Contents

Plug Those Spending Leaks

Spending leaks are hidden expenses that slowly drain away our money without us knowing. They are typically small by design and levied in clever ways to ensure they go unnoticed for as long as possible.

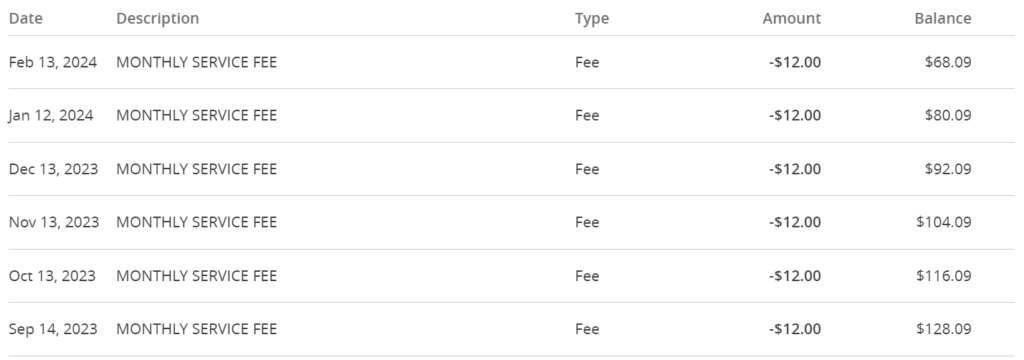

Take for example this spending leak on my backup checking account that I discovered last night. It was initiated without me noticing and would have continued had I not been lucky enough to see it.

This leaky expense had been siphoning off $12 per month over the last 6 months for a total of $72. And while it’s true a small expense of $12 won’t kill me, I’m not in the business of just giving away money. I know every dollar counts as I strive to save up $50,000 in 10 months, and I know the same holds for my long term goal of becoming rich.

Plugging spending leaks is an exercise in financial discipline. We simply can’t sit back while sneaky expenses slowly steal away our hard earned money.

That said, here’s my advice for plugging those pesky little spending leaks so we can achieve optimal finances with minimal waste.

Understanding The True Costs Of Spending Leaks

Why address your spending leaks in the first place? The main reason is because they are costly. That is, while typically small in isolation, spending leaks can really add up over time and delay our progress toward other financial goals.

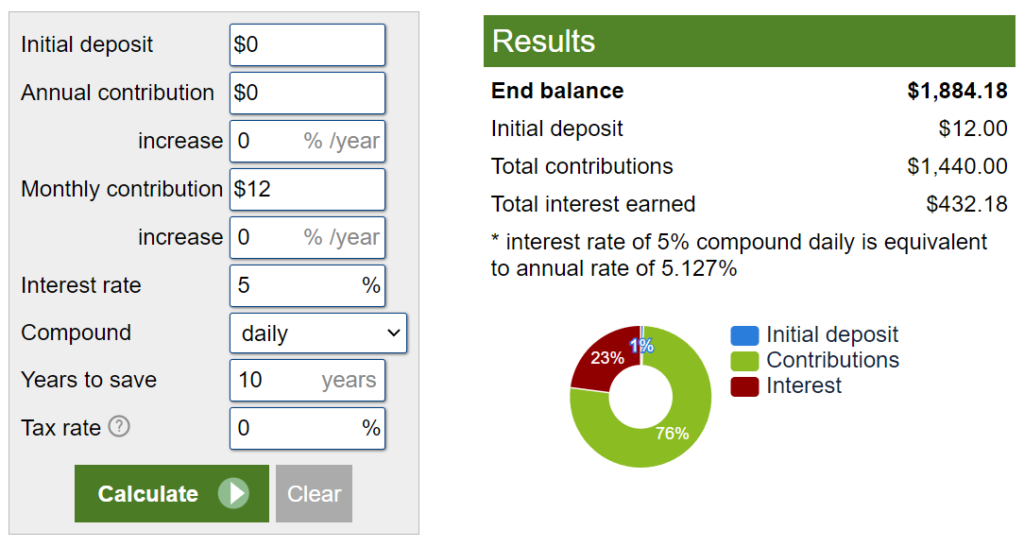

Imagine for a moment that I let the spending leak from above continue for another 10 years. At $12 per month, I would have leaked out $144 per year for a total of $1,440 over 10 years. Not so bad, right?

Of course, $1,440 lost to a spending leak over 10 years isn’t “that bad”, but it’s still lost money. Moreover, that lost money is worth a lot more than $1,440 when we consider the opportunity costs of allowing spending leaks to stay attached to our finances like the blood sucking leeches they are. Let’s take a simple example to illustrate:

Opportunity Costs Of A Spending Leak

At today’s rates, one could get a high yield savings account bearing a solid 5.0% guaranteed rate of return.

Opening one of these accounts and dropping the same $12 per month into it would result in an ending balance of $1,864.39 after 10 years. Of this, $1,440 would have been the total amount of your contributions, with the remaining $424.39 being compound interest growth.

Astoundingly, thanks to the power of compound interest, earning $424.39 on a $1,440 investment represents a 29% return on investment.

If these numbers seem small and unexciting, then consider the fact that this is the equivalent of someone earning $294,000 on a million dollar investment over the same number of years. In other words, it’s not only the face value of the money we have that matters. It is also important to consider the growth potential of even the smallest sums.

Spending Leaks Multiply Business Profits While Multiplying Against Us

The unique thing that separates a business from an individual person is that businesses are a lot less prone to the whims, emotions, and shortcomings of the individual person. This is why so much of personal finance centers around behavior as opposed to business finance which focuses on the fine intricacies of money.

I mention this to say that businesses understand the true value of $12 per month over a 10 year period far better than most people do. What’s more is they will gladly take that seemingly measly $12 from us and invest it in productive ways that generate massive returns for them.

With that, recognize that companies such as Chase levy similar $12 charges to hundreds of thousands of customers per year. With this understanding, it becomes easy to grasp how they can generate net profits of 49.6 billion in a single year.

Again, if we aren’t willing to manage even small sums of our own money such as $12 per month, then someone else who understands the long term value of every dollar will gladly take it from us and put our money to use for their own enrichment.

To this, I say no more!

How Spending Leaks Multiply Against Us

That should help you understand the nature and power of spending leaks from a business perspective. Companies taking small sums of money from thousands of customers over time results humongous profits.

With the right focus, the same process can also work in our favor for our own wealth building, but as I’ve said, we often don’t value small sums of money. Chase Bank, and most other companies know this and take full advantage of this weakness is our psychology.

So far, I’ve used Chase Bank as my punching bag since they are top of mind. I’ve taken that $12 charge and shown the losses in potential wealth building that we incur from such expenses. And I’ve highlighted the value of those small charges to a business. Now, I’ll round things out by showing you just how substantial spending leaks can be.

More Of My Recently Discovered Spending Leaks:

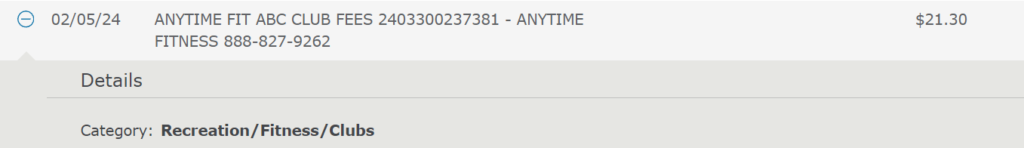

Anytime Fitness Spending Leak For $42.60 (Billed Bi-Weekly)

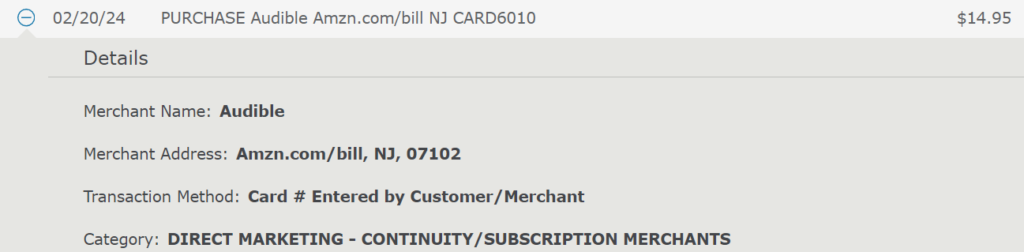

Audible Spending Leak For $14.95

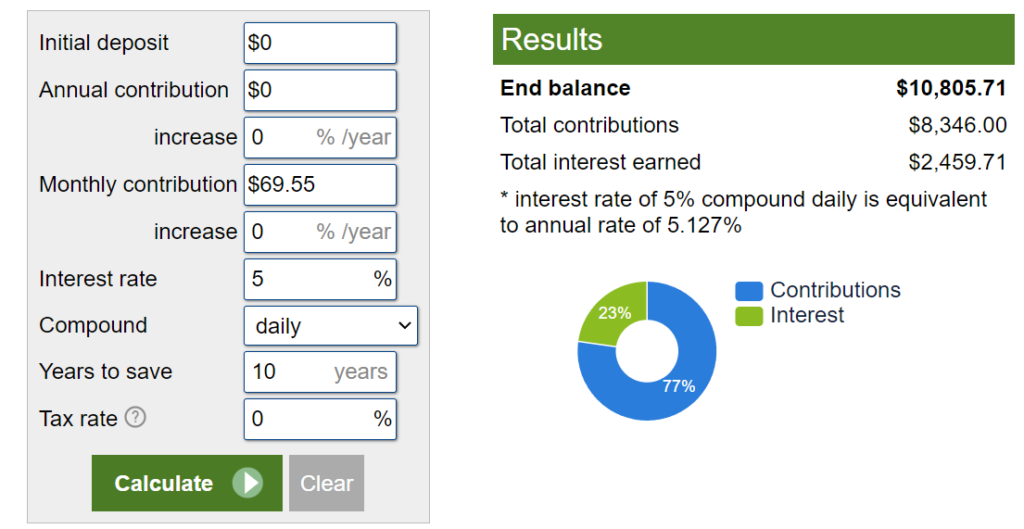

I’ve now added 2 additional spending leaks to the equation which brings the grand total of the 3 mentioned in this post to $69.55 per month. These are real expenses that were hitting my monthly cashflows and funds that I will never see again. They will be missed.

Using the same approach as earlier, I can extend the opportunity cost of these 3 expenses out over a 10 year timeline and see that they would have costed me $10,805 in potential wealth.

Most People Have A Lot Of Spending Leaks

If 3 spending leaks could cost me over $10,000 in lost wealth potential – what would double or triple that amount of spending leaks be worth?

You should stop and think about the same with your finances as I’m willing to bet the average person or family has many more than just 3 spending leaks slowly bleeding them dry.

Plug Your Spending Leaks With A Spending Audit

With a bit of due diligence, plugging up spending leaks is quite straightforward. All that it takes is for you to conduct a complete spending audit that will shine light on those previously hidden expenses that have been slowly siphoning away your money.

The hardest part about completing a spending audit is actually doing it since the process could take 1 – 2 hours from start to finish. That said, here are the steps complete.

Step 1: Pull Statements For All Spend Accounts

The first thing you’ll need to do is get your hands on a copy of all statements for accounts that are subject to any form of spending.

Just a few weeks ago I completed a spending audit on my main credit and debit card accounts, but overlooked the backup checking account where my leaky Chase charge was happening. This was a valuable lesson that taught me the importance of auditing all accounts where potential spending can take place.

I Suggest Auditing Your Spending Leaks For 12 Months

While more work on your part, I highly recommend completing your spending audit to cover a 12 month period to ensure you don’t miss any annual subscriptions. If you only limit your coverage for a few months, you could miss spending leaks that are still coming down the pipe.

As with monthly subscriptions, companies deploy annual subscriptions because they are a great way to catch us off guard. A year is a long time to remember a single charge, and most people have forgotten about them by the time they come due. Therefore, you will want to audit for a year ensure you see the full picture.

Typical to most of my advice, this suggestion comes from personal experience.

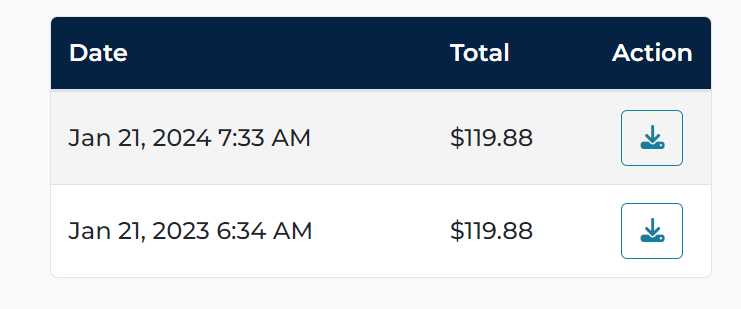

Most recently it was this charge from Tiny URL for $119.88 that took my be surprise. I signed up for it the year prior to serve a purpose for the blog, but later pivoted, thus making it a spending leak for the no longer needed service.

Step 2: Determine If You Truly Have A Spending Leak

There is a fine line between wants and needs that could make it difficult to identify with clarity which expenses are legitimate and which are spending leaks.

For example, I’m wrestling with this dilemma now as I try to determine whether I need my second mobile phone line that is costing me $25 per month. I originally got the line to use for work, but I haven’t actually put it to use in quite some time. As such, my hesitancy to cancel it lies in my inability to determine whether I will need it in the future.

My solution? I will cancel the line since it has been months since I’ve actually used it.

In like manner, you will want to examine your recurring expenses to determine whether you really need them. While you do this, you want to be sure to be honest with yourself and avoid talking yourself into keeping something you really don’t need. And of course, always opt to cancel when in doubt since you can always reinitiate a service should the need arise.

Step 3: Get Rid Of The Source Of The Spending Leak

There is a certain inertia involved in getting rid of spending leaks. That is, the process of plugging these holes in our finances takes a bit of effort to do. And because of this, it can be easy to put off in lieu of more fun activities.

Aside from recommending you summon sheer willpower to complete this process, I’ll pose a useful mental approach that could help drum up a bit of motivation to plow forward.

Here it is:

Plugging Spending Leaks Could Be Worth Hundreds Of Dollars Per Hour

In this article alone I’ve discussed spending leaks in my own finances that amounted to about $80 dollars per month. I’m willing to bet that my spending leaks are on the lower end of the spectrum since I manage my money relatively well. In other words, I’d guess that many of you have a lot more leaky expenses in your finances which means you also have a lot of opportunity with this process.

Let’s say that you have 10 spending leaks that total up to $600 dollars per year between monthly and annual subscriptions. Taking 3 hours to clean all of this up would save you $600 per year and equal a return on your time investment of $200/hr that you’ve essentially paid yourself.

Said differently, committing 3 hours of time to save $600 dollars breaks out as follows.

$600 savings / 3 hours = $200/hr return on time investment.

Would earning at that rate be worth the effort? I’d say so considering that very few of us make anywhere close to that amount on an hourly basis in our day jobs.

Preventing Future Spending Leaks

After we’ve successfully rid ourselves of sneaky spending leaks, our mission should be to stop them from cropping up in the future.

I think the best way to do this through mindfulness before making the decision to initiate a transaction in the first place. It’s enticing to take those free trials, but we must remember that they are designed to work against us.

For the things we do put ourselves on the hook for – the absolute best strategy would be to record those in a spreadsheet that we periodically review. This would streamline the spending audit process in the future and truly ensure nothing gets missed.

I’ll experiment with this process and report out on my results in the future.

Plug Those Spending Leaks To Claim Back Your Money!

One of the things I like to ask is “who’s got their hands in your pockets?”. For many of us, their are quite a few hands in our pockets and folks are gladly taking our hard earned money for their own gain.

Unfortunately for them, we’re now taking back our hard earned money as we plug up those spending leaks and clean up our finances.

At the end of the day, our money has to go somewhere. And from here on out it will go to the places we want it to go and not into the wrong hands. Let’s say it together… no more of those sneaky little spending leaks allowed!