers prefer credit cards.

If this sounds unfair to you, then it probably means you at least have a decent conscience. Still, no one will really care because this is capitalism and to the victor goes the spoils.

But while on the topic of fairness, I’ll examine how credit card companies further skew things in their favor.

Credit Cards Companies Are Bad Because They Use Unfair Business Tactics

A fee structure that hurts small businesses isn’t intentional. It’s just a byproduct of the system that we’ve all accepted as the norm. We all technically share some part in it.

Be that as it may, credit cards are still at the root of the issue and the companies that create them aren’t exempt. In fact, those very companies still deploy some very questionable business practices that are bad for the economy.

I’ll keep this brief to not bog us down in economics jargon. But essentially, there is a very small number of dominant players in the credit card arena. You know who they are – Chase, Citibank, Bank of America, Capital One, Discover, and American Express.

On the surface, there is nothing wrong with this – but any good economist knows that a few small players controlling a gigantic industry becomes problematic.

This situation is known as an oligopoly and is generally regarded as harmful to the economy because it creates an unfair business environment. What usually happens is the few companies strategically work together to ensure competition stays out. It also enables them to implement advantageous policies that work to their favor with little recourse.

Anticompetitive Business Practices

In terms of the credit card industry, one way that the current oligopoly ensures its survival is by controlling information. More specifically, the Consumer Financial Protection Bureau reports that the major credit card companies have been deliberately suppressing their customers’ actual payment amounts from the nationwide consumer reporting system.

What benefit does this serve? The primary advantage of this tactic is to limit competitors from making competitive pricing offers to customers. This means that rates generally stay high for customers and that potential new companies are hard pressed to find competitive ground in this space.

This is just a single example of the sorts of anticompeititve tactics deployed by the major players in this industry. There are still many others. Here is a summary of several notable ones.

- The Federal Trade Commission orders an end to illegal business tactics that Mastercard has been using to force merchants to route debit card payments through its payment network, and is requiring Mastercard to stop blocking the use of competing debit payment networks.

- Justice Department Sues American Express, Mastercard and Visa to Eliminate Rules Restricting Price Competition.

- The Supreme Court has agreed to hear Ohio v. American Express, an antitrust case brought by a number of states against the credit card giant that poses the question of how federal antitrust law should treat two sided markets.

Low Competition Hurts Consumers

Ultimately, consumers suffer the most when businesses use anti competitive practices. In limiting competition, businesses effectively remove the natural checks and balances of a healthy economic market. And instead, they create a situation where they can operate against the greater good.

Imagine for a moment that we had a single, private run gas station chain. In this situation they can feasibly set any price they would like and the world would be forced to accept it. But if a new player suddenly entered the market offering lower prices, then this company would have no choice but to reduce prices or go out of business.

This is why competition is healthy. Credit card companies know this and want to squash it as best as they can.

Credit Cards Are Bad Because They Promote Inequality

There seems to have been a rise in our collective social consciousness in recent years. I believe that a lot of this has led to much needed improvements in the ways things are done and how people think.

I also think that there has been a great deal of smoke being blown and that many who scream the loudest about caring for others are actually feeding their own egos with very little action to back up those screams for change.

At any rate, those of us who have even a semblance of concern for the next man will benefit from knowing that credit cards help fuel the inequality that so many claim to care about. That’s right, credit cards actually serve as a tool that helps keep certain people down while boosting others forward. This is the definition of inequality.

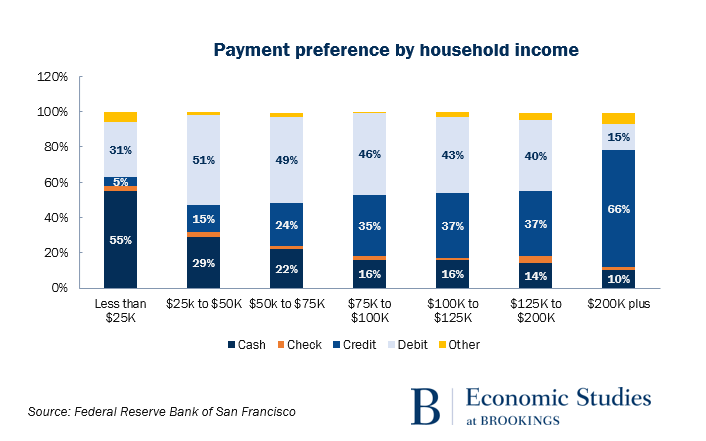

Rewarding The Rich And Punishing The Poor

What’s in your wallet? That was the question posed by the Los Angeles Times in an article where they presented the idea that richer people had a disproportionate advantage over poor people when it came to credit cards.

They argued that credit card rewards redistributed wealth into the hands of both the credit card companies and their most affluent customers. At the same time, customers on the lower end of the income and credit score range are penalized as they don’t get to partake as much in the lucrative rewards programs that they certainly help pay for.

The scale of this redistribution is huge and growing. Consider a wealthy family that racks up charges of $250,000 a year on a top-of-the-line credit card that gives them 2.5% cash back. That family gets a $6,250 stocking stuffer from the payment system elves—worth more than $10,000 in pre-tax wages. Meanwhile, families using cash or debit cards, who tend to be at the lower end of the earning scale, get nothing in return for their spending.

LA Times: How credit card companies reward the rich and punish the rest of us.

Essentially, what this is saying is that richer families enjoy benefits from credit cards and lower income households don’t.

This is because richer households are in a better position to actually use and properly manage credit cards in the first place. And as a result, they receive better credit cards with higher rewards and lower rates. On the other end of the spectrum, poorer households cannot qualify for the same perks and are forced to use cards with fewer benefits or cash.

The Poor Actually Pays For The Rich

Stating the fact that richer families benefit by being able to participate in credit card rewards does not fully paint the full picture. On the other side, we must take one more look at those pesky fees that I’ve spoken so much about.

No matter what, all consumers pay the same price for products regardless of which payment type is used at checkout. For their part, merchants off-set the costs imposed by credit card companies (~2%) by charging higher prices. This means that everyone pays a higher price at the grocery store – poor and rich alike. At the same time though, rich households can swipe rewards cards and get something back in return.

But poor households? Well, they are simply left to hold the bag as they are the only ones to not benefit in this equation. Thus, the poor pay the full penalty of this economic system as the costs flow down from the top to the very bottom and impact those who are the least fortunate.

This is great for all of us six figure earners and points gurus. I’m currently sitting on hundreds of thousands of credit card miles, so I should thank everyone in the inner city for giving me a leg up. I’ll be sure to toast to them on my next exotic vacation paid for via rewards points.

The Benefits Of Credit Cards

Selfishly speaking, there are a plethora of benefits to credit cards. I get a access to money that I don’t have. Credit card are convenient. And they provide me with rewards. So, what’s not to love about them?

Well, now that jig is up I have to grapple with a dilemma of the conscious as I now must decide whether I want to participate in a destructive system for my own gain. Or I choose to be an outlier and look out for the greater good.

That is yet to fully be seen as the lure of miles may just be too strong for me to fully let go. Afterall, there are just so many magical places to visit for “free”.

But regardless of the path I choose, I now have the wisdom and cannot simply ignore it from here on. Or, I suppose I could just take a page from the book of the mighty Ostrich and simply stick my head in the ground as I feign ignorance.

How about you, what’s your strategy given your new found knowledge on why credit cards are bad for the economy and consumers?