“The journey of a thousand miles begins with a single step”. This quote rang true back in 2018 when I was drowning in debt and unable to pay all of my bills each month. I had to do something to make a change and move forward. It also rings true now as I contemplate where to start with this blog.

This is the single step.

I have much to say as I first envisioned starting this blog back in 2014, and have been collecting a backlog of possible topics ever since. Things were a lot simpler back in those days. I was 2 years out of college and only had $35,000 in student loans and another $10,000 on a credit card.

Those figures seemed impossible to tackle at the time but were really nothing compared to the $242,000 that I would eventually amass just a few years later.

Many who read this will see $242,000 and scoff at how low this figure is in comparison to their own debt loads. I admit that this overall number should seem relatively low by today’s standards, but as with most things – it’s just not that simple.

Things are completely different today as I’m totally debt free and able to comfortably save at least 50% of my income which will afford me the ability to retire in under 15 years if I keep up this pace. I don’t say this to brag either. Instead, I’m hoping to show just how quickly you can turn things around for the better.

My goal for this blog is to share my story and ideas in the hopes that I can inspire others to see what is possible and make the changes necessary to take charge of their lives today. The future is coming no matter what – so we might as well make the most of today to ensure we don’t look back with regret.

There is plenty more to say about the future, but first let me take a trip down memory lane and explain how this all came about.

Early Financial Lessons

Some folks are lucky in that they are raised by parents who are good with money and who impart financial wisdom onto their children. I wasn’t so lucky.

Mom was 27 when she divorced my father. She had 4 young kids at the time and had to figure things out on the fly. Fortunately, mom is one of the most energetic people I know, and she is also a hustler which means she did whatever it took to ensure we had enough.

Enough can mean very different things depending on who you talk to. We had a roof over our heads but very little excess in any area of life. We didn’t have new clothes for school most years, few toys or gadgets, and were hungry all the time. Mom was also away most of the time working one of her 3 jobs to keep things afloat.

The interesting thing about growing up poor is that you don’t really know you are poor until later in life. I found out in middle school, because ya know.. other middle schoolers will tell you.

Elementary school was a bit different. I was quite the problem child when it came to challenging authority and a bit too aggressive with fellow classmates at times. But, I was smart and diligent so all of my teachers loved me.

A few loved me so much that they would bring hand me down clothes from their own children to give to me. Another helped me tape the sole of my shoe after it separated from daily use. She eventually just brought me a used pair of sneakers from her home.

I’m sure my teachers did all of this because they really did love me, but it wasn’t until many years later that I realized they were probably also doing this because they recognized a critical need.

It never occurred to me in those early days that poverty was the root cause of having holes in my shoes or being made fun of at school because my clothes were not up to par. Nor did I have this realization when a tow truck came to our house and hauled away our car, or when mom filed for bankruptcy.

What I did take away from these situations were feelings of fear, uncertainty, and scarcity. Money was never really talked about, so my only lessons around money came from highly traumatic events.

I had to figure the rest out on my own.

College – Debt 101

I started my collegiate career as a Division I football player with a full scholarship that covered out-of-state tuition, room and board, food, and medical insurance. Then I quit football after 1 season because the personal costs of earning that $100,000+ scholarship were too high in terms of my physical and mental health.

Quitting football meant that I had to figure out a new way to pay for college. So, I did what most students were doing, which was take out student loans.

I found the student loan process to be shocking because up until that point in life I wasn’t aware of just how easy it was to take on debt. I could just walk into some random campus office, wait in line, sign some papers and walk out with tens of thousands of dollars per year. No parent, no counseling, no hoops to jump through or questions asked.

What was even more fascinating was that I could take out more than the minimum needed to cover the cost of tuition. So, like any teen would – I took out enough student loan money to buy a car and fund a lifestyle consisting of daily chipotle and random splurges.

I never paid mch attention to how I was managing my finances in college. I juggled multiple part time jobs that could have paid for most of my tuition, but I still took out loans the entire way through. In all, I finished undergrad in 2012 with a $35,000 student loan balance.

Early Career and Graduate School

I began my career as a teacher making $35,000. My salary was low, but my expenses were also low as I simply maintained my college standard of living. Looking back, I should have capitalized on this time to pay off my student loans and begin building for the future.

But that of course doesn’t make for much of a good story.

What I did instead was discover (no pun intended) credit card points and I quickly racked up $10,000 in the pursuit of a free vacation using miles.

At least I got that free vacation to Jamaica!

I kept my undergrad student loans in deferral for as long as I could over the first several years after graduating and eventually began a graduate program which I also pursued using student loan debt.

By 2017, my original undergraduate debt had grown by $15,000 to a new balance of $50,000. Plus I added an additional $13,000 of graduate school debt which took my total student loan balance to $63,000.

The one thing that I did well in this period was pay off that $10,000 credit card balance. The positive feelings of paying off this debt were so empowering that they inspired me to sprint right back into debt at an even greater scale and all but crash myself in the process.

Real Estate Failure

The cliff notes version of my real estate deal is that I made a 2 properties for the price of 1 purchase from my mom in 2016. I walked away from the deal with one home owned free and clear and the other with a small mortgage of $100,000.

This was such a sweet deal in so many ways, but I of course screwed things up.

My plan was to use one of the properties as my primary residence and the other as a rental property. Both places were in need of some repairs and upgrades, but the rental was much worse off and actually needed significant work to get it up to a rentable standard.

Oftentimes some of our greatest strengths can also be our greatest weaknesses depending on the situation. One of my strengths is the ability to quickly analyze a situation, come up with a plan, and plow ahead with determined effort.

My youngest sister once compared me to my pit bulldog whose name is Rocky. Rocky is a sweet and loving dog, but he isn’t perfect. His one (and only) flaw is that he pulls a lot when on the leash. Rocky is determined to go where he wants to go and will not be stopped by some leash wielding human.

My sister says that I’m the same way when I’m pursuing a goal – I put the blinders on and its full steam ahead. I concur!

I was determined to accomplish my goal of getting both properties up to par in as short an amount of time as possible which meant that I needed large sums of cash – which I did not have.

I’m not really sure what I was thinking at the time, but I plunged headfirst off the deep end into a burning pool of credit card and personal loan debt to the tune of $79,000 with an additional $10,000 from my girlfriend.

Let’s stop for a second to tally up the score.

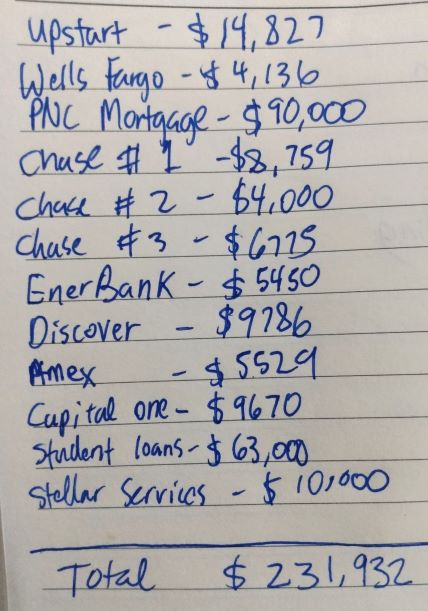

Credit card & personal loans: $79,000

Girlfriend loan: $10,000

Student loans: $63,000

Mortgage: $90,000 (I had managed to pay it down by 10k over 2 years)

Total Debt: $242,000

Hitting Rock Bottom

Things were actually working out under this scenario for a very short while, but no perfect plan unfolds perfectly and I left myself practically no room for error.

My peak income for this period was $72,000 from my main job in 2017, plus another $28,000 from rental income for a total of $100,000.

Murphy’s Law states that “If anything can go wrong, it will”. And this is exactly what happened.

Career Crumbling

My $72,000 job was a disaster and I quickly headed for the exit after only 6 months. Fortunately, my previous job was willing to take me back and I even made a secret-under the table-handshake deal for a promotion in a few months with the old boss.

My income would temporarily drop to $48,000 and then go back to the low-mid $70,000s after the promotion. Predictably, the promotion never materialized so I was stuck making $48,000 as a P.E. teacher back in my hometown.

I quit the P.E. job after another 6 months.

I moved to a new city and took another P.E. teaching job making $50,000 at a wonderful school. But, this didn’t last long either as I quit for another job after only 6 months.

I made around $55,000 in this new job as a school administrator at an alternative school for challenging students. At this point, I had been in the education field for roughly 7 years and was burn out. I was having my own personal issues outside of work to deal with so I lacked the capacity and empathy needed to deal with constant disrespect and bad attitudes at work.

I would eventually quit this job also. Anyone care to guess after how long? If you guessed 6 months, you are spot on! You should go play the lotta because you may have the hot hand on this day.

All of this change resulted in me having 5 different jobs in a 2 year period. It was official – I was a job hopper extraordinaire.

These career setbacks struck a blow to my ego, but my problems were only beginning.

Real Estate House of Cards

Over at my rental properties my tenants, who happened to an entire family unit from my own family, had begun to miss their rent payments. It started with late or partial payments and eventually became no payments at all. And my other tenant moved out without notice and demanded his security deposit back – which I refused and was promptly summoned to court by him to settle the dispute.

Financially, I went from barely keeping things afloat on an income of $100,000 to completely drowning on an income of $55,000.

$242,000 may not seem like a lot of debt at face value, but it’s a monster when you factor in high interest rates. I don’t know the exact figure, but I estimate that I was paying an average of 20% interest on the credit cards and personal loans.

I was bringing home $3,200 per month but was coming up short on my bills and had to borrow several hundred dollars from my girlfriend to cover the difference. This sucked.

Relationships Tumbling

Oh, and speaking of my girlfriend – we were having major relationship issues and began the process of ending our sixteen-year relationship while I was in the midst of all this other calamity.

And just to add a little cherry on top of all of this mess – I also had major knee surgery during this period and had to be on crutches for 10 weeks with another several months of intensive rehab.

So, What’s The Point of All of This

Things were so emotionally difficult for me at the time that I was barely sleeping due to the stress. I remember averaging 2-3 hours of sleep each night. I would string the days together with coffee and the occasional nap when my body would crash.

I also remember sobbing like a baby to my girlfriend as she looked on with bewilderment and defeat because she was incapable of helping pull me out of this funk.

I don’t share all of this as some sort of sob story and I’m not looking for sympathy. I share this story to highlight how quickly things can fall apart in life and how vital our finances are in the grand scheme of it all.

In a 2.5-year period between 2017 – 2019, I built a house of cards using debt that came tumbling down at the exact same time other major areas of my life were imploding. This was no coincidence either since money was directly or indirectly behind much of what I was facing.

I was dead broke with a large amount of debt because of bad financial decisions and did not have a high enough income to stay afloat.

I had to evict family members and cause intense pain and friction in the family because of money. My other tenant was also suing me over money.

My career was on the fritz – problems I created because I began chasing jobs for the sake of money.

My romantic relationship was dying, and I was too distracted to save it because I was too busy wrestling with my money problems.

The mildest issue of all was the major knee surgery which isn’t totally money related, but my recovery may have been easier with less stress.

Destroy and Rebuild Back Better

Rap legend Nas released a song called Destroy and Rebuild in 2001. I’ve always enjoyed the song, but the title is what really left an impression on me.

The wonderful thing about rock bottom is that up is really the only direction to go. Sure, my life had crumbled to pieces, but each day was a chance to make things better. I decided to take Nas’ advice and destroy it all then rebuild things one piece at a time.

Fixing the Real Estate Problem

My first priority was to sell the real estate. This is where the majority of my troubles stemmed from, so I had to blow it all up and start over from scratch. Against the advice of some family and friends, I sold both properties in order to access cash.

It was amazing to me to see how people viewed real estate relative to debt. I would tell people my situation and how I was drowning in a hole that was only getting deeper and they would tell me “stay the course” or that “owning property is special” or that I should keep focused on “generational wealth”.

The best one I heard was that I should just ignore the debt and pretend it wasn’t there. Mind blowing!

I knew that I was giving up potential future returns, but I was broke in the present moment so the future could wait.

One of the few things I got right in this ordeal was avoiding racking up a lot of debt on stupid crap that had no upside value such as a car or trinkets. Instead, I dumped most of the $89,000 credit card and personal loan money into my fixer upper projects which allowed me to increase the property values and ultimately sell for a break even.

Selling the properties cleared the mortgage, the credit cards, and all personal loans. This meant that I was left with $63,000 of student loan debt to tackle. I was well on my way to being free of debt. I felt really good, but the journey was only just beginning because I was still sitting in a huge financial hole and lacked any additional major assets that I could sell to accelerate my pace.

Tackling Student Loans

The only option on the table was to buckle up for the long haul to clear this remaining debt over time – a single step at a time.

It would ultimately take me another 2.5 years of dedicated focus to climb this last mountain of debt. I did everything in my power to speed things up such as working an additional job, selling things, and squeezing the budget. These things definitely helped, but it was really just commitment, time and patience that got me over the finish line.

Fixing Everything Else

I also took this time to make other sweeping changes to my life. There is something about an extreme low moment that can give you the courage and motivation to make wholesale changes for the better.

I decided to quit working in the education field altogether and move my career in a different direction. I worked hard to build up new skills in preparation for what was next. I landed my first corporate job in September 2019 working in IT as a project Manager for $55,000.

My 16-year relationship was on its last leg, and we had an important decision to make. We would either fix things and marry or break up once and for all. We chose to break up.

Breaking up is difficult no matter what, but it was even harder to do considering this was with my first real love and the person who knew me better than anyone else. We loved each other deeply, but had some deep seeded problems too.

Change was necessary.

My health has always been a top priority for me, but I took things up a notch. I was 31 years old and began thinking about my health in the long term. I wanted to ensure I got out in front of those little ailments that crop up and are ignored.

I established care with a primary physician and measured baselines health metrics to track long term. I also addressed nagging sports injuries which led to yet another knee surgery in 2020 and a lifetime of physical therapy.

The most significant health related changes I made were not physical. The greatest changes came from my mental health and from within. Hitting rock bottom thrust me into emotionally dark places that I didn’t know existed before all of this began. My relationships were also stressed tested.

These stressors could have easily permanently broken me down, but I decided to harness the pain and turn it into something better.

I began seeing a therapist and talking through my struggles with my upbringing, my career, my relationships, and family. I also joined a meditation group that I still participate in today. I eliminated coffee because it stroked anxiety within me. And I reprioritized relationships and eliminated those that did not serve me well.

The Spoils of Victory

A lot of this work is still ongoing, but it’s not really a journey that ever ends. My life is in a better place and I have a level of peace that I never had before all of this went down. I chose to destroy most major components of my life to build them back better and it was worth it.

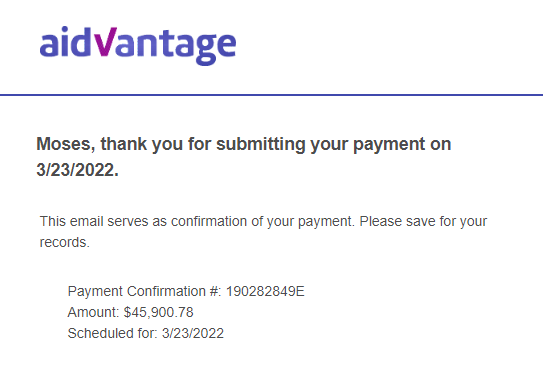

I made my first payment on the $63,000 student loan in November 2019, and made my final lump sum payment of $45,900 in March 2022.

The COVID interest pause allowed me to save up penalty free so I could make a big splash.

The four-year journey from hitting rock bottom to claiming what is probably my life’s most significant accomplishment was now complete. The best way to describe how I feel about what I have done is satisfied and at peace.

This is not a debt free story – and it’s really not just a story about money either. This is actually a story about life.

For me, there are many lessons wrapped into this story such as how to navigate failure, dealing with sorrow, and facing life’s inevitable curve balls. I also take from it lessons on patience, discipline, and personal growth.

These are just some of the themes that I’ve learned over the course of the last four years, but I’ve also learned many other valuable lessons on how to manage money and the mind for better results. I would like to share everything I know with those interested in learning with me.

I don’t consider this a money blog, but rather a place where I have the privilege to discuss all of the complexities of life through a prism that focuses on money.

This blog is my avenue for personal expression and is a means for me to leave my own unique mark on the world. Maybe I can help others reshape their lives for the better along the way.

Let’s just see what happens.

14 Responses

I’m so proud of you !!! I saw how hard you worked as a young adult you were so determined.. ❤️So blessed to have known you most of your life … Keep up the great work !

Thanks Connie (and Ronnie)! You guys have always treated me so well and I’m forever grateful!

I am SO proud of you, but that’s nothing new. I have always believed in you and your ability to succeed. I pray that you will continue to grow and prosper. Carry God with you on your journey.

Thank you so much. I owe you more appreciation than I can ever give!

Awesome read! Part of your story reflects mine when you talk about your mom. I too was divorced raising 4 children, working 3 job while putting myself through college. Only I went into debt trying to give my children what I didn’t have have growing up.

Getting out of debt is a struggle but like everything in life, you have to preserve to get out. You have to make sacrifices!

Hi Margo! Thank you for this comment. It definitely resonates. Getting out of debt is a struggle that many face, but it can be done. The biggest factor is time.

The one thing people underestimate is the effects that debt has on our mental and physical health.

https://www.moneygeek.com/debt/resources/how-debt-can-harm-your-health/#:~:text=Debt%20can%20lead%20to%20anxiety,which%20further%20enhances%20financial%20struggles.

Wow this article is eye opening! I can totally relate as well because I experienced a lot of what was mentioned when I was at my deepest point of debt. It impacted literally all aspects of my life. Thank you for sharing this article, I will definitely bookmark to touch on later!

Thanks you for being bold and sharing your story. As I mentioned to you before I could resonate with many of the questions you’ve asked yourself in terms of financial literacy and why was it that we weren’t taught these things at a younger age. Crazy to see what the application of knowledge and dedication during struggle can lead to. Congrats on being debt free!

Thanks so much for the kind words. So many of are never taught these lessons, but we can always learn and succeed no matter where we are today. That’s the beauty of life!

Yes, definitely thanks for sharing your story, and it’s intriguing to understand how you managed to put a down payment of 45k on your student loans vs. using it towards everyday life needs. But for sure, definitely goals and congratulations.

It was tough not to use that money for other things like investing or buying a house / car. My grandmother used to say that money would “burn a hole in our pockets” as kids. Same for adults. We have it and just want to spend it!

Mos,

I’m very proud of you for sharing your story. It takes courage to be so open about your personal life and I applaud you for doing it in such an honest way. I have enjoyed this first episode and although I do agree with most of it, I would argue that a well balanced and thoughtful use of spend on credit cards can afford you additional benefits in the long run. These benefits are are not to be outdone by high interest rates as you have learned and shared in the blog. I’d be happy to discuss more whenever you would like. Keep doing it, we’re enjoying the story.

It takes a sophisticated and disciplined individual to play the credit card points game and win out. The card companies aren’t stupid when giving out points as they know most people will take things to far.

Thanks for the encouragement, and I’m looking forward to teaming up soon!