Wondering how much you should spend on a car? The rules are simple: 1) pay with cash – never with a loan, 2) spend no more than 10% of your income. If you do these, you will always make a financially optimal car buying decision.

Understandably, it’s easy to fall into the trap of paying too much for a car since everyone else does it. It can be difficult to go against the grain of an entire culture, but doing so can be to your advantage as I believe cars are the #1 thing holding most people back.

Let’s dissect why budgeting 10% of your income with cash is the smartest move to make when it comes to buying your next car.

Car Spending & The Paradox Of Freedom

We love our cars and often see them as the ultimate symbol of freedom. To be able to hop behind the wheel and go wherever we want, whenever we want is a liberating experience.

While cars offer tremendous freedom, they paradoxically limit the freedom of many people due to poor spending decisions. Most people overspend on vehicles they can’t afford or take out loans, both of which ultimately restrict the very freedom these cars promised to enhance.

That’s why it’s important to follow the car spending rules mentioned at the start.

By spending only 10% of your salary on a used vehicle, you are able to get the mobility you desire while avoiding handicapping yourself financially which only limits your options and freedom down the road.

The key is to remember that cars primarily serve as a means of transportation. As such, you want to be careful to not goldplate the need for transportation into an expensive want that will cost you in ways that extend beyond just the price tag.

Car Spending Rule #1: The Pay With Cash Rule

The first, and most important car buying rule is to make your vehicle purchase with cash that you have on hand. Cash that you’ve earned and saved. Following this rule alone will ensure, at minimum, that you avoid the financially destructive decision to take on car debt.

Take a look at this chart showing the average cost of new vehicles over the years and ask yourself how long it would it take for you to save up the $48,401 that the average new vehicle costs today?

It would take many months or years for most people save this amount – so they end borrowing the money. The problem is they are then stuck in a mountain of debt for an average of 68.5 months for a depreciating asset that they don’t even truly own until it is fully paid off.

As such, limiting your car purchase amount to your cash on hand will serve as your fist financial guardrail to ensure you don’t overspend on your new vehicle while being able to save, invest, and a tremendous sense of freedom.

Cash Car Buying Rule Example

I still remember sitting in the lobby of my local community college in 2018, overhearing a young student signing away her future for a brand-new Honda. I cringed as I listened, knowing she was about to make one of the biggest financial mistakes of her life.

Sadly, she was following the default financial order of operations that most people adopt without second thought. And of course, she was at step #1 which is debt accumulation.

I understand many young people have legitimate needs for reliable transportation. But how much better off would she be today if she had saved up and bought her first car for a few thousand dollars cash as opposed to the $30,000 loan she committed to?

It reminds me of my own early financial mistake – using $7,000 to $9,000 of student loan money to buy a ’96 Camaro from a buddy. I took out those loans in 2008, but it wasn’t until 15 years later, in 2023, that I finally paid them off.

Sadly, this young lady seems to be following the same path which could all be avoided by simply buying her car with cash.

Car Spending Rule #2: Only Spend 10% Of Your Salary On A Vehicle Purchase

The second car buying rule to follow is the 1/10th rule as made popular by personal finance blogger, Financial Samurai. It wisely states that you should spend no more than 1/10th your gross annual income on the purchase price of a car.

This car buying rule exists to help you avoid overspending on vehicles which are already super expensive to own and operate. Many people fall into the trap of only considering the monthly payment of their new vehicle purchase when in reality, the costs for cars extend well beyond the up front price.

In their Hidden Cost of Car Ownership Study, Bankrate found that the average cost of owning a car is $6,684. That’s before factoring in monthly payments which brings that total up to $12,960 for used vehicles and $15,504 for owning new.

Once you own it, you have to maintain it by covering costs for fuel, maintenance, insurance, and cleanings. Plus, you have hidden costs such as depreciation and the increased risk of tickets or car accidents which can only be partially offset via insurance.

With cars being so costly, the least you can do is start by purchasing one that fits well within your means by following the 1/10th rule.

1/10th Car Spending Rule Example

Let’s follow the same young lady mentioned above and assume she actually followed the first rule car buying rule and bought that initial car with cash which she now looks to upgrade from six years later.

She’s now well into her career earning an average salary of around $60,000. As she looks for a new car, she is fortunate to have heard of the 1/10th car buying rule and limits her maximum purchase price to $6,000 which she plans to do with cash.

Sadly, none of the cars in the price range are very luxurious. But she sticks to her guns, avoids the temptation to overspend, and coughs up $5,000 cash which she combines with the $1,000 proceeds from selling her old beater.

Financial Margin: The Top Benefit Of Spending 10% Or Less On A Car

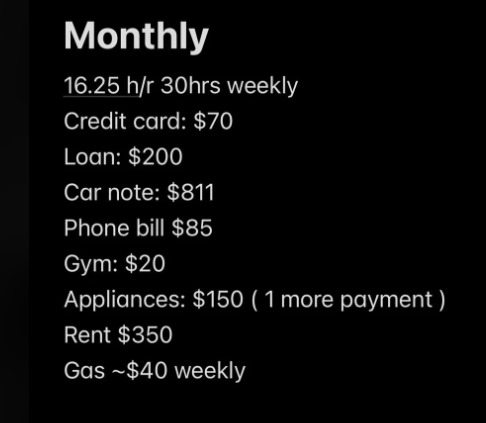

Let’s take a look at another example highlighting the power of the 10% car buying rule. This image below is of a guy from Reddit’s budget. He was in one of the forums looking for advice on how to improve his difficult financial situation.

Based on the 10% rule, he should have purchased a car for $2,400 – which seems reasonable for someone earning $16.25 hour or $24,000 per year.

He wouldn’t turn any heads with his ride, but he’d sleep well at night knowing he has plenty of cash flow in spite of not earning a ton of money.

Sadly, he went the opposite direction and bought a newer car for nearly double (166%) his gross income that now costs him $811/month. Because of this, he’s in perpetual survival mode thanks to a car that’s costing him 42% of his before tax monthly salary.

Following the 10% rule from the beginning would have saved this guy a lot of financial pain later on.

Debunking Excuses For Overspending On Your Car

Most of the time people justify overspending on a car with an excuse. Let’s cover the most popular ones so I can disabuse you of any notion that it’s ever okay to spend too much on a car. You can thank me in the comments later!

Car Overspending Excuse #1: Used Cars Are Unreliable

People convince themselves that more expensive cars are necessary for reliability, even though plenty of reliable options exist at lower price points.

Ironically, creating the problem of overextending yourself financially to solve the problem of reliability doesn’t make much sense. The best approach is to spend the least possible on a vehicle that still provides high reliability – without violating the 10% rule.

Car Overspending Excuse #2: I Deserve A New Car

In life, you only deserve what you’ve already earned. If you don’t have the cash to pay for the car outright, then you haven’t truly earned it.

Financing a lifestyle you can’t afford isn’t a reward – it’s a setback.

Car Overspending Excuse #3: I Can Afford The Monthly Payment

Be careful to not convince yourself you can afford a car simply because you can squeeze the monthly payment into your budget. Affording the monthly payment doesn’t mean you can afford the car – it means you’re borrowing against your future financial freedom.

Stay focused on the bigger picture by remembering that you will be taking on a long-term loan, paying interest on a depreciating asset, and committing future income to something you may won’t even own outright for years.

Just go back and review the budget of the guy mentioned above. He can technically afford the payment, but how much easier would his life be if he didn’t have to contend with that payment each month.

Car Overspending Excuse #4: I Have A Low Interest Rate

A friend once challenged my car-buying recommendations, citing his low 2% interest rate to justify breaking both rules on his new $56,000 Chevy Tahoe. His argument? Since he had the cash on hand, he believed it was smarter to put the $56,000 into a high-yield savings account earning 6%, effectively netting a 4% profit.

Wow, if his logic holds, his car is practically free, right? Wrong. Here’s why…

Vehicle Depreciation Offsets Low Interest Rates

The first thing he overlooked was depreciation. On average, new cars lose 20% of their value in the first year and nearly 60% by year five.

So, tell me – does losing $11,000 in year one, plus another $22,000 over the next four years, sound like a good deal in exchange for earning a few thousand dollars a year from a savings account? Not even the highest-yield account in the world can offset that kind of math.

And let’s not forget – high-yield savings rates fluctuate with the Fed Funds Rate. They are now a about 1% lower today than when he made his decision.

All in all, a smarter strategy would’ve been to buy a several-year-old model, saving $25,000 upfront.

Higher Ownership Costs

Factoring in average monthly payments and costs of maintenance, Bankrate also found in their Hidden Cost of Car Ownership Study that the annual cost of owning a new car is 20% higher than used cars at $15,504 versus $12,960.

Considering he drives a brand new car, the 4 % difference my pal was earning on his high yield savings is not enough to make up for this new car premium which comes mostly from mandatory full coverage insurance which averages $2,388 per year nationally and $3,594 in his state of Florida.

Remember, rather than focusing solely on price and monthly payments, it would be wise to factor in cost of insurance and other ownership expenses in your car buying decision.

Car Debt Always Increases Your Financial Risk

Risk is the final thing I’d mention for my buddy to consider with his low interest rate car buying strategy. What happens if he loses his job or something like another catastrophic hurricane comes through and destroys his neighborhood like several massive storms have already done in other parts of Florida this year?

Naturally, he might decide to dip into the savings he’s set aside. But then he’d still have the debt. So hopefully he also has an emergency fund to ensure he’s prepared for any unforeseen circumstances.

Car Overspending Excuse #5: Everyone Finances A Car

It’s true, everyone does seem to finance their vehicles. So much so that the $1.626 trillion of auto loan debt accounts for the second largest share of consumer debt behind mortgages.

You can do things because everyone else is doing it. But to win with money, it’s better to be different.

Why sign up for the average 68.5 months (~6 years) of debt slavery for a car like everyone else when you can spend 1/10th your gross income for a used car and remain free instead?

The choice is yours.

Don't Overthink How Much You Should Spend On A Car

Now, you’ve got the 1/10th car-buying rule at your disposal. So don’t overthink it.

Simply budget 10% of your gross income for your next vehicle, save up the cash, and move forward with enjoying your life knowing you’ll still have the financial freedom to do so, thanks to not overspending on a car.