To splurge is one of the best things you can ever do with your money. Yet, knowing what to splurge on can be tricky.

The problem is not all splurging is made equal. There’s an art and science to it:

Splurge on the wrong things and you will basically throw away money. But if you splurge on the right things, you will get optimal value from your money since the whole point of having it in the first place is to maximize its utility.

So, let’s get the money spending equation right with a recap of the best things to splurge on.

I guarantee that after reading this post, you will be much more comfortable doing a lot more guilt free spending.

1) Splurge On Your Priorities In Life

Ever see the old movie clips where a wannabe gangster sprays up his target with an oozie, but happens to hit everything but the target? Well, that’s what splurging is like if you go about it the wrong way – you’ll end up “splurging just for the sake of splurging” without ever hitting your goals.

To avoid this, it’s best to splurge on things that fit your priorities in life.

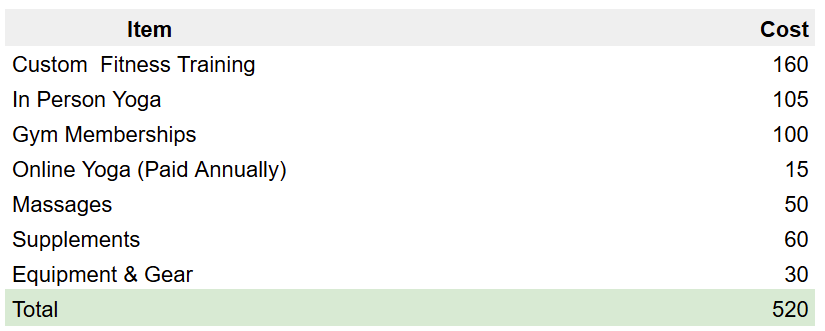

As a fitness enthusiast and former collegiate athlete, most of my splurging is on training programs, gym memberships, athletic gear, yoga classes and massages.

Here’s a breakdown of how I splurge each month on these things:

That’s right, it’s costing me about $500 each month or $6,000 per year. But to me, these are worthy splurges because they help me keep my body moving and feeling great. It’s like Lebron James splurging $1,500,000 annually on his body, just at a lower scale since I’m a regular guy.

Of course, you may not be willing to spend so much on fitness – and that’s okay.

Just figure out what’s most important to you and focus most of your splurging their while ignoring all the rest.

2) Splurge On Personal Growth

To get the most out of life, we must continually work to improve ourselves because there is always room for us to get better.

I don’t know the specific areas you should work on, but I can all but guarantee that splurging on your personal growth would be a worthwhile endeavor.

Over the past 1.5 years, I’ve spent thousands of dollars to travel the world, living in Colombia and Spain to learn Spanish. To accelerate my progress, I have also splurged on a full time Spanish course that that I attend for 20 hours per week.

It wasn’t cheap. But it’s been worth it to develop my linguistic abilities and cultural depth. I’ll never see the world quite the same as I did before. And I’ve undoubtedly improved my job prospects.

Life is way too short to waste our valuable time not working to become the person we’re destined or would like to be. It’s also way too long to remain stagnant.

Because of that, I think personal growth is the best splurge we can make.

3) Splurge On Education

Whether formal or informal, I think education is one of the most reliable ways to make one’s life better since acquiring new knowledge is what unlocks new doors.

Splurging on education isn’t necessarily about paying to go to the most expensive college. It’s about using our funds to acquire the knowledge we need to take us where we’d ultimately like to go.

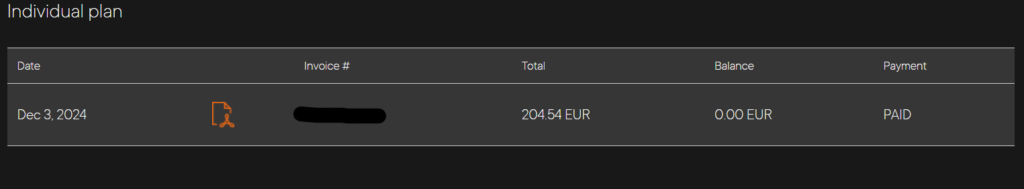

Since I’m gearing up for a career change, I recently invested in a membership to an online platform offering technical IT skills.

For just $200, I now have access to a wealth of knowledge that will not only accelerate my progress in this new career path but also empower me with the skills needed to thrive in the tech industry.

Of course, we can always splurge on fleeting things like eating out and shopping, but using our funds to acquire education offers more bang for our bucks as knowledge is both infinite and priceless.

4) Splurge On Your Health

It used to amaze me back in my personal training days that so few people were willing to spend $300 – $400 per month for a personal training package. More often than not, a prospective client would express interest, but ultimately cite cost as the primary reason for not moving forward.

We’re happy to splurge on things like entertainment and eating out, but when it comes to our health – most people become tightfisted with those dollars.

Meanwhile, contrary to most, I’ll spare almost no expense when it comes to my health. I feel it’s my duty to ensure I’m optimally healthy – moving well, feeling good, and thinking as clearly as I possibly could.

They say our bodies are our temples, and we only have one to live inside of during our time on earth – it’s basically our only true possession, so I figure I may as well take good care of mine.

Plus, there is a high cost of having poor health that most of us ignore. Therefore, by splurging on being healthy, you can avoid being unhealthy since you’re going to pay the piper either way you slice it.

Some ideas for splurging on health could be hiring a personal trainer or joining fitness classes such as Yoga, Crossfit, or Spin.

You could also splurge on at home exercise equipment assuming you’ll actually use it. Also consider buying new athletic clothes since having those can be motivating. And don’t forget the occasional massage to help keep your body nimble.

5) Splurge On Good Food

If done with reason and within your budget, splurging on exceptional food could be a great way to add a bit of flavor to your life (pun intended). There are two ways to go about doing it:

The first is eating as deliciously as possible – either at restaurants or at home by preparing special dishes featuring unique ingredients. The second is by eating “good” from a sense of how nutritious the foods you consume actually are.

Which is better? Don’t split the difference. Aim to do both.

Splurge at times on foods that set your palette ablaze. Do this by earmarking funds from your budget each month for culinary adventures.

As an example, I recently planned an outing around Madrid to explore some of the cities most unique offerings such as tripe, snails, and even searched for bulls testicles.

As for the rest of the time, splurge in the grocery story on the highest quality foods your budget will allow.

The caveat here is not to assume a correlation between price and quality.

Most people think they need to flock to Whole Foods to begin eating healthy, but the wisest of us know an optimally balanced meal of meat, beans, rice, and simple veggies can purchased in practically any supermarket.

6) Splurge On The People You Care About

I recently booked a plane ticket for my mom to come visit me for a few weeks in Madrid. It will be her first time out of the country, a trip she tells me she’s dreamed of all her life.

In all, this trips will probably cost me about $3,500 – $4,000 (yes, travelling is expensive, and therefore sucks). But I’m more than happy to foot the bill because splurging on people I care about makes me and them very happy.

It’s sort of like giving, we can always be selfish and hoard our money, but being able to share our wealth with other people makes life much more special. Because of that, I rate this as one of the best ways to splurge.

7) Splurge On Rewarding Yourself

For about a decade now, I’ve been making a concerted effort to reward myself for the accomplishments I’ve had along the way.

When I passed my first certification exam to become a project manager, I treated to Chipotle – which was special at the time considering I was broke. Since then I’ve upgraded my self-reward splurging to high grade sashimi since it’s one of my favorites.

Maybe it was because of my sports background that teaches us to not celebrate anything short of a championship, but for may years prior, I never enjoyed rewarding myself. I’d achieve an accomplishment, and simply keep grinding without doing anything to recognize my efforts.

Well, that’s not way to live – we should always celebrate our success no matter how small they seem.

Next time you achieve something you’ve worked hard for, don’t be afraid to splurge on a reward that matches the level of the achievement.

8) Splurge On Taking A Sabbatical

Maybe you have several months of cash saved up beyond your emergency fund and are looking to make a big slash. If so, why not splurge on a sabbatical?

That’s exactly what I’m doing.

I figured that since time is the best thing we can buy with our money, why not get a taste of what retirement is like well before I’m actually ready to hang up the working career. And trust me when I say this: it’s been more than worth it.

Maybe taking a year off like I’m doing is too long. 3-6 months could be your sweet spot. Or perhaps you’d like to go for even longer.

Regardless of the length, I’m willing to bet you’d never regret splurging on a sabbatical and the adventures it promises to offer.

9) Splurge On Nice Clothes & Accesories

I was first introduced to the world of personal finance by OG bloggers Mr. Money Mustache and Jacob at Early Retirement Extreme.

I owe a lot of my money philosophy to them and am thankful for the wisdom they’ve imparted upon me, but will admit that I won’t be taking fashion advice from these guys any time soon.

I say it a bit cheeky, but it’s true that being fashionable is not something high up on FIRE enthusiasts list of priorities. Me on the hand am a promoter of fashion when you have the money for it and it’s done within reason.

Take for instance my new Timex Weekender. At under $60, it was a great way to add a bit of sophistication to my expanding wardrobe:

I don’t suggest you buy clothes with credit cards, but it can be a good thing to dedicate a small part of the budget each year for splurging on a few new items to keep things fresh and interesting.

10) Splurge On Quality

Bless her heart, but my ex mother in law almost never splurged on quality. Her favorite store is The Dollar Tree – which is known for the exact opposite of quality. Just about any given day of the week she’d arrive at home from a day’s shopping with bags of $1 trinkets.

I can remember the time she purchased low quality sprinkler heads which were all broken and in the trash within a few days – as was usually the case with just about the rest of the trinkets.

Moral of the story? You should absolutely always splurge on quality.

Quality things last longer and work better. They are made with more precision and higher degrees of craftsmanship while having more robust materials.

Because quality equals better, you end up saving money in the long run since you don’t have to replace things as frequently.

That said, don’t just assume that something is of higher quality because it costs more.

For instance, Nike sells some of the most expensive shoes on the market – but I’ve noticed their level of quality going down over the years. The shoe soles are a lot less durable than they used to be, and they often come with hardly any supportive material.

Meanwhile, brands like New Balance have maintained quality, which is why they are becoming my new favorites and totally worth the occasional splurge.

Bonus: Splurge On Giving

Before I had any significant money, I couldn’t understand how Billionaires such as Warren Buffet or Florida’s Tom Golisano can be so crazy to want to give away practically their entire fortunes. Afterall, they’ve worked so hard to attain it – why then give it all away.

Now I get it.

The truth is, they understand the secrets of money:

The first is, it serves very limited purposed – we can spend it, save it, or we can give it away. And once we are dead, we can’t do either. They also know that one of the most rewarding things any person can ever do is uplift others through giving.

Therefore, they are happy to splurge their tremendous fortunes for the better of the world. They want to leave a real legacy. And no one will remember us for having a lot of money that we only hoarded for ourselves.

If you aren’t giving, I implore you to give it a try. You’ll likely be pleased to find that it’s one of the best splurges you can ever make.

How To Splurge Wisely

Not so fast! Just because I’ve written a post about the best things to splurge on doesn’t mean you should run out and start yolo spending like it’s the year 1992 again.

Splurging is something to be done with care. If done wrong, splurging can bring you to financial ruin. We’d rather avoid that, so it’s best to establish some ground rules for splurging in terms of when it can be done and how much money to do it with.

Should You Splurge While In Debt?

Getting out of debt is akin to losing a ton of weight: it takes tremendous discipline and will, loads of time, and monk-like patience. Having gone through the process myself, I believe it’s best to splurge a bit during your trek to give yourself a reprieve and recharge your battery.

It’s a tall order to think you will be perfect in your getting out of debt journey. Even if you could resist the occasional splurge, why should you want to? I think it’s much better to allow yourself small rewards along the way – especially for hitting debt reduction milestones.

Plan Small Splurges Into Your Budget

The best way to splurge is by doing so with a plan. Accounting for your splurges in your monthly budget is a great way to enjoy your money while maintaining financial control.

How much to allocate towards your splurging depends on your overall budget, but up to 20% of your post tax + investing funds each month seems like a reasonable target.

You can dedicate a separate line item in your budget entitled “splurging” or you can do what I’ve done in the past which is beef up the “fun” allotment of my budget – the portion that includes my funds for eating out, dating, and shopping by a couple hundred bucks per month.

Save Up For Big Splurges

Maybe you have a big ticket item in mind that you like to splurge on. Perhaps it’s a new laptop or something larger like a car. No problem, just save up for it and purchase it when you have the cash.

The great thing about saving for big purchases is you can buy them without guilt.

You’ll also enjoy the things you buy much more after you’ve saved for them because they will be more meaningful to you. You’ll take better care of them once you have them.

It takes time and patience to save up for things. But once you get into the habit, you’ll realize it’s the superior way to having anything you want because you avoid putting yourself in a financial bind with debt or money that you should have used somewhere else.

Caution About Splurging Gone Wrong

As a final caution on splurging, I’ll point out that you should do it as sparingly as possible to avoid diminishing its value.

Imagine your favorite food suddenly appeared in front of you. It was prepared by the world’s greatest chef and you will surely enjoy it. Now imagine if it were the only thing you could eat for an entire year – would you still enjoy it? Probably not.

In economics we call that diminishing utility which is a fancy way to say that things lose their value the more we consume them.

The more you splurge, the less special it will be. To keep it special, be intentional about it, have a plan, and do it when the moment truly calls.

Reader Question: What's Been Your Greatest Splurge?

Hmmm, I think my greatest splurge has been my sabbatical. It has not been cheap, but it’s been worth it. My life has been forever changed, and I’ll return to the real world with a new language under my belt. I doubt I will have any regrets.

As for you, what’s been your biggest splurge? Maybe it was the new car you’ve always dreamed of or you are a unicorn person who saved up for many years to buy a house with cash?