Just last night, I was on a date with a Tunisian woman who, upon learning about this blog, asked if I was the type of person who saves money. I said yes, of course—saving is what allows me to take a year-long sabbatical in Europe. She replied that she’s the opposite: she never saves because she’d rather “live her life.”

I get it. It’s easy to think that spending money is the key to living better. But which lifestyle is truly better—one based on saving or one based on spending?

In this post, I’ll present my Save Money, Live Better Matrix—a tool for comparing lifestyle choices between saving and spending. By the end, I think you’ll see that the small sacrifice you make when saving is more than worth it for how it enables you to live better than those who don’t save.

Let’s dive in.

The Save Money, Live Better Matrix

One fundamental lesson I learned during my Economics studies is that everything in life has a tradeoff. With that in mind, I designed the Save Money, Live Better Matrix to show the trade-offs we make when we save versus when we spend.

We’ll start with a simple table of different savings rates and score several variables based on how they are influenced by the relative savings rate. Check it out below:

Save Money, Live Better: The Variables

Before analyzing the spending and savings profiles, here’s a quick rundown of the variables I’ve chosen to capture the essence of a good life:

- Fun: Spending money is fun—that’s why everyone does it. Eating out, traveling, shopping, and entertaining ourselves are just a few of the fun things we can buy with money.

- Material Standard of Living: Spending money can increase our material standard of living with fancier clothes, newer cars, and bigger homes.

- Peace: Saving money gives us the ability to withstand life’s woes and find peace in financial stability.

- Financial Freedom: Saving eventually leads to financial freedom, the point where work becomes optional.

- Retirement: Saving today determines how well we’ll live tomorrow.

- More Options: He with the most money has the most options. Saving money gives us the flexibility to choose our path.

- Flexibility: Saving provides the ability to adapt or change with ease, navigating life’s unexpected twists and turns.

- Ability to Give: Saving allows us to be generous and contribute to causes or people we care about.

- Risk: The more we save, the less financial risk we face.

Combining the Variables

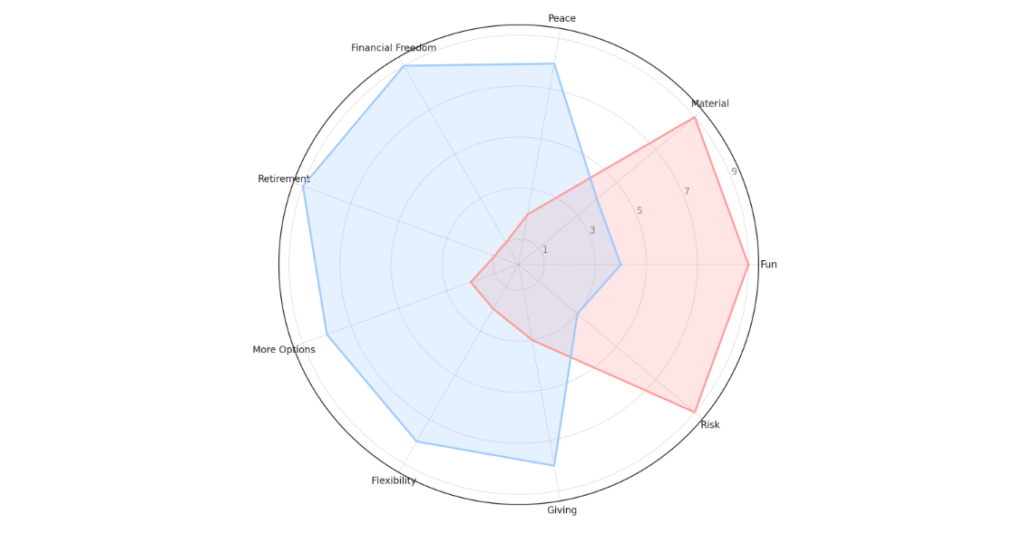

Now, let’s combine these variables to paint a picture of how they contribute to living better depending on how much we save. For this, I’ll compare a 5% savings rate in red (representing the Tunisian woman from my date) with a 50% savings rate in blue (my average over the past five years).

Spending Money Is More Fun:

All else being equal, spending money is more fun than saving. The Tunisian woman gets the nod here—spending practically everything she earns maximizes her fun.

If I spent all my money, I’d probably splurge on two things I enjoy most: eating out and slow travel.

Spending Money Leads to Higher Material Standards:

Spending money also leads to a higher material standard of living. It’s why even ordinary people spend large portions of their earnings on fancy clothes, new cars, and big homes.

Meanwhile, savers like me inevitably sacrifice some material comforts to build wealth. Once again, the Tunisian woman takes this one.

Save Money, Live Better With Peace:

From the moment I met her, I could tell she was stressed—frazzled from her long day at work. Meanwhile, I sat back sipping vino tinto, cool as a cucumber.

Financial pressure combined with work stress is a recipe for burnout. Savers always have lower financial stress, making life easier and more peaceful. The nod here goes to saving.

Save Money, Live Better With Financial Freedom:

M.W. Harrison once said, “The waste of money cures itself, for soon there is no more waste.” Spend everything, and you’ll always need to earn more.

Meanwhile, savers build wealth and eventually achieve financial freedom. The nod here goes to us savers.

Saving Money Leads to a Better Retirement:

I didn’t ask the Tunisian woman about her retirement plans, but if she continues spending everything, her future will be tough. At 26, it’s probably hard for her to think about retirement, but saving today ensures a better tomorrow.

Saving Money Gives Us More Options:

With a hefty six-figure savings, I have the freedom to quit work, travel, or move continents. Meanwhile, the Tunisian woman has few options and is stuck in her current situation.

Saving money opens doors. The nod here goes to saving.

Saving Money Makes Us Flexible:

What would happen to her if she were blindsided by a layoff? Without savings, the woman from my date would have limited options and likely be overwhelmed with stress.

Savings provide resilience and adaptability for life’s unexpected changes.

Saving Money Enables Us to Give:

With savings, we can contribute to causes, help loved ones, or donate our time and resources. Saving isn’t selfish—it’s what allows us to be generous.

Saving Money Minimizes Risk:

Spending everything you earn is risky. A single emergency could derail everything.

Saving money reduces risk, creating a financial cushion to handle life’s curveballs.

Saving Money Equals Living Better

The Tunisian woman I went on a date with spends 95% (or more) of everything she earns. Like she said, she’s “living her life.” There’s something appealing about that level of carefree spending—but is it sustainable, or even wise?

The downsides of this lifestyle are glaring. By spending lavishly, she remains completely dependent on her job – needing her next paycheck just to stay afloat, leaving her vulnerable to any financial hiccup.

Beyond immediate risks, she’s also neglecting her future. Without saving, she’s making no progress toward financial independence or a comfortable retirement. If she continues on this path, she’ll likely retire with very little to lean on.

In contrast, saving has given me the best of both worlds. By allocating a portion of my income to fun and material possessions, I enjoy life in the present. At the same time, saving consistently has afforded me peace of mind, flexibility, and options for the future.

I’m building toward financial independence, ensuring a retirement where I don’t need to worry about money. Plus, saving allows me to give generously, which is one of the most fulfilling aspects of life.

In the end, saving money isn’t about sacrificing—it’s about securing a better, more balanced life now and later.

Clearly, saving enables us to truly live better.

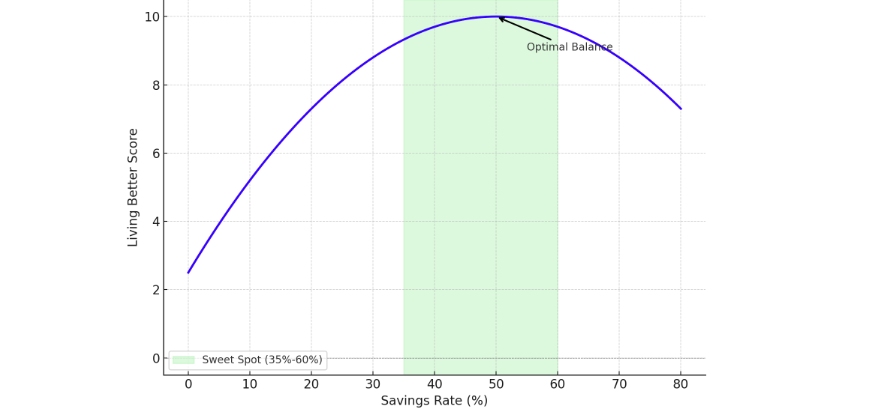

Beware: Save Too Much, and You Won’t Live Better

For a much as I am a fan of saving money, I must caution you that it can be taking to far. Pinching pennies isn’t worth it. There’s diminishing value in saving too much:

Diminishing Value Of Saving Money

The sweet spot for saving money is between 35-60%. In this range, you can enjoy a perfect balance between fun, material comfort, and financial security.

The default target for me is to always save at least 50%. This is the amount that gives me the greatest financial peace without feeling too constrained.

Why Does Saving Get Such a Bad Rap?

Spending has its perks, but saving is the path to living better. Yet, many share the Tunisian woman’s perspective, seeing saving as a burden.

My question for you is why does saving get such a bad rap – why is it considered so much of a negative that a woman on a date would rag on it? I though women would prefer a man that saves and is responsible with money, but obviously I must be mistaken.

At any rate, let me know your thoughts below!