Should You Marry Someone With Debt?

It’s perfectly reasonable to marry someone who has debt. That said, this is not a decision to take lightly and you should carefully think through the bigger picture.

In this article I’ll discuss relevant factors to be considered when determining if you should marry someone with debt.

Contents

How To Decide If You Should Marry Someone Who Has Debt

There are many factors involved in deciding who to marry. Personality, attraction, and common interests are just a few things that must align for a match to be made in heaven. Money is also something that would ideally be in agreement, but money remains one of the top causes for divorce.

From experience, the top money and marriage concerns center upon whether people should marry when debt is in the mix and how couples can mesh finances once a decision to marry is actually made.

Let’s focus on the first of these concerns to ensure we are all making the best possible decision on who we decide to tie the knot with.

The Proper Way To Approach Dating

Questions such as whether you should marry someone who has debt are actually easy to answer. The trouble is that most of us approach dating all wrong, and spin our wheels. Then, we pan out many years later and realize that we’ve invested significant amounts of time in people who may not have been the ideal match for us from the start.

This is not an ideal situation, but it happens quite often.

A better approach to dating would be to start with a set of values. Chiefly, it is worthwhile to sit down and really think through your general set of personal values and also your values surrounding money. With values established, you should then approach all of your dating interactions with these factors at the forefront of your mind.

Unfortunately, this is easier said than done because we are all blessed (or cursed) with powerful internal systems called emotions.

Emotions often overrule any logic we have in the dating process with infatuation and love leading the way. Further, these emotions often cloud our judgment and cause us to abandon our values.

That said, we are still rational and responsible human beings who must take ownership of the fight between our logic and emotions. Ideally, we find a mate who makes this easy – but we are responsible for our choices either way.

What This Looks Like In Real Life

I’ve had some interesting dating experiences that have allowed me to hone this process over the years.

For example, I once met an attractive woman who seemed to have a decent personality. In spite of this, I was able to quickly decide that we wouldn’t be compatible because of lifestyle differences. In short, her lifestyle consisted of partying and drinking copious amounts of alcohol which does not align with my health focused lifestyle.

Fortunately, I was able to recognize this fundamental difference early on and quickly move on toward finding better fitting prospects. Like many guys, I could have stuck things out for the simple fact that she was attractive. But again, this would have been following my emotions rather than leading with my values.

Financially speaking, you would want to approach dating in the same manner as you try to understand a potential mate’s financial values.

Questions To Ask Before Deciding to Marry Someone With Debt

Not everyone is an open book in dating relationships. Therefore, you will need to do a little bit of fact finding to figure out whether your date is marriage material. To be clear, I’m not suggesting that you go and dig through the other person’s trash to find information.

Instead, all you need to do is have mature conversations, ask great questions, and actively listen.

The designs mentioned in the above quote happen to be the technological changes that we’ve experienced in recent decades.

No one will argue against the fact that technology has streamlined things when it comes to money. Yet, the question remains whether or not these new payment technologies are actually beneficial for our long term financial success.

I’ll explore this question next using credit and debit cards as the primary payment types for considerations.

Five Questions To Ask Before Marrying Someone With Debt

1. What Type of Debt & How Much?

I generally believe that most debt is dumb, but will concede that not all debt is created equally. Medical school debt, for example, is necessary for many aspiring physicians since the average cost of medical school exceeds $200,000 in addition to whatever was already paid to attain the undergraduate degree.

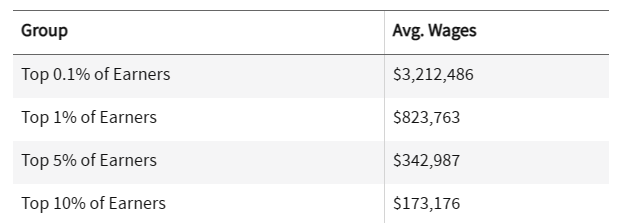

This means that a doctor could graduate with student loan debt exceeding $300,000. Fortunately, the median salary for U.S. based physicians is $208,000 which easily makes them some of the highest paid professionals.

This is far different from a young lady that I dated a few years ago who had over $100,000 worth of student loan debt for 3 degrees – none of which she used and all in low paying fields such as social work. This isn’t to say that her debt would have made her ineligible for serious consideration, but it did warrant further understanding on her plans for the debt.

The combination of debt type and amount are important because you want to really understand what you are signing up for before you vows are exchanged. Marrying someone with a small amount of credit card debt incurred for emergency car repairs is drastically different than marry a spendthrift who racked up $50,000 on an Amex because of an incessant need for a little retail therapy at the luxury shops.

2. What Is The Plan For The Current Debt?

A physician should be easy. They are incurring significant student loan debt so they can get through medical school and become doctors. If everything goes according to plan, they will enter their profession earning a salary near the top 5%.

From there, you’d just want to make sure they actually plan on paying things off because, ironically, there are tons of broke doctors out there.

3.What Is Their Relationship With Debt?

Some people love debt and some don’t. It’s all a matter of personal preference, but it is still important to understand where your prospect falls on the spectrum.

Ideally, you want to marry someone who closely aligns with you.

The last thing you want to do is try to force someone to get on your financial program. At best, you will drag them along as the kick and scream every bit of the way. At worst, the two of you will run you own programs because you can’t align. Either way is a recipe for disaster.

Interestingly, I’ve always been the most attracted to the women who I’ve most closely matched with from a financial perspective. I can’t say whether it was the innate similarity that was alluring or whether my mind was most open to these women – but I digress.

4.Do They Plan On Acquiring More Debt?

Regardless of where things start, we must know where things will go. Even if you don’t mind having debt in your life, it helps to know if you should expect to have more.

For example, the person you are currently dating may be in the market for a new car and considering taking out a loan. This doesn’t absolutely make them unworthy of marriage – but it may be a disqualifier if you are one who prefers to pay for things with cash.

Anyone considering dating me would have to be okay with living a more modest lifestyle that doesn’t use debt to fund things. If a lady is unwilling to forego the wonders of debt, then we are probably not a good match.

5.How Much Do You Like The Person?

Money isn’t everything. In fact, I’d say that money falls behind love and compatibility in terms of order of importance when selecting a spouse. If you like the person and have all of the ingredients of a fulfilling relationship in place, then why deny yourself the gift of love?

My theory is that we should all seek to live a rich life today, and having real love is one of the few things money simply cannot buy.

The Verdict: Would I Marry Someone With Debt?

I hate it when pundits settle on “it depends” for things week seek answers to. Some of us like concrete answers, so I will give you mine.

Yes, I would marry someone with debt – but there are limits.

For starters, I wouldn’t marry anyone who loves being in debt or who is not on board with living a debt free lifestyle.

I would also have to consider the amount-type mix. This is not as clearly defined for me, but I doubt that I’d sign up for a journey involving hundreds of thousands of dollars of high interest debt that doesn’t come with a spouse who earns an an equally substantial income.

The Biggest Decision You’ll Ever Make

Deciding who to marry is one of the most important decisions you will ever make.

Marriage is all encompassing. Love, family, children, dreams, lifestyles, and habits all mesh in what is hopefully a harmonious bond. Then of course we throw money on top of all of this and hope for the best.

So how might you decide – would you marry someone who has debt? Let me know in the comments!