As word of my year-long sabbatical gets around to my friends and family, I’m met with one response: “wow, I wish I can do that”.

Well, you can. You just need a bit of F You Money to pave the way.

As its name suggests, F You Money is having enough cash on hand to say F You to the people and “rules” that don’t jive with your life at the moment.

In a toxic situation at work? F You Money can enable you to escape before having another job lined up. Crappy public schools in your area? No worries, use your F You money to send your kids to private school or move to a new city altogether.

Or, you can be like me and take a year-long sabbatical because, amongst other things, you just feel like it. You don’t need permission because you’ve got F You Money.

Sounds intriguing and wondering how to get F You Money and what having some can do for you? Keep on reading to find out.

F You Money Is Freedom Money

What I love most about the concept of F You money is there are many ways to define it. I’ve already given you my definition which is having enough cash on hand to say F You to the people and “rules” that don’t jive with your life at the moment.

Meanwhile, a user named Phelen at Urban Dictionary defines F You Money as “The exact amount of money required in order to tell an individual or organization to go f themselves without facing repercussions.”

A couple of my favorite bloggers also endeavored to offer up their own unique definitions.

First up is the Financial Samurai who defines F You money as $3 million per person in an expensive city and $1 million in America’s heartland. He says this should be enough money to tell others to F Off without fearing financial repercussions.

And then there’s also personal finance OG, JL Collins, who describes F You Money as being able to provide you with the “freedom to do what you want and work for whom you respect”.

All solid definitions for sure. But none of us could quite capture the essence of what F You Money is like John Goodman did while schooling Mark Wahlberg with this legendary monologue from the movie The Gambler:

The 3 Levels Of F You Money

So, you now know what F You Money is, but do you really need a fully paid for $500,000 house as instructed by John Goodman to get there? Better yet, do you need the $1,000,000 per person in Omaha Nebraska as suggested by the Financial Samurai to finally say F You?

Well, it depends. These milestones certainly wouldn’t hurt. But as the cool kids say, there are levels to this F You Money thing. Let’s discuss those below.

Level 1: Enough To Stick Your Chest Out

Back in 2014 my ex girlfriend and I attended a large birthday dinner at a fancy south Florida restaurant that her friend was having. It was a nice dinner and things went well.

That is, until the checks came…

There were so many of us that the restaurant refused to split the bill. Instead, they brought out a single check for us to divvy up amongst what was probably 15 people.

One would think that a group of intelligent young adults could adequately split a check so everyone pays for exactly what they ordered, but things were complicated by the fact that there were probably a dozen appetizers equally shared without a responsible owner to point to. And of course, most of us were drunk.

My girlfriend and I did our best to resist as we knew exactly what we had ordered. But in spite of our efforts, we ended up paying double what we should have – which means we paid for other people’s food and drinks.

This, of course, upset us as we were broke early 20 something year olds just getting started in life. In short, we didn’t have F You Money.

Fast forward to today, and I have a bit of F You Money in coffers. So, how would I handle that same situation?

Instead of all of the confusion and frustration, today I’d probably would just pull out my credit card or a wad of cash and pay the bill for everyone. I’d then stand up, wish everyone a nice evening, and allow them to stare at my back as I head for the exit with my girlfriend in tow.

Ahh the power of F You Money.

You Don't Need A Lot For Level 1

So relax, you don’t need to have a fully paid off half million dollar house to have some F You Money. And you certainly don’t need $1,000,000 as suggested by the Financial Samurai.

In truth, you really only need two things to initially join the F You Money team. Those things are 1) a bit of cash savings 2) adequate cash flow margin.

With no debt, $20,000 should be enough to feel you have some F You Money. Alternatively, you can safely say you have F You Money if you’re able to save 50% of your income for 1 year or more.

You may not want to throw the credit card down to pay for other people’s dinners (I certainly don’t). But you could.

Or, you could do other things like buy an affordable car with cash instead of using a loan. And at minimum, you can walk about the world with your chest out because you know deep inside that you’re in a strong financial position.

Level 2: Enough Money To Actually Say F You

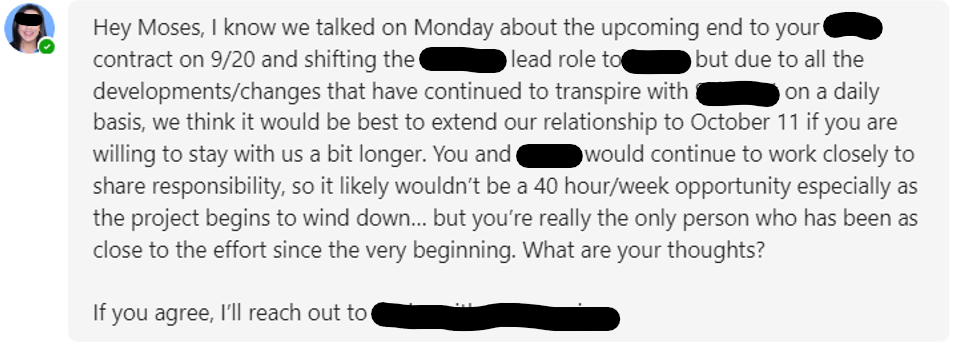

A week before my sabbatical started, I was offered an extension by the company which I was consulting for.

The irony is that this extension offer came after I was initially blindsided by an earlier email stating that they would be terminating my contract 3 weeks earlier than I originally expected.

They clearly needed me for longer to put out a few more fires. And maybe they thought I’d be eager to accept. But as I mentioned in my post discussing my reasons for taking the sabbatical – I was burned out and not really in love with the work in the first place.

In the end, I politely declined the offer and sailed off into the sunset thanks to me having enough F You Money to walk away.

Use The Stress Test To Determine How Much You Need For Level 2

We all have different lifestyles and needs which means we will have different targets for F You Money level 2.

For instance, I probably wouldn’t have turned down the offer to extend my work contract a year ago. Even then I had a large amount of savings, but I don’t think I had enough to not feel stress and anxiety over being out of work.

Ultimately, how much money you will need to be able to actually say F You will depend on your lifestyle, obligations, and tolerance for risk. You may not feel good sticking it to your boss at $40,000. But maybe you will after you save up your first $100,000.

Just put your head down, save as much as you can, and watch your savings grow. Then, like magic, one day you will cross a savings threshold where you will just know that you are ready to add a little F You to your life without stressing over repercussions.

Level 3: Forever F You Money

Level 3 of F You money is where the big boys (and gals) play. For instance, the Financial Samurai set his target at $10 million while suggesting a F You money goal of $5 million to $10 million for everyone else.

I think $1 million would be enough for me. That’d give me $40,000 a month to live on which is more than enough given my lifestyle. But I’d need more if I had to support a family.

At any rate, this is the level of financial freedom where you have enough to never be financially beholden to anyone ever again. You can live off your investments and pretty much decide how to use your time.

The average person will land here once they hit retirement. In the meantime, we can still dream about it as we aim to save up an nest egg that will return out annual income at a 4-6% withdrawal rate.

How To Get F You Money

Here’s where the F You Money rubber hits the road. How do you actually get some?

The first way is to avoid debt.

“Sheesh Moses, you’re always telling us to not take on debt.” Yes, and it’s for good reason. Consider this..

I know of at least a handful of friends who earn more than me and likely have more cash than me. Yet, they don’t have F You Money like I do. Why is that?

Well, like most people, these friends are beholden to their debts which means they would certainly have repercussions for saying F You – especially to the bosses who cut their checks. Meanwhile, I can feasibly step back from work for up to 3 years and be okay.

The difference between us is my cash is all mine because I’m debt free. My friends, on the other hand, have the monthly ticker signaling it’s time to pay their creditors.. or else.

In addition to avoiding debt, the other thing you have to do for F You Money is save. And I mean save aggressively. Hell, you should even deploy some extreme savings if you have to.

A 50% savings rate is a good target to aim for to gather up F You Money as quickly as possible. Lessor amounts, of course, will also do. Just aim to save as much as you can for as long as you can until you’re ready to say F You.

As I mentioned earlier, you’ll know when you get there.

An Automated F You Fund Can Help

If you struggle with saving money, you may want to consider standing up a separate account just for your F You Money. Let’s call it an F You Fund.

This has several advantages. For one, having a separate account enables you to better target a specific amount if you know what your goal is. Rather than comingling all your funds, you can set this one aside and forget about it until later.

Another benefit is that you can also automate deposits to the account to remove the need to always have to exercise willpower. Set automatic deposits on your bank’s side or ask your employer to divvy up your direct deposit each paycheck to ensure you are setting some aside.

What Can F You Money Can Do For You?

By now you should be fired up over the idea of having some F You Money. I can personally smell more freedom for us all in the air!

Since your appetite for F You Money is already whet, let’s kick things up a notch with a look at a few of the benefits of having F You Money in your back pocket.

F You Money Improves Your Confidence

There’s just something about having F You Money that helps improve your confidence like almost nothing else.

Perhaps it’s the process of saving up a large sum of money that makes you believe you can do other difficult things. Or, maybe it’s simply knowing you have that safety net there in case you need it.

It’s probably a mixture of both combined with the fact that you know you are a person who enjoys more freedom than everyone else. Even if you don’t flex your F You muscles, just knowing you can if you want goes a long way for improving your confidence

Can Make You A Better Employee

An old car salesman friend would tell stories of how everyone at the dealership was broke and deeply in debt. Apparently it was customary for other vendors, such as the Jet ski salespeople, to come and sell the car salesmen expensive things they also didn’t need.

It sounds like the predators were becoming the prey. But what these unwitting salesmen didn’t know was that their boss strategically pushed them toward buying things on credit because as he told my friend: “debt keeps them motivated”.

It’s true, debt does keep people motivated to perform at work. Yet, that is precisely the issue – they are performing rather than being authentic.

Meanwhile, those of us with F You Money show up at work as our authentic selves and excel because we want to rather than need to. It’s called intrinsic motivation which is always more powerful than being externally motivated.

F You Money Cures Jealousy

F You Money also helps you say F You to jealousy.

As you start to relax in your newfound freedom and security, you suddenly stop looking around and being upset at the good things happening to everyone else.

Back in 2021, a good friend of mine had just gotten laid off a month or two before I landed a new role that I was excited about. Upon telling him, he could only muster up a very unenthusiastic “ok”. What was up with that?

The answer is he wasn’t in the best spot, so I forgave him. He also started being supportive after he landed his next role and his money problems subsided.

I tell this story to show it can sometimes be hard to be happy for others when you aren’t doing well yourself. As such, one way to combat those jealous feelings is to build up a healthy amount of F You Money.

Enables You To Take More Risk

This should go without saying, but the very concept of going around saying F You is a risk in itself.

I hope it’s also obvious that we don’t literally mean you should go around verbally telling people F You; though you certainly can if you’d like. Afterall, you’ll have the F You Money backing you up as you take that risk.

You’d also have the F You Money to take other risks such as making a career change, starting a business, or leaving toxic relationships.

It’s a shame that so many of us are held back from taking risks because of money. As I mentioned, I would have never pulled the trigger on this sabbatical a year ago.

What is something you’ve always wanted to accomplish? Now imagine how much easier it would be if you were sitting on $100,000 or even $1,000,000.

Improves Your Wellbeing

If our finances were akin to a cake, F You Money would be the cherry and sprinkles on top.

The more foundational levels would be composed of things like earning, saving, invested, managing risks, and spending wisely. Once these things are properly situated, there is much else to do aside from building up a bit of a financial cushion which I’ll eloquently refer to as an F You Fund – the colorful sprinkles on top.

Cakes with sprinkles are good. But the real pleasure of having a fully baked financial cake is in what it does for your wellbeing.

Specifically, simply getting yourself to a point where you can build F You Money at any level means you have positioned yourself so strongly financially that all remnants of financial stress should be far in the rearview mirror.

The Financial Health Network reported in 2022 that 65% of financially vulnerable Americans experience symptoms of anxiety, while 53% experience symptoms of depression. Financial security, like having F You Money, can drastically reduce these mental health stressors.

Got F You Money?

As always, I speak from truth and what is happening in my own life. Thanks to a good bit of F You money, I’m able to call my shots at least for a little while. And who knows, maybe I will be able to stack enough wins over the next year or so to call those shots forever.

In the meantime, I’d like to hear from some of the readers on their thoughts about F You Money. How many of you have some?

And for those who don’t, what can you do to get some? I’m here to help, so drop a comment and let’s chat.

2 Responses

The suggestion about setting up a separate bank is where I’m going to start now for my savings plan. It’s sometimes the small things that add up well. Thanks for that nugget

Hi Jose! Good for you. I think that is a solid first step. Set it and forget it, then later you will have some F U Money!