Are Credit Card Rewards Worth It?

Are Credit Card Rewards Worth It? Simply put, hell no! Rewards credit cards aren’t worth it and in fact, they are devised as the lure that leads consumers into the credit card debt trap.

I once fell for this trap myself and quickly stumbled into more than $50,000 worth of credit card debt over a period of two years. A few short years later, I am completely debt free and far less naive than I once was.

That said, the journey out of the credit card debt pit wasn’t easy and I’d like to save as many other gullible souls as possible from what could be a lifetime of pain wrought on by the rewards credit card trap.

I’ll use this article to do just that. Consider this the definitive and final declaration against rewards credits cards as a financial tool for most consumers.

Contents

Rewards Credit Cards Aren’t Worth It Because They Are Rigged Against You

Ever been to the carnival? In addition to being one of the few places to get a delicious plate of funnel cake, the carnival is also a great place to be conned out of your money.

That’s right, I’m talking about carnival games. A carnival secret that isn’t much of a secret is the fact that most carnival games are rigged against you. And of course their sole objective is to extract as much money out of unsuspecting patrons as possible.

Fortunately, the money lost on carnival games is trivial for most of us which is why we tolerate them in the first place. That said, there is another con that is extracting far more than these innocent carnival games. In fact, consumers are being led into a multibillion dollar trap.

That trap is credit card debt. And instead of being lured in by confetti filled stuffed animals, consumers are being drawn in by rewards attached to credit cards.

But just how big is the con worth? Well, total U.S. credit card debt sat at $986 billion as of Q4 2022. This is an all time high for those who are counting. But really, who is actually doing that nowadays?

This just sets the stage for my thesis on why credit card rewards aren’t worth it, so let’s just dive down that rabbit hole.

Origins Of The Rewards Credit Card

Context matters. And in the case of rewards credit cards, context really matters because we must first understand where they come from in order to fully understand their role as a financial product today.

Firstly, credit cards were created as financial products that banks and retailers ultimately leveraged to drive profits.

The credit card business was not very lucrative early on thanks to intense competition amongst banks and a customer base who generally managed credit well. Though they did profit, banks could only extract so much revenues from responsible customers who actually paid their bills on time.

With maximum profits in mind, banks and retailers began to look for new ways to expand their balance sheets and struck gold on the credit card side of their businesses. That said, two important developments would unfold in the 1980s.

The first was the adoption of data analytics by banks as a tool for gaining deep insights into consumer behaviors. The second was greater product differentiation in the credit card market which ultimately included the rise of rewards credit cards.

How Credit Card Companies Make Money

We now know that banks use credit cards to drive profits. But, that still begs the important question of just how credit cards generate those profits? In short, credit card companies make money by charging interest and fees, and by earning a percentage of every transaction processed on their cards.

Given that, here is a list of the most common types of fees.

Transaction fees: Credit card companies charge merchants a fee for every transaction they process. The typical transaction fee is 1% – 3% of the purchase amount.

Interest charges: Balance carrying customers are charged interest on outstanding balances, which usually ranges from 10% to 25%.

Annual fees: Some credit cards charge an annual fee for using the card. A common fee nowadays is $100 for many cards, but some go up to $500 depending on the benefits and rewards promised.

Late fees and other penalties: Credit card companies charge late fees, over-limit fees, and other penalties for customers who do not make their payments on time.

Credit Cards Are All About Fees

As you can see, credit cards are really all about fees which ultimately extract money from merchants and consumers for huge profits to credit card companies. On one hand, merchants pay a fee every time a credit card is swiped. Then at the same time consumers pay additional fees in the form of interest charges, late fees, and annual fees.

Even more, the list of fees above isn’t even exhaustive of all the fee types collected by credit card companies as I opted to list only the ones that are most common.

In essence, credit cards are like a parasite with an insatiable appetite that is embedded into the financial system sucking money out of merchants and consumers alike. And just how greedy is this financial parasite? It turns out that credit card companies generate $120 billion in interest and fees each year.

Credit Card Rewards Aren't Worth It Because They Are Designed To Trap You

So how did we get to a point where Americans have a record $986 billion worth of credit card debt and an insatiable credit card industry that continues to bilk consumers for upwards of $120 billion per year? More specifically, how have credit card companies been this successful at luring customers into their fee and debt trap?

As you may have already predicted, the answer to this question is that credit card companies lure unsuspecting customers into the trap by way of credit card rewards.

Rewards Credit Cards Play On Your Psychology

As with games at the carnival, credit cards must come with attractive bait to lure consumers into the trap of exorbitant fees and debt. Carnival masters use shiny trinkets and stuffed animals as their bait while credit card companies dangle a carrot of frequent flier miles and cash back as the lure.

The credit card points guys will say that credit cards are totally worth it for the sake of these rewards. After all, who wouldn’t love a discounted trip to the Bahamas or “free money”?This sounds great indeed, but in reality the rewards are just a facade hiding a system that takes far more from all consumers than it gives back. And that holds true for even the best credit card gurus.

More on the hidden costs of credit cards later, but for I will focus on how credit cards play on our psychology.

I’ve already made the unpopular case for using cash over credit cards which centered upon the interplay between human psychology and credit cards. So with that, here is a rundown of the relevant points.

- A study using MRI brain scans found that credit cards increase spending by activating the pleasure centers of the brain.

- Credit card usage is proven to lead to more spending.

- Credit cards make spending extremely easy and convenient.

- Credit cards can significantly accelerate the spending process.

- Credit card usage inhibits the natural pain felt in the spending process. A process known as psychological decoupling.

Credit Card Consumer Research

The concerning thing about the points above is that credit card companies are also aware of them. Even more damming is the fact that these companies seek to actually leverage these trends to their advantage – which ultimately hurts consumers.

Additionally, beyond just being aware of the items listed above – credit card companies have a treasure trove of additional insights that they unleash to their advantage.

What I’m specifically getting at here is a little known fact that credit card companies spend millions of dollars each year on consumer research. Consumer research is the process of using technology, data, and psychology to better understand consumers and devise strategies to extract maximum profits from them.

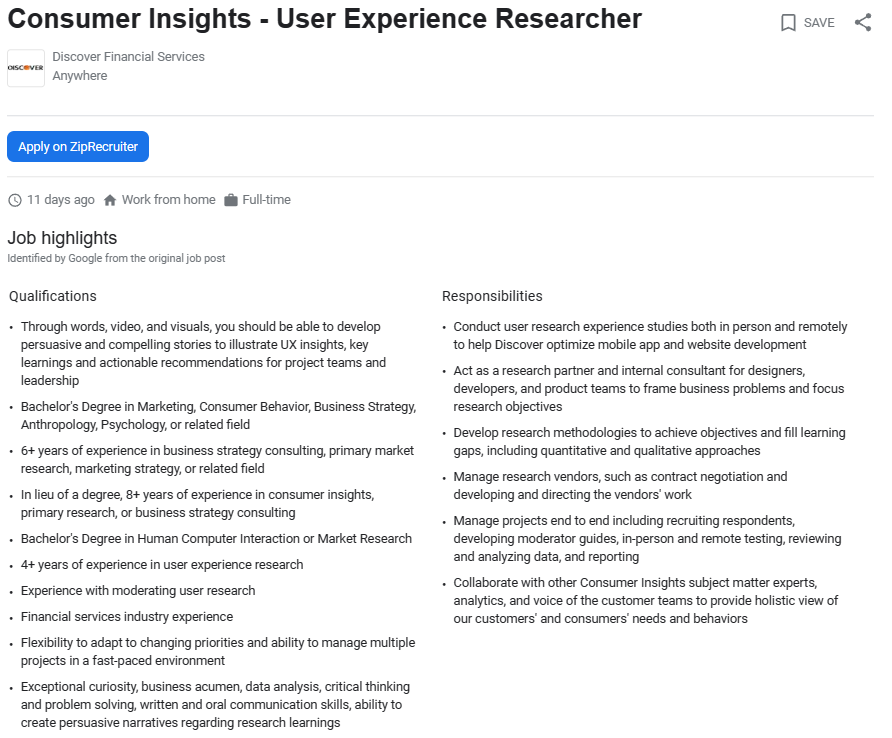

Here is an actual current job posting at Discover Bank that captures exactly what I’m referring to. Notice that a background in psychology or anthropology are desired qualifications. Also pay special attention to the responsibilities while keeping in mind that this job is for a financial institution – not a university research lab.

So, what exactly is the problem with Discover Bank having such a position? Technically there is no problem as I’m sure the person who fills the role will mean well as they dutifully carry out their responsibilities.

Unfortunately, the issue arises when the success of the person in this role hinges upon their ability to devise strategies that enable the company to successfully extract increasingly more money from consumers.

Credit Card Rewards Create Profits For Banks & Pain For Consumers

The discussion has come full circle. We’ve established that credit card companies deploy credit cards to generate revenues and actually make their money from fees charged to merchants and consumers for practically every transaction.

We’ve also established that credit card companies collect troves of analytical data and leverage consumer psychology to extract as much money as possible from consumers.

With that, the final piece to the equation is the fact that rewards offered by credit card companies which serve as the little carrot to get hapless people into the web of fees and debt. And once inside, most people don’t escape as evidenced by the record levels of debt we see today.

But People Should Just Use Rewards Credit Cards Responsibly

I can already hear the echoes from the credit card gurus as they say that people should just learn to use their credit card responsibly. While this sounds like a logical solution, it is severely shortsighted.

An oft debated topic in the realm of addiction recovery centers around whether it’s better for addicts to practice moderation or abstinence. Simply put, abstinence is better according to the research.

Further, Socrates once said that to know thyself is the beginning of wisdom. What the wise elder was getting at here was that rather than focusing on what should happen, people would be much better off focusing on what is happening. In other words, Socrates is saying that people should focus on reality as it applies directly to themselves to achieve better outcomes.

With that being said, the reality for most people is that they simply lack the discipline, skill, and savvy to manage a credit card optimally. We know this because millions of people are in credit card debt to the tune of billions of dollars per year.

Therefore, telling them to simply do better won’t cut it as an actual solution because we won’t be dealing with reality – we’d just be focusing on how things should be.

On the other hand, a much better approach would be to meet people where they actually are in reality by simply telling them to quit participating a things that are causing them harm altogether. Afterall, why play games in a system that is rigged. One that knows their weaknesses and is designed to take advantage?

In reality, we all know from experience that the more you play with fire the higher the likelihood of you getting burned. Or better yet, the more time those alligator tamers mess with those angry gators – the higher the chances of them actually getting bit.

The same applies for credit cards.

Still Not Convinced That Credit Card Rewards Aren't Worth The Hype?

No fret because this article was just the warm-up and I’ve actually doubled down with a more fact based approach that removes the subjectivity from the discussion.

That said, check out my next article below for an objective discussion on why credit cards are generally harmful to all of us – even those who claim to be winning at the game.