Are you ready to make some financial progress? Great, because this post will show you how.

Making financial progress isn’t difficult; in fact, it can be quite straightforward. Simply pick a few strategies from this post, focus on them one at a time, drive them to completion, and lock in your results before moving to the next.

No matter where you are on the financial spectrum, there’s always room to make financial progress. The key is to choose strategies that fit your situation.

Think of this post as your financial progress shopping list: pick what works for you now, and come back to update your list as your circumstances evolve.

Pay Off As Much Debt As Possible

Is it better to invest or pay down debt? Easy, pay off your debt because it’s almost always a superior form of investing. Here’s what I mean:

Imagine for a moment you had a $1,000 personal loan with an interest rate of 24.72%. You’ve just received your annual bonus of $1,000 and are unsure whether you should pay off your loan balance or invest the money in a 52 week t-bill returning 4.57%.

Many personal finance sites tell you to split the difference. Some even tell you to invest. But, you’ve read this site and know I’m a proponent of going all in on paying down debt; so that is what you decide to do. Here’s how you would come out on top:

Scenario 1: Paying Off Personal Loans

Debt Amount: $1,000

Interest Rate: 24.72%

Interest Savings From Paying Off Loan: $247.20

Scenario 2: Investing in a 52-Week T-Bill

Investment Amount: $1,000

Annual Return Rate: 4.57%

Annual Return on Investment: $45.70

Comparison

Interest Saved by Paying Off Debt: $247.20

Interest Earned by Investing in T-Bill: $45.70

Net Gain From Paying Off Debt: $201.50

...The Power Of Paying Off Debt

I admit, paying off debt isn’t sexy. In fact, it’s downright painful to do.

Investing is much more attractive because we love the excitement of seeing things grow – especially our money. It’s why people opt for the dual approach of investing a little while paying off debt. It enables you to mix a bit of good (investing) with bad (paying off debt).

Be that as it may, paying off debt is still superior. For one, paying off debt has a guaranteed ROI while most other forms of investing involve risk.

Paying off debt also increases your net cash flows which makes you feel richer than investment numbers in a computer screen. Further, paying off debt relieves a tremendous amount of financial stress while providing some pretty cool benefits.

I’m not a debt crusader. I just know from personal experience that paying off debt is overall the best way to make financial progress and improve your life.

Save Up Some Cash

A well cited report from Bankrate found that 27% of U.S. adults had zero dollars in emergency savings. More troubling than this is that 56% percent of U.S. adults wouldn’t be able to pay for an emergency expense of $1,000 with savings. Instead, would finance the expense with credit cards and loans, or cut spending in other areas of their budgets such as food.

Given these points, we can see that building up some cash savings is a great way to make financial progress. Doing so would bolster your resiliency from emergencies and help you avoid taking on additional debt.

Aiming to save even $1,000 is a great place to start.

My recommendation is for you to open a separate savings account apart from your normal spend accounts. Once established, you can slowly contribute to the account until you reach at least $1,000. Then you can build up to six months of expenses.

Use More Cash For Everyday Spending

In spite of credit cards being ubiquitous in our culture, I firmly believe they are the inferior choice to cash.

Evidence shows credit cards decouple us from our money during spending. This causes us to spend more than we intend since the money doesn’t seem real. Credit cards also trick us into spending by activating reward centers of our brains thanks to credit card points.

Using cash is a much more intimate way to spend and manage your money. Sure, credit cards are more convenient, but the convenience is the root of the issue of decoupling.

Just last night, I had a date at a fancy Japanese restaurant where I did a good bit of guilt-free spending to the tune of $190 dollars. To my waitress’s surprise, I paid for the meal using all cash, something she didn’t seem to see very often.

Most people can’t remember how much they spend when using credit cards. But I remember the exact amount of last night’s bill because I had to physically pull the bills from my pocket, count them out, and wish them goodbye as I handed them over in the fancy little wooden box.

Sell Some Stuff

Less is more when it comes to making financial progress. Specifically, selling some of the stuff you own is a surefire way to get ahead.

Many Americans have homes that are far too big for their needs, filled with electronics, cooking supplies, appliances, fitness equipment, camping supplies, holiday fare, party supplies, clothes, jewelry, guns, children’s toys, and a nearly limitless list of other things that can be sold for cold hard cash.

Why keep so much stuff in closets, cabinets, and garages collecting dust when we can use it to make financial progress? Consider taking an inventory of what you truly need, then sell the rest. In doing so, you may discover there is power in owning fewer things.

Optimize Your Taxes

Even if you make a lot of money, you can still make financial progress. One of the best ways to do this is by optimizing your taxes to ensure you pay not a penny more than you owe.

I’m feeling quite bitter after paying $44,000 taxes on more than $200,000 income in 2023. As a fatherless black man who overcame being abandoned at 12 years old, the taxes feel like a penalty for persevering.

Accordingly, one of my top financial priorities moving forward is to strategically optimize my taxes. I won’t lie, cheat, or steal from the government. But I will use every legal means at my disposal to keep the money I work so hard to earn.

Establish A Budget

I’ve stubbornly not used a budget for the past few years with mixed results.

On one hand, I’ve saved a lot of time not going through the budgeting process while still managing to save my first $100,000. On the other, I’ve failed miserably in this year’s $50k savings goal thanks to out of control spending.

In the five months since February when I made my goal public, I’ve spent $31,200 which is 29% more than the $24,100 spent in the five preceding months.

Given this, and with consideration for the sabbatical I plan to soon take – I need a tool to help me better control cash flows. Or, in short, I think I need a budget to help me make financial progress.

Optimize Your Insurances

Ensuring you are optimally insured is an important component of your financial risk management. It’s not about paying for the “best” insurance available. Nor is it about saving the most money possible. Instead, it’s about dialing in your coverages to be precisely sufficient for your needs given your unique circumstances.

Admittedly, insurance can be really confusing. There’s an overabundance of options and a ton of jargon to sift through to land on what we need.

Yet, this is precisely why we should focus on it. That is, optimizing this overlooked area of our finances is a guaranteed way to make progress.

Implement Some Extreme Saving

Would you buy it if I told you there is anyway to 10x your savings rate? Let me introduce you to the concept of extreme saving.

Extreme saving involves saving extreme portions of your income or saving money in extreme ways and is a great way for you to make financial progress.

The average savings rate in the U.S is shockingly low at 4%. In spite of that, you can opt to deploy extreme savings tactics that enable you to save 50% or more on an average income.

Be warned that it’s called extreme saving for a reason. Most people aren’t willing to move to undesirable parts of town to save on housing. And you’ll be hard pressed convincing people to ditch their cars for bikes. Regardless of that, you could dare to be different by choosing this effective strategy for financial progress.

Change Your Environment

As someone who has become successful in spite of being from the hood, I know all too well the importance of the environment. From very early on I knew the people and places around me would influence my results.

For instance, a good friend of mine recently had her checking account wiped clean of $50,000 dollars by her loser ex-boyfriend. She had fallen in with the wrong crowd which he was a part of. In spite of my many warnings, she couldn’t let the group go. Sadly, she had to learn the hard way that environment matters.

Accordingly, the same applies for you and your money. Take stock in your environment to determine if it is good for you. Consider the people in your circle and the places you go. Also think about the music and social media you follow.

Improving your environment may not be easy, but it is a worthwhile way to make financial progress.

As your environment gets better, so will you. Imagine being surrounded by a group of healthy, successful family people and entrepreneurs versus a friend group of addicts and criminals. Which would be better for you and your money?

Simplify Your Finances

Steve Jobs once said that “simplicity is the ultimate form of sophistication”. And while he wasn’t talking about money, we can still use the concept to help us make financial progress.

I’m currently engaged in an effort to simplify my finances where the name of the game is less is more.

This week alone I’ve closed 2 backup cell phone plans costing $40 per month and a checking account that has been charging me $5 per month for far too long. I plan to consolidate recurring payments onto a single credit card and closing the others. Additionally, I’ve started to use more cash.

With a single credit card and no spending leaks, I will have greater visibility over my money. This creates financial progress by giving me more control and predictability. It should make budgeting smoother, and easier for me to spot any new spending leaks that arise.

Plug Those Spending Leaks

I mentioned plugging my own spending leaks in the previous section. Now it’s your turn to do the same so you can make some headway with your finances.

Spending leaks are those insidiously sneaky, hidden expenses that slowly drain away our money without us knowing. Or, like the backup mobile plans that I recently canceled, they can be expenses that we know about but ignore. Sort of like those dating red flags we like to overlook until it’s too late.

My guess is that at this very moment you have a handful of recurring expenses that are slowly leeching away your hard earned money. Given that, why not take a few moments to review your monthly statements to flesh them out? No pun intended.

Get Some Stability

I haven’t written much about it, but I’ve been traveling quite extensively for the past year and have gained a lot of wisdom because of it. One of the biggest takeaways I’ve gained is that stability is key for making financial progress.

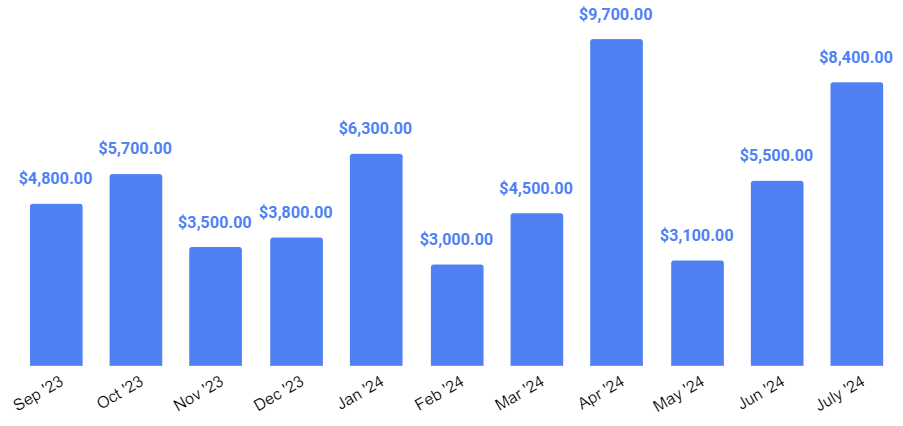

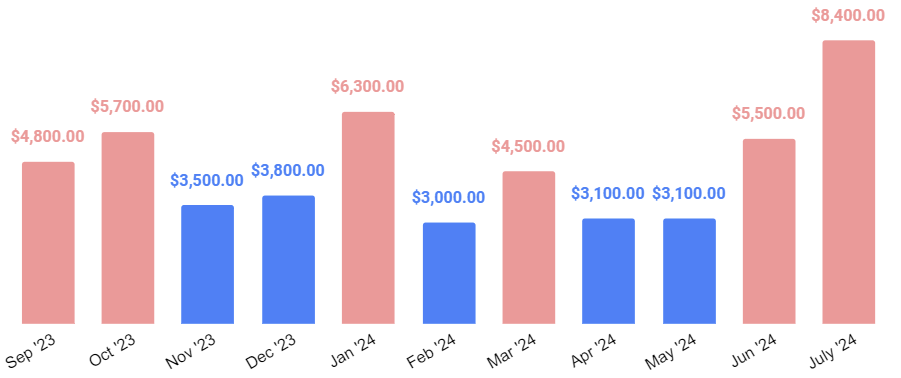

For illustration, let’s take one more look at my spending for the past year. I’ve highlighted the months where I was travelling or had travel related expenses such as moving to a new city. I excluded from April the $6,682 tax bill since it is an uncommon expense.

What we see is that I spent an average of $5,867 during travel months which is 78% more than my $3,300 average during non-travel months.

Airline tickets, Ubers, hotels, restaurant meals, and the dozens of other travel related expenses add up fast. Plus, it’s difficult to stay organized under all the movement and stress. As a result, I aim to travel as least as possible over the next 18 – 24 months.

Travel aside, instability can manifest in many ways. Constant moving, frequent job changes, poor mental health, and relationship issues are just a few. To make financial progress, take stock of you can improve your levels of stability and make changes where necessary.

Sell Your Car

On one hand, cars give us limitless mobility. On the other hand, they prevent most people from making financial progress.

Auto debt is the second largest category of debt behind mortgages. In Q1 2024 alone, Americans took out $165.5 billion in new auto loans for an average car payment of $735 per month.

I have trouble understanding the rationale behind car payments because I’ve always driven cars I could afford with cash. They have mostly been beaters, but they’ve enabled me to make financial progress. Not taking on auto debt is the best financial decision I’ve ever made.

With so many people struggling financially, we would be better off without auto debt on the books.

Hence, you should do whatever it takes to rid yourself of your auto debt. Your best option is to sell your car. Even if you are underwater on the loan, work hard to save up the difference between the potential sale price and loan balance to clear it out. You’ll be making financial progress thanks to lower debt and increased cash flow.

Optimize Your Bills

My girlfriend from a few years ago paid around $115 per month for Sprint mobile service in spite of me constantly telling her she could pay half that amount by switching to prepaid .She always said she would “look into it”, but never did.

Something held my ex back from making financial progress. However, that doesn’t have to be true for you.

Take a look at all of your bills and ask yourself if they are optimized to give you the best price. I’m willing to bet you can adjust or negotiate down the following bills to give yourself some financial headway:

- Medical Bills. Seek payment plans to increase cash flow. Or discounted settlements for paying in full.

- Credit Card Interest Rates. Call your credit card company and ask for a lower interest rate, especially if you have a good payment history.

- Cable and Internet Bills. Politely demand the promotional rate offered to new customers. And refuse all rate increases in the future.

- Rent. Landlords would rather work out deals with good tenants than roll the dice with new ones.

- Phone Bills. Don’t be like my ex. End your silly contract and go prepaid.

- Insurance Premiums. Periodically shop around for the best rates.

- Subscription Services. Threaten to cancel to see just how much they value your business.

Optimizing these bills could probably net you several hundred dollars per month. Don’t be a naysayer by telling yourself you can’t make the changes. My motto is to always make the ask!

What Does Financial Progress Means To You?

It is important to mention that you should start the process of making financial progress by defining what progress actually means to you. In other words, begin with the end in mind so you know where you’re headed.

I’m motivated to make financial progress at this moment because I’m planning for a long sabbatical. To this end, I need my finances to be perfect to ensure I come out on the other side with as much of my stash as possible. The last thing I’d want is to quit working for a year or more and go broke.

As for you, define what it means to make progress. Do you want to spend less, get out of debt, save up for something big – or a bit of all three? Knowing where you’re heading and why can really help.

Drop a note in the comments section if you’d like to share. Here’s to your financial progress!