I may have chosen the perfect name for this blog. Over the years, I’ve noticed a major gap in the personal finance world where most blogs and podcasts deliver content that primarily focuses on building wealth and getting rich.

It’s not uncommon to see an online influencer strutting about telling people how they should become real estate moguls, crypto investors, or insert the newest get rich scheme of the day. I can’t blame the influencers for feeding the people what they want to hear. These topics sell well because we all like to dream about and envision life with more than we currently have.

There is nothing wrong with having a desire for more, or even wanting to be rich. But, as all of this talk about getting rich ensues, I notice that the majority of people are not actually becoming rich and that most people are just broke.

Pardon the bluntness, but there is no point in dancing around the issue. You came here to gain some value, so I won’t waste your time parading around trying to ensure that everyone feels good.

How Can I Say Most People Are Broke

The saddest, and most compelling indicator of the financial brokenness in America comes when we look at how people are making out in terms of retirement.

We legally become adults at the age of 18 and the standard retirement age is 62. This means that most of us have a 44 year period to earn and save toward retirement. In theory, this long period should give everyone ample time to stow away enough money to have a very reasonable lifestyle at the finish line.

Theories are good, but never quite hold up to reality. It’s an unfortunate truth that the majority of retirees enter retirement with very little in their nest eggs.

There also seems to be a major discrepancy between retirement expectations and reality. Retirement account holders say they expect to need $1,250,000 to retire comfortably, yet the average retirement savings is only $86,869 according to a study by Northwestern Mutual.

It would be tempting to discount the above by saying that young savers skew the totals downward, but data by Vanguard shows that the average 401k balance for those 65+ is only $255,151. This is not a terrible amount to have at retirement. It’s just $995,000 short of what people say they would need to live comfortably in retirement.

What’s more, people are expecting to work until 64 which shows that we’re slowly pushing out the retirement date to allow for more time to make up the difference. No one likes being compelled to work and we all would enjoy retiring a few years early, but the majority wont have this option.

It saddens me to think of all the people who will spend more than 40 years working out of necessity, only to retire at the age of 64 with almost nothing to show for it.

The Many Layers of Brokenness

Being broke has traditionally been thought of as a financial issue. While it is true that most people are not doing well financially, I think the definition is too narrow. Setting money aside, it is my opinion that people can also live broken lives in additional ways.

This is great news for someone like me who has a lot to say on the subject, and it also bodes well for those of you who are looking to make a change. We can tackle the brokenness that plagues many of us together, hand in hand. But first, let’s create some additional definitions of what it means to be broke from both the financial and non financial perspectives.

Financial Brokenness

Loaded with Debt

All roads of financial brokenness end with debt. Greed, impatience and poor money management cause us to chase after something. We get the things we seek, but exchange our future earnings and time in the form of an expensive IOU that hold us back from ever making real financial progress.

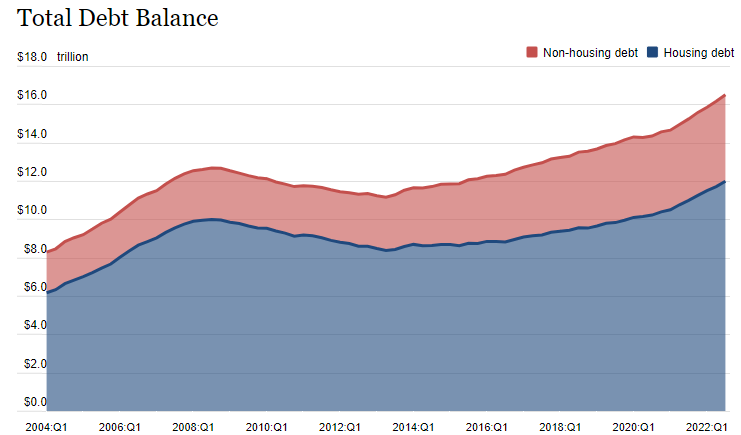

Just how bad is the debt problem? Q3 of this year saw the largest increase in household debt of the last 20 years with credit cards and mortgages leading the way.

It’s as if someone convinced us that the road to prosperity involves buying things that we can’t afford. Yet, we complain that the rich are getting richer.

The real question is this – who is on the other end of all of those debt payments we make each month?

The answer would be those very rich people we like to complain about.

Paycheck to Paycheck

I knew I was broke in 2018 because I simply could not pay all of my bills. Living at, or below paycheck to paycheck each month means that you are walking on the edge of a steep financial cliff – or you’ve already fallen off.

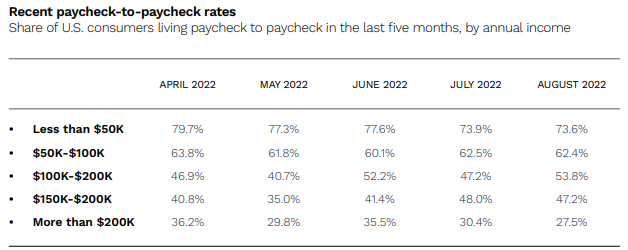

Don’t fret if you fit into this category because you have plenty of company. This issue is so pervasive that it is estimated that 60% of U.S. consumers are living paycheck to paycheck. This is not just a poor people issue either. Estimates project that 45% of those earning over $100,000 per year are also living paycheck to paycheck.

Vulnerable to Emergencies

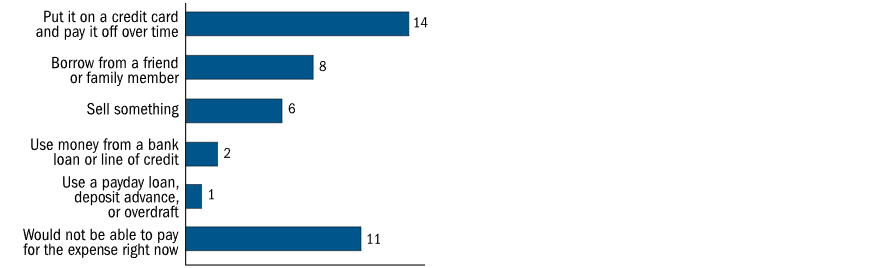

An annual survey by the Federal Reserve found that 42% of respondents would not be able to cover a $400 expense by simply using cash on hand. Instead, the respondents would have to come up with the money via other means which mostly involved borrowing the money on a credit card. Many others said they would not be able to cover the emergency by any means.

This is not surprising considering the paycheck to paycheck numbers. Simple logic tells us that there will be no money left to cover emergencies if folks are spending all of their money in a given month.

My advice is that everyone set aside some funds to hedge against life’s inevitable curve balls. It’s not a matter of if bad things will happen – the only question is when.

House Poor

I’ve never been one to follow the crowd, so it was interesting to watch from afar what unfolded in the housing market over the past few years. “Irrational exuberance” is a great way to describe what happened as homebuyers flooded the market and threw all caution to the wind in a quest to win out on a home purchase.

We saw buyers willingly and gleefully pay well above asking price, while making compromises such as skipping inspections or settling on the wrong neighborhood. As the dust settles, the hangover ensues for some 72% of buyers who now have regrets primarily because they overpaid or were not prepared for the maintenance costs.

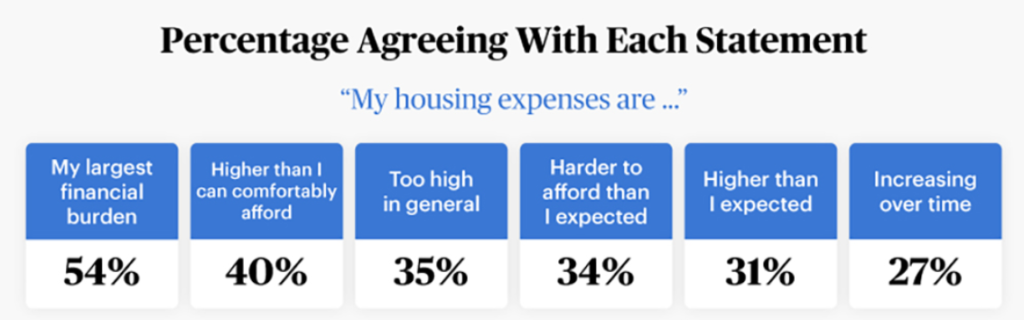

The homeownership pain goes deeper when we consider that 69% of homeowners report feeling house poor in 2022 – all as we are seeing record levels of home equity.

Renters aren’t exempt from the agony. A Q4 2021 report by the Census Bureau found that 16% of adult renters were behind on their rent. Sixteen percent seems low relative to some of the other numbers presented, but this just captures those who were actually behind on their rent and not those who make their rent payments each month while walking the financial tightrope of living paycheck to paycheck.

Car Poor

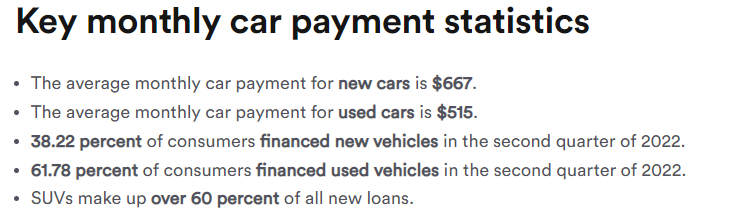

With such little wiggle room in most budgets, auto financing becomes an attractive option since saving up for a car in a short amount of time is nearly an impossibility. As a result, many consumers sign up for an average monthly car payment of $667 for a new car or $515 for used cars.

Trends show that consumers are at least opting for the cheaper option with 62% purchasing used vs 38% new. It’s great to see more used car purchases, but it would be nicer to see more people leaning toward all cash purchases to maximize cost efficiency.

Through all my financial mistakes, I’ve managed to avoid ever having a car payment. As a result, I’ve driven some cars that many would never even consider. The roughest may have been my ’94 faded green Camaro with no AC. The car was super reliable with fewer than 100k miles, but summer heat in Miami made driving it absolutely brutal.

Life Measures of Brokenness

Failing Health

Not spoken about enough is the fact that medical bills are the top cause of bankruptcy in America, so we can see a clear link between our physical health and financial wellbeing.

The CDC reports that obesity prevalence is now 41.9% and rapidly rising. The issue also costs $173 billion to manage each years. There is a decent amount of talk about obesity, but much of it hones in on the superficial components that have to do with the way people look. Obesity is not just about a person being overweight. We should spend more time educating people on the linkage between obesity and other health problems such as high blood pressure, cancer, inflammation, and diabetes.

At the same time, a person dies of heart disease every 34 seconds which makes it the top cause of death in the United States. This one hits home for me as I’ve had my own mini battle with high cholesterol in recent years. (Check out the podcast for more on this).

To round things off, I’ll quickly mention that gambling, porn, smoking, alcoholism, and illicit drug use are also afflicting large portions of the population.

Failing Relationships

Promising trends show that divorce rates are declining. This is good news as we’ve all heard the bearish outlook on marriage. As we dive a bit deeper into the numbers, we see that the declines in the divorce rate may be offset by the fact that the actual rate of marriage is also declining.

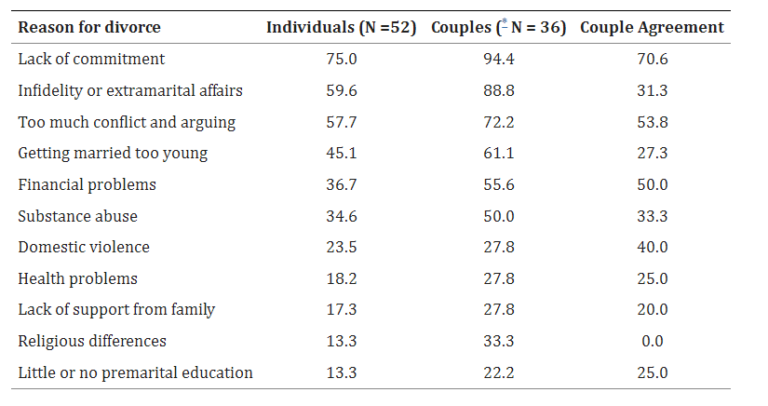

Accurate statistics are all over the place, but it appears that around 45% of marriages end in divorce. There is certainly a financial component to divorce. Financial problems rank near the top of the list of reasons why couples divorce.

Money is surely an afterthought for those who must grapple with the emotional fallout of divorce. I openly share about my 16yr relationship that ended a few years back. We weren’t married, but may have well been. I can attest to the difficulty of breaking up with someone you love.

Mental Health, Stress, and Anxiety

Suicide is a top 10 cause of death and actually increased in the 2 decades since the year 2000 before declining over the last 2 years. Even though only 45k people took their own lives in 2020, another 16 million either thought about it seriously, planned it, or made an attempt.

There is a relationship between anxiety and other mental ailments. Anxiety is estimated to afflict 48 million people (19.1%) annually. I had my own brush with intense anxiety when my world collapsed in 2018 and can say that living with anxiety is a crushing experience that gets in the way of progress and happiness.

Loneliness

We are facing a loneliness epidemic in America. Most reports focus on older populations when it comes to loneliness, but I can tell you that this is also impacting younger people. Loneliness and social isolation lead to real health issues such obesity, but being lonely also places a strain on your mental health.

I’ve been focusing on the quality of my long term relationships and have lost a few friends over the years. Fewer friends means more time spent alone. I’ve always been a bit of a solo act, so this works well enough for me. But I, nor anyone else wants to spend too long in solitude.

Career Dissatisfaction

My only regret thus far in life is the fact that I stayed in a career field that I hated for 7.5 years without making a change. Hitting rock bottom was actually a good thing for me because it shook me up enough to finally make the change. The sad reality is that many people won’t have a “that’s it” moment and will stay in jobs they hate for decades.

A 2022 Gallup study found that sixty percent of workers are emotionally detached at work and 19% report that their jobs make them miserable. With such a wide gap between simple detachment and all out misery, there is a lot of room for many people to experience some form of dissatisfaction with their careers.

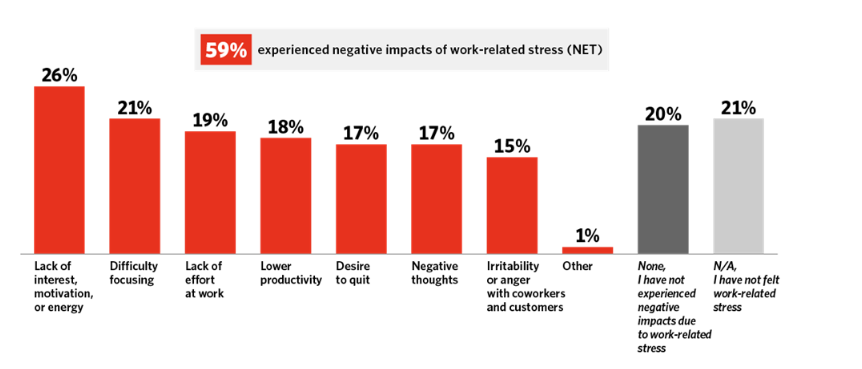

Many jobs contain an element of stress. I believe that it is okay to feel a bit of stress doing something you love, but from my experience, stress turns toxic when it comes from a job you already hate. This notion is supported in data by the American Psychological Association who found that three in five employees have experienced negative impacts of work-related stress, including a lack of interest, motivation, difficulty focusing, and a lack of effort at work.

I believe that there are multiple jobs out there that each of us could find contentment with. No situation will be perfect all the time, but we should all expect to at least enjoy the work we focus on and the companies we offer our services to.

Lacking Purpose

No stats for this one – just my thoughts. It seems that people lack a general sense of purpose and a sense of who they are. I struggled in this area for many years myself, and am still in progress. I’ve made great strides over the past few years for the betterment of my wellbeing and personal life satisfaction.

For me, I didn’t have a great blueprint on how to go about this process and it doesn’t seem to me that others have a good idea either. What I notice is that many people begin to search for answers externally and look to society for clues on how to proceed.

The problem with this external focus is that we watch, mimic, and elevate others while forgetting about the person that matters most – which is ourselves. As a result, we see an externally focused society develop that measures itself by things such as jobs, status, money, attention, and material possessions.

This external orientation makes us vulnerable because all of these things depend on outside forces to be maintained. If I, for example, made approval from others my success metric for this blog – then I will always be vulnerable to disappointment and may become afraid to express myself freely out of fear. Another example would be those who lean too heavily on their jobs for meaning. Imagine what would happen to this persons ego if they were to be let go for some reason beyond their control.

I believe that a life worth living is one that is done in a purposeful manner. And that our highest purpose in life means living it according to our inner compasses – free from external influences. Everyone should spend more time reflecting on where they are today, who they are today, and where they are heading. It’s never too late to shift things onto the right track.

The Good News

There was a lot of doom and gloom above. Sometimes it’s easy to focus on all of the bad in life. In fact, we are wired to focus on the bad – and this is actually a good thing. The reason being is that we humans are naturally driven to solve problems. And since life is not perfect, we all have our fair share of problems to deal with.

The way life works is we take our current situation and begin to identify all of the little things wrong or out of place. We then begin working to overcome this current set of problems, and we usually succeed over time. Instead of resting on our laurels, we adapt to our new baselines and then we almost immediately begin seeking out our next set of problems to focus on.

The key is to embrace the idea that life isn’t perfect, and learn to enjoy the process of solving your problems because solving our problems and accomplishing things is what makes life worth living. The only way to fail is to run from or ignore your problems – and we don’t do that over here.

Not all of the problems listed above will apply to everyone, but I’m willing to bet that each of us can benefit by making improvements to at least a few areas listed. We can all be a bit better with money, have better health, or maintain better relationships. You also likely have unique problems radically different from the ones listed above.

The good news is that problems are normal and you can overcome them. All that is really needed is self honesty, desire, and initiative.

That’s Where I Come In

If we are to judge men by the distance traveled from where they started in life, then I would certainly be up for some sort of award. My life’s journey has been an epic journey full of failures, triumphs, and redirections.

It is because of this journey that I have the conviction to speak about money and life. In reality, it’s pretty easy because I’m simply sharing my experiences, wisdom, and opinions about things that I care about in hopes that I can help others along the way.

In doing so, I hope to share ideas that will help you address your own problems and continue forward in your own life. It’s as simple as that. I can wax forever, but the stage has already been set. Americans are broke. Change is needed. And I’m here to help. Let’s just get on with it.

What problems are you working on in your own life? Comment below!

8 Responses

I am personally feeling the squeeze of looming retirement. Yes, I am only 42 but I have no retirement savings. However, like your posts states, humans are problem solvers. I am tackling my retirement issue head on. Blogs like yours will definitely help on this journey.

I love your attitude of facing your challenges head on. This alone shows that you are a winner. At 42, you still have 20+ years to work and build for retirement. And I promise you that you can even retire a millionaire in that time with the right approach. I will definitely help with this blog.

You can definitely do it and your attitude inspires me!

Another amazing post. You covered some topics I imagined would be covered along with some that took me by surprised and are often overlooked, such as health and relationships issues. It was important for you to cover all topics because they really all overlap and play a factor to each other.

In regards to your savings topic, I remember reading this article years back and was very amazed that it could be true https://money.cnn.com/2017/01/12/pf/americans-lack-of-savings/index.html. What is so interesting to me is although this was posted in 2017, this is still relevant today, I recently saw a snippet that @morningbrew posted on their Instagram that showed a poll from Prudential showing that most Americans still don’t have 600$ in their savings.

On a personal note the r/personalfinance page on Reddit has helped me have a guideline of an easy to follow and not to extreme way to budget and view my finances. I also like to read their posts for motivation of how to do better along with understanding, I’m honestly not in such a bad position. I also listen to the Dave Ramsey podcast for the same reason. Although I am not necessarily full into Dave Ramsey because personally it does not align with how I view my life, there are many good things I’ve learned from his work.

I definitely think that it’s good to pan out and take a total look at the entire picture of our lives because as you said – they all overlap.

It really is amazing that most folks still don’t have that $500 saved up. I always wonder why it’s so hard for people to really get ahead. Any thoughts?

I’ll check out morning brew! And I am a fellow lurker in reddit, so will be seeing you over there! Thank you for sharing you wisdom with me!

I think Americans can’t distinguish wants vs needs in many circumstances. Ultimately life is full of choices with consequences, both good and bad. Often times due to marketing schemes, ignorance, and poor influences, it’s easy to cave focus on wants to the point you are never saving money. Also with how easy it is to obtain credit, it’s so easy to spend money you don’t have.

Totally agree! It’s like we have a system that sets us up to fail. And then we have our own person in the mirror to fight as well. It is hard to stay consistent long term.

Great use of sources here and I think this post is an important one for all of us to discuss openly and honestly. Starting savings (401k, IRA, etc.) early and living within your means can be the key to retiring comfortably. Compounding interest is your best friend here, even if your contributions are small to start. I love the mentality of forgoing the extravagant things in order to maintain a healthy lifestyle.

This post is definitely a punch in the gut, but valuable to just see the magnitude of things in one place. Not everyone will be impacted by each topic, but we can all examine where we are for areas of improvement.

Living within our means and being satisfied with that is powerful because it helps us avoid trouble and stress. And then, as we grow and build more wealth we can enjoy more things.

You are so right on compound interest. I wish I would have started earlier!