Find a job you love, and you will never have to work a day in your life.

For me, early retirement isn’t worth it. Rather, it seems to be a suboptimal way to approach life and meaningful work. Pursuing passion, purpose, and curiosity beats an early retirement any day.

In this post, I’ll present a strong case for why setting early retirement as your ultimate goal may not be the best choice. Even if you’ve managed your finances to make early retirement possible, continuing to work at something you love will be more fulfilling and better for longevity.

Sound crazy? Keep reading for my take on why early retirement might not be worth the hype.

Case Study On Why Early Retirement Isn't Worth It

No matter your political views, it’s hard to deny that what Donald Trump just did is remarkable. At 78 years old, he’s taken on one of the world’s most demanding jobs – the U.S. presidency – at an age when most people would be looking forward to slowing down.

In the personal finance world, early retirement is often the ultimate goal. Many of us dream of stepping away from work in our 40s, envisioning decades of relaxation and freedom. Yet here’s a man, a full decade past the standard retirement age of 67, stepping up to lead the free world.

Trump’s example is notable. He’s not only completed one presidential term but spent the past four years navigating high-stakes legal battles and making 100s of public appearances and rallies with his campaign. And he’s doing it all at 78.

So why would someone choose to work so hard at an age when most people are looking to kick back?

The point here isn’t to idolize Trump. Instead, he’s a compelling example of why we shouldn’t be fixated on early retirement. Let me explain.

If You Never Work, You’ll Never Need To Retire Early

In 1989, Jerry Jones purchased the Dallas Cowboys for $140 million dollars. He was 47 at the time. Today, he’s 82, and in these late years of his life he’s taking on the demanding role of heading up the most valuable sports franchise in the world as owner, president, and general manager.

Why is he still doing it, why didn’t he retire early?

Maybe Jerry Jones is just crazy. Or perhaps he’s built different. In reality, it’s neither. Instead, he’s living out the not so secret, secret, that doing work you love doesn’t feel like work.

Passion & Purpose Beats Early Retirement

Trump has repeatedly said life was better before entering politics and that he doesn’t need the job. Jerry Jones is worth over 15 billion dollars, so he can easily hire competent people to run his team.

Yet, both continue to show up, compelled by a sense of passion and purpose that gives them the energy and drive to do what they do.

They serve as examples of what life looks like when you have something to be passionate about. Why would you ever want to retire early from something you love to do? I certainly wouldn’t.

Back in my first year of teaching, I was tapped as the school’s girls basketball coach. It was only middle school basketball, and the building was located 45 minutes away from my house – but I eagerly worked late evenings, weekends, and holidays out of sheer passion for seeing the team develop and love of competition.

Even to this day, some twelve years later, I haven’t found anything I’ve enjoyed doing more. And if it had paid more than $2/hr (you read that right), I’d probably still be doing it.

Fortunately, the year long sabbatical I’m on gives me space to move myself in the direction of work I love. Being debt free also helps because it frees me to pursue passion over chasing money.

Early Retirement Kills

Instinctually, we all know that having work we love wouldn’t feel as much like work and would diminish our need to retire. But a much lesser known secret in all of this is that early retirement also kills.

In a Freakonomics episode entitled “Retirement Kills” , the hosts discussed several studies showing a direct link between earlier retirement and increased mortality. For instance, one study found that for every extra year of early retirement, you lose 2 months of life expectancy.

If true, this would mean that early retirement, especially as promoted in the FIRE communities can have dire consequences for your health. Retiring at 45 versus the current standard retirement age of 67 could cost you about 3.5 years of life expectancy.

Why might that be so?

The Healthy Worker Effect

Generally speaking, there appears to be a healthy worker effect where employed people have favorable mortality experiences than non employed people. Of course, this is partly due to more sick and disabled people being unemployed. But there is also evidence that retirement has a negative impact on the brain.

In a later episode entitled “How Does Retirement Affect Your Brain”, an M.D. at Freakonomics dove into numerous studies exploring the impacts of retirement on cognition and found strong evidence of a link between early retirement and cognitive decline. For instance, after starting social security, retirees showed a 10% decline in their ability to recall the same set of information as before.

Studies have also found that retirees are twice as likely to feel depressed than their working counterparts. This is not surprising to me given the fact that work provides routine, consistency, community, and purpose.

It’s easy to envision early retirement being a time to kick back and relax. But, paradoxically, too much idleness and disconnectedness is never a good thing.

If You’re Going To Do This, Then You Might As Well Retire Early

Is there any case where early retirement makes sense? Of course there is. Here’s one that I’ll present with a quick story…

An old friend of mine currently works as a teacher. Undoubtedly, it’s a noble profession. The problem is he hates it – he’s told me as much for over a decade.

I often wish I could fuse into his brain to understand what goes on to make a man in his mid thirties resign himself to a job he loathes for decades. Why not just put in a little bit of effort to find something he enjoys a little bit better?

Even if he still retires early, his life would be better with work he enjoys.

I know a lot of people are stuck in the same position. To these folks, I say that early retirement is clearly a superior option than remaining stuck for decades in career misery. Life’s both too long and too short for that.

More YOLO Spending: Top Bonus Of Not Retiring Early

If you’re still not convinced, here’s another consideration for why working longer is better: you can enjoy more YOLO spending if you never plan to retire. By leveraging a longer time horizon for earning, you don’t have to be so restrictive during your best years.

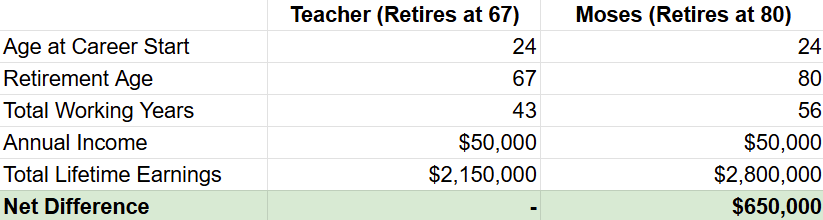

Take for instance me – versus – my buddy whose the teacher. He most certainly will retire as soon as he can – my guess is 67. Meanwhile, I will work for as long as I can – let’s call it 80.

Using a hypothetical scenario and figures, here’s what our lifetime earning would look like assuming we earned the same exact amount from age 24 thru our chosen retirement ages 13 years apart:

My buddy is playing it safe by staying in a job he dislikes, focused on securing a comfortable retirement as soon as possible. He’s sacrificing the best years of his life now in exchange for the freedom he hopes to enjoy later, in his golden years.

Meanwhile, I’m taking a different approach. I’m using my youth to travel, pursue meaningful work, and explore new interests, knowing I plan to work for as long as I’m able—possibly up to age 80.

With a longer earnings runway, I don’t feel the same pressure to cut back or save every dollar. Instead, I’m able to live fully now, confident that my longer career will support both my future needs and my present-day “YOLO” experiences.

We only have one shot at this life. And for me, it’s too short to do it any other way.

My Plan Instead Of Retiring Early

Since I’m persuading you to avoid early retirement, I must give you a better alternative. It’s quite simple. Here it is: dedicate your life to finding work you love.

I’ve already found that with this blog which I launched in October 2022. It’s been more than 2 years, and I don’t envision stopping anytime soon. Even if I never make a dime, or decide to eventually ramp down my writing here, I have future aspirations as a writer that I’m confident will carry me well into my later years. I can also go back to coaching girls basketball since I know I love it so much.

You may not have yet found it, but there is work out there for you to be passionate about.

Think about the causes, innate skills, burning interests, or favorite pastimes you have. Then, slowly move yourself in the direction of those, trying them out until you find one that sticks. Consider it a long term project of self-investment to eventually find some form of work that doesn’t actually feel like work.

Best Of Both Worlds: How To Feel Retired, While Not Actually Retiring

Let’s assume you do find that work you love. Still, you’ll eventually get older and may naturally lose a bit of energy as a result. You like the work, you don’t think early retirement is worth it, but you can also use the periodic breather.

This is the ideal scenario!

The 20 Hour Work Week

No one ever said you had to work full time in perpetuity. In fact, I think part-time work is the sweet spot between early retirement and regular employment since you get the best of both worlds.

On one hand, you get the benefits of remaining mentally and physically engaged. You’ll also have the structure and community that work provides. Meanwhile, working a part-time schedule of, say, 20 hours per week, should provide you with enough free time to enjoy your life outside of work and rest a bit.

Make Your Own Schedule As A Consultant

One of the things I love most about consulting is that everything is project based. I get hired on to do a job, I complete it, then I move on to the next project – taking as much time as I’d like in between. Another perk of being a consultant is that we can often make our own daily schedules as well.

This may not be an option for everyone. But if your field has a large consulting base, keep this option in your back pocket as a nice future option to achieve the best of both worlds between retirement and regular employment.

Take A Sabbatical

Yet another perfectly viable option for you to consider would be taking a sabbatical instead of outright retiring.

There’s no rule that says we have to stay on the grind forever. Period of rest and redirection could be just the thing you need to remain energized over the long haul. It’s akin to weekends; we need them to keep ourselves fresh. An extended sabbatical can serve the same purpose for a decades long career.

I’m 36, and this is my first sabbatical, but it probably won’t be my last. As long as I’m saving, investing, remaining debt free, and keeping a bit of F You Money on hand – I see no reason not to take a break if that’s what I need in a given moment.

Never Retire, But Achieve Financial Independence ASAP

Early retirement isn’t worth it, but financial independence still is. There is a difference.

Early retirement is about stepping away from work to sail off into the sunset of white sandy beaches as you sip pina coladas. Financial independence is about having enough money to not work if you so choose – but that doesn’t mean you have to quit.

That said, you should still focus on achieving financial independence as early as possible – even if you plan to work into your later years. The primary reason for doing so is that it will give you the greatest sense of freedom and the most options.

In the traditional financial order of operations, most people will arrive at some level of freedom way too late in life. At that point, retirement is the only option because they’re usually burned out and desperate to live life on their own terms.

Conversely, following my recommended financial order of operations will give you the most agency and greatest sense of control over your life without all of the financial stress most people experience.

When Do You Plan To Retire?

There you have it – my thoughts on why early retirement isn’t worth it. As far as I’m concerned, I’d rather find some things I love and do them for as long as I can.

That said, I’m interested in hearing from you. What are your goals for retirement and when do you plan to do it?

Drop me a comment below!