To live without takes sacrifice and commitment. It’s not not easy, but it’s definitely possible.

I know this because I’ve been living life without debt since 2018. In the six years since adopting a debt free lifestyle, I’ve learned what it takes to pull it off. Most of what I’ll share in this post is from real life experience. And the rest is exactly how I handle certain situation when they arise.

Living in our debt based economy and culture makes it extremely difficult to figure out how to navigate life as a debt-free person. Living life without debt is also not the sexiest of lifestyles, but it’s worth it because you will always feel free.

This post will show you exactly how to live life without debt. I’ll guide you through avoiding the 5 most common sources of debt that are enslaving millions of people today.

Let us begin!

Contents

Understanding What Debt Adds To Your Life

Debt makes the world go down. At least it does in a debt based monetary system like we have in much of the world today.

I’ll spare you the boring macro-economic discussion on money creation and instead briefly cover a few key points about the functions of debt that will help you conceptualize how to live without it.

- Debt Compounds Growth: Most folks have heard the term leverage which essentially means turning a small amount of debt into a much larger sum of money. In other words, debt can serve as a tool for creating rapid growth for businesses and individuals.

- Debt Generates Wealth: If you’ve ever wondered why the U.S. is such a wealthy place compared to other parts of the world, the answer is debt. The compound growth mentioned in the previous section leads to significant wealth creation.

- Debt Speeds Up The Acquisition Process: Home, cars, and even businesses are but a few things that can take a long time to acquire without debt. Luckily, debt is readily available. It also allows us to have almost anything we want much sooner than otherwise possible.

Compound growth, wealth, and access to just about anything you want may sound like good reasons to take on debt. But we must remember everything comes with a tradeoff. The tradeoffs for taking on debt are increased risk, stress, loss of options, and above all – the financial costs.

The fact that you’re reading this article tells me you may already be giving debt the side eye and are looking for inspiration and guidance on how you can live your life without borrowed money. Kudos to you!

How To Live Life Without Debt

Most people who have grown accustomed to living life with debt will have to work pretty hard to live life without it.

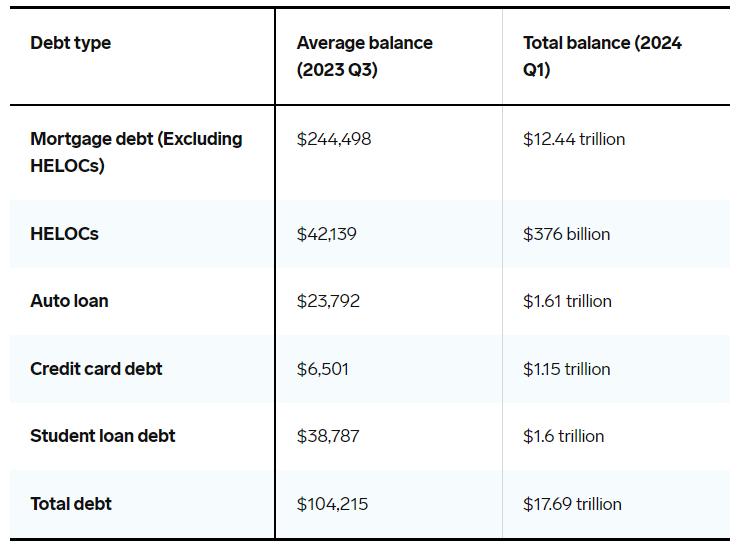

The chart below shows the 5 most sources of debt by total and average balance. Not surprisingly, mortgages top the list. Then on an average balance basis, we see HELOCs, student loan debt, auto loan debt, and credit cards respectively.

Now that we know where most of our debt comes from, let’s discuss how you can navigate forward without taking on any of the popular forms of debt – mortgages included.

Owning A House Without Debt

At a total of $12.44 trillion with, an average of $244,498 per person, mortgages are by far the largest source of debt for people. Homeownership is such a staple of U.S. culture that it can be hard to imagine life any other way.

Well, how can one possibly ever own a home without debt considering the average sale price for a new home as of Q1 2024 was $513,000?

Here are your options:

Save Up Cash For A House

As mentioned above, debt can significantly accelerate the purchase of a home by providing easy access to hundreds of thousands of dollars through a mortgage. Without mortgages, the only option left for acquiring a home would be to purchase it with cash or inherit one.

This can seem daunting or even impossible given how expensive homes are. But, at the same time, 34% of home sales in 2023 were purchased with cash. Therefore, we must at least give credence to the idea that it is possible to purchase a home without debt; although it may take a while.

Saving $20,000 per year for 15 years would amount to $300,000. You’d have even more if your savings were invested over that time. This would be enough cash for a pretty nice house in most cities. And let’s not forget that cash buyers usually get the better deals which means your money could fo even further.

Be A Lifelong Renter

Another option for living life without debt for housing is to simply never buy a house. This isn’t the best option for everyone, but I’d argue that more people should consider this route given how many people are made poorer or worse off by their decision to buy a home.

Renting is now cheaper than owning in all 50 states. And it’s already common for people to be lifelong renters in expensive cities like New York, Miami, San Francisco, Washington D.C., and Boston. The problem is that renters fall behind because they typically spend their excess savings, and this gives renting a bad rap.

Given that, if you are someone who’s financially disciplined and values living life without debt – then renting forever could be a rational choice.

Buy In A More Affordable Area

A while ago I stumbled upon this Youtube video discussing why large American cities such as Tucson Arizona, Kansas City, Nashville, Jacksonville and New Orleans are mostly empty. All I could think about while watching was that these cities would be perfect for snagging up a nice home for a fraction of what it would cost in more popular areas.

You could also look at medium size cities that are out of the mainstream spotlight.

Omaha Nebraska, for instance, has a large inventory of nice 1,000 sq ft+ homes selling for under $250,000. Take this beautifully maintained 1.5 story home with a list price of $250,000 as an example of what’s possible if you were to think outside the box. Homes like this would sell for double or triple in parts of California, Florida, and the greater North East.

How To Live Life Without HELOC Debt

HELOCs come in as the second largest debt type on an average balance basis at $42,139. Interestingly, at $376 billion, they also account for the smallest total balance of the group. This tells us that fewer people take on HELOC debt relative to the other types – but the amounts are staggering when they do.

My guess is it’s far easier for people to stomach taking on tens or even hundreds of thousands more debt when it’s attached to a house that has already put them in hundreds of thousands of debt. What harm can adding a bit more to the pile do since the damage is already done?

The simplest way to live life without HELOC debt is to remember what the last 3 letters of the acronym stand for – “line of credit”. Which means you are still going further in debt if you take one on.

Unfortunately, there isn’t much magic to this one. You must simply decide this isn’t an option you are willing to consider and sticks to your guns.

Getting An Education Without Debt

I completed my undergraduate studies in 2012 with about $32,000 in student loan debt. Today, the average student loan balance is $38,787 which makes them the third highest debt type by average balance. They also account for the third largest total balance behind mortgages and auto loans with a total balance of $1.6 trillion.

Looking back, there is absolutely no reason I should have graduated college with debt.

Thanks to my lifetime earnings exercise I was able to estimate that I earned around $100,000 before age 23 when I started my career. With the right mindset and discipline, I could have used some of that money to get myself through college without debt.

At any rate, wisdom is the best teacher. So, here are my ideas for how anyone can get an education without debt today.

Pay For College As You Go To Avoid Debt

I had a job through the entirety of my undergraduate studies. From memory, I was making between $500 – $700 per month from my main job with an additional $100 – $400 a month from side hustles that included being a chauffeur, magazine delivery boy, and youth shelter counselor.

With an average monthly income of $800 per month and super low expenses, one would think I could have managed my money well enough to pay for college without debt. Even if it meant taking 1-2 years longer to finish, graduating without debt would have been worth it.

As I mentioned at the start, debt is the great accelerator for acquiring things we can’t afford. But the irony is, it traps and enslaves us on the back-end. This fact should give new students pause when considering taking on student loan debt. Live could be much easier by entering the real world without debt.

Go To The Military

Another viable option for obtaining an education without debt is to give service to the country and military in return for access to GI Bill benefits which are designed to help service members pay for college, graduate school, and other training programs.

The military could be a great opportunity to learn discipline, responsibility, and marketable skills all at the same time. Throw on top of that a chance to avoid student loan and it sounds like a pretty sweet deal .

Find An Employer Who Will Pay For Your Education

It makes little sense to me that anyone has to go through college nowadays with debt given the glut of options we have to go through college for nearly free.

Take for instance Starbucks’ College Achievement Plan that covers full tuition for employees to earn a bachelor’s degree through Arizona State University’s online program. Or Walmart’s Live Better U program that fully covers program cost for Associates. And amongst many others, we have Target’s debt-free education assistance program covering tuition, fees, and textbooks for part-time and full-time employees.

These programs give you a chance to work and earn money while getting an education without debt. Imagine committing to such a program for 4-6 years. You could feasibly earn well over $100,000, gain valuable work experience, and snag a diploma all at the same time.

Find An Employer Who Will Pay For Your Education

I recently heard mention of someone who was getting a degree in real estate. There is nothing inherently wrong with this. But I can’t help but wonder if there is more upside to skipping the formal education and instead simply becoming a realtor and cutting their teeth in the industry for 4-5 years.

A realtor with real life experience will be ahead of a new graduate who only has book knowledge. They’ll also have higher quality connections, a more robust customer base, and likely more cash since they’ve been earning as a professional for longer.

This is just one example. But in general, we should not forget that the purpose of college is to prepare us for our careers. If you can prepare for long term career success without college, then don’t be afraid to skip it altogether because the opportunity costs of going to college can be huge.

The Six Levels Of Avoiding Auto Loan Debt

The next largest share of consumer debt is in the auto loan category. Providing transportation will be a challenge for anyone trying to figure out how to live life without debt.

Few people have thousands of dollars readily available to purchase a car which results in most people getting their vehicles via loans. Additionally, new cars are everywhere which makes it seem like having car debt is the thing to do.

As someone who’s never had car debt, I admit that it takes a great deal of sacrifice to avoid it. But you do have options. In fact, there are six levels of decision making you go through before you ever have to consider taking on debt for a car.

Level 1: Walk For Transportation

When I was living on my own as a 12 year old, I had a roommate named Keith. Keith was an interesting guy for many reasons, but perhaps most notable of his peculiarities was the fact that he walked everywhere no matter how far it was.

Keith was around 40 at the time and in excellent shape in spite of never hitting the gym. I remember going around town with him on a handful of occasions and nearly had to run to keep up with his walking pace.

Looking back, this experience is likely what opened my mind to walking as a perfectly reasonable form of transportation. If push came to shove, I’d opt to walk 2 hours to work before I’d take on a car loan. Just add in stretching, and that would serve as my daily workouts. Best of all is it would be free.

Level 2: Ride A Bike

If you find the idea of walking untenable, perhaps the thought of riding a bike is a little more palatable. For $200 on Marketplace or Craigslist, you could be mobile today.

I think bikes are the pinnacle of transportation when you combine their costs and efficiency. They can move you around 4x faster than walking. And while being much slower than cars, they are 100x cheaper and smaller which makes them significantly more efficient.

Granted, you will have to work and sweat while riding a bike. But can we really argue that this is a bad given the obesity and health statistics plaguing our nation?

Level 3: Carpool & Public Transportation

Back in 2012, when I was fresh out of college, I got my first job as a teacher in a city about an hour away from home. The issue was I didn’t have a car at the time and didn’t want to go into debt to get one. Thankfully, I was able to carpool with a buddy in return for paying him $200 a month.

For a total of $2,000 over a 10 month period, I was able to get myself to work without taking on car debt. And had my job been closer to home, I could have just as easily taken a public bus to work.

We’ve become so privileged that many people consider themselves above taking public transportation, choosing instead to live with debt to drive a car. Meanwhile, those of us who’d strive to live life without debt avoid gold plating our need for transportation into an expensive want that can hold us back.

Level 4: Get A Beater

With a small amount of cash, you can get yourself a beater that will make you mobile in no time. Unfortunately, I don’t mean a car that will get you dates or impress you friends. Instead, I mean a crappy vehicle that will get you from one point to another while keeping you out of debt.

You’ll most likely have to go hunting for one. But with a bit of due diligence, you should be able to find yourself a car for around $1,000 dollars that fulfills the need. And yes, I can almost guarantee it will have mechanical issues – but you are only using this option as a stop-gap as you save up for something better.

Once of the best cars I ever owned was a beater. She was a rusted green 96 Camaro with no A.C. Her interior was in tatters and she was brutal to drive in the hot Miami summers. But, she had absolutely no mechanical issues sinch she hadn’t been driven for many years while being diligently maintained by my mechanic friend. I got her for $1200.

Level 5: Get A Cheap, Reliable Car

Your next option up from a beater is to purchase a cheap, yet functional car that you can rely on for a few years.

I snagged my beloved Corolla in 2021 for $3,000 and happily drove it for about 3 years. Sure, it had body damage and bad paint job. But it was a steal given it only had 125,000 miles.

I think this is the ideal level of car ownership because cars in this range offer the most value. For a few thousand dollars, you can have a quality vehicle that will enable you to continue to live your life without debt.

Level 6: Use The 1/10th Car Buying Rule To Buy The Best Car You Can Afford

At some point, you may find that you are ready to upgrade to the nicest vehicle possible. You’ve worked hard, have managed your finances well, and would like to splurge on something to show for it. No harm there!

In these instances, I recommend you follow Financial Samurai’s car buying rule which states that you should spend no more than 1/10th your gross annual income on the purchase price of a car. This means that a person earning $50,000 per year should spend no more than $5,000 on a car.

The great thing about this car buying framework is it allows you to get the nicest car you can truly afford without debt and without jeopardizing your finances.

How To Live Life Without Debt From Credit Cards

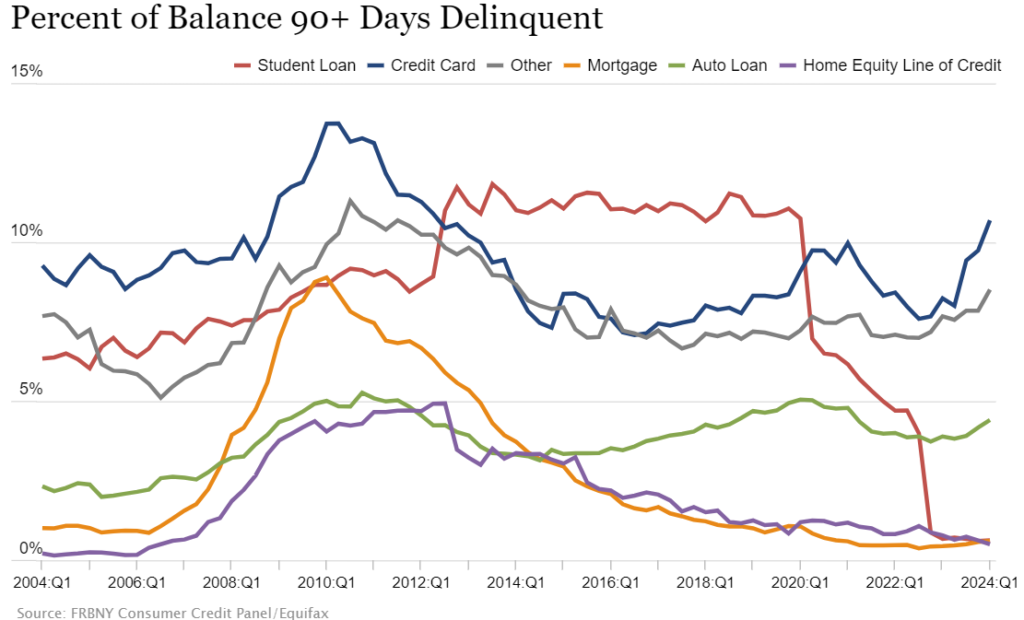

No discussion on how to live life without debt is complete without a discussion on how to live without credit card debt. At roughly $1.15 trillion, credit card debt is at an all time high. Credit cards also account for the largest share of credit delinquencies which tells me people are being buried by those high interest rates.

These statistics make me very sad and I hope we can see things change. For my part, here are my ideas for how you can live life without credit card debt.

Understand The Psychology Behind Credit Cards

I’ve discussed in detail the sinister psychology at play when it comes to credit cards and how they are designed to trap us in debt. In short, the objective of credit card companies is to make profit which they do by luring us into spending more and more money with their cards.

They know credit cards inhibit the pain response to spending and losing money which they capitalize on further by offering rewards points that trick us into thinking we are actually benefiting from spending money. It’s a sinister little trick they play on our minds.

Don’t Use Credit Cards

It seems obviously simple, but the easiest way to live life without credit card debt is to never have a credit card in the first place.

There is a plausible argument that using credit cards provides rewards points and slightly enhanced fraud protection over debit cards. In truth, these arguments don’t hold considering rewards points are offset by higher spending. Debits cards also offer nearly identical fraud protection since they are usually created by the same exact banks and card issuers such as Visa.

When we say cash is king, we aren’t suggesting you keep your savings and investments in cash. Instead, what we mean is that cash is the best payment type for living life without debt.

Investing & Building Wealth Without Debt

Alas, we’ve covered ways to live life without taking on debt and will round things out with a discussion on how to invest and build wealth without debt.

Not Having Debt Debt Allows For Huge Savings

Living life without debt has enabled me to consistently save more than 50% of my income for the past several years. No one has a claim on my money which means that I’m able to fully enjoy each dollar I earn by either saving or guilt-free spending.

Saving is the critical prerequisite to building wealth. Without a steady supply of inputs, your money simply cannot grow.

That then leads us to the question of where we can actually put our savings so they can grow. Let’s answer that next.

Building A Business Without Debt

A lot of people think they need credit to start businesses. I don’t think this is true. With a bit of ingenuity and hustle, I believe it is perfectly possible to launch and grow a thriving business without debt.

If I were to launch a brick and mortar business today, I would simply do it using the cash flows from my day job to fund operations until the business becomes solvent on its own. By starting small, focusing on efficiency, and keeping customers first – I think I could do it.

Beyond brick and mortar, there are also internet businesses which can be started for even less capital. It will still require dedication and hustle, but the opportunities to earn income online are almost endless.

Building A Real Estate Portfolio Without Debt

Life as a real estate investor has to be better without debt. It could take years to get there, but scooping up your first cash property becomes a powerful domino in what can be a lucrative and relatively stress free real estate portfolio.

Let’s say you can save $20,000 per year for 10 years to buy your first property that provides $1,000 per month in debt free cash flows. Adding that to your existing savings would bring you to $32,000 per year – which would enable you to buy your next $200,000 in just over six years. The third property? That would only take 4.5 years with your portfolio rapidly compounding from there.

Most real estate investors agree that cash investing ultimately beats out leverage investing in the long run. This is because investors who have taken on debt must spend considerable time paying down debt. Meanwhile, cash investors typically start slower – but rapidly catch up later on.

You Could Easily Invest In Stocks Without Debt

All of those extra savings from not having debt can easily be shuttled into taxable and non-taxable retirement accounts. Without debt, you can more easily max out your 401k while simultaneously funding brokerage accounts and IRAs.

The challenge for most people is they are working to “pay bills” first which really just means there are many claims on their money before they’ve done the hard work to earn it. Having to pay for mortgages, student loans, credit cards, and auto debt makes it hard to invest.

Still, you can be different. You can be the rare person who income goes largely towards saving and investing rather than servicing debt.

This is what it means to be on the third level of financial freedom—to be semi-financially free. It’s a brief stop on your way to the fourth level, where you are fully financially free.

A Tool To Help You Envision Life Without Debt

If you still have doubts that a life without debt is truly for you, I suggest you snoop around on reddit’s r/debtfree community for greater perspective.

What you’ll find here is a community of more than 1M people who are all over the debt spectrum. You’ll encounter stories such as a 28 year old guy who wants to give up because he can’t figure out how to get out of his $21,000 debt in spite of taking home $60,000 per year. And stories of people triumphing over debts of all magnitudes.

The common thread for all of these people is they are all seeking to live life without debt because they know that being debt free is worth it.

Whether you agree with that is ultimately up to you. Thankfully, you can always return to this post if you are looking for the blueprint.