Debt is Slavery

Debt could be wonderful way to expand ones financial and material standing, but it can also place a financial burden on it’s holders.

That said, financial pundits are split on whether debt is a net good or bad for consumers.

This article dives a bit deeper into the matter to present some ideas so you can decide if debt is beneficial or if having debt would become a form of financial slavery for you. We’ll cover:

- How Debt Slavery Has Evolved Throughout History

- What the World Was Like Before Debt

- How Debt Becomes Financial Bondage

Getting out of debt was one of the best personal decisions I’ve ever made. Eliminating debt significantly reduced the amount of stress that I have. I have more confidence knowing that I’m not beholden to anyone.

But how about you – are you financially beholden to anyone?

It’s clear that most people don’t think of being in debt as a form of bondage. I say this because American households have accumulated record levels of debt this year.

Debt is so prevalent that it’s hard to believe that there are some people who consider it as a negative. Still, one author boldly proclaims that debt is a form slavery subjugating the masses.

That author Michael Mihalik and his book Debt is Slavery: and 9 Other Things I Wish My Dad Had Taught Me About Money is an interesting read that explores the idea of debt being a form of slavery.

On the whole, Michael does a great job of supporting his case by presenting a compelling mixture of facts and real life anecdotes. Additionally, the best part of the book is his tactical advice for re-structuring your finances. Following the steps in this section would surely help you work your way out of debt.

I highly recommend the book for anyone who is serious about getting their finances in order.

That said, reading this book made me a bit curious on the topic. As a result, I dug into this concept a bit more and came up with some interesting ideas.

Let’s hop right into them.

The Evolution of Debt as Slavery

Some people may be triggered hearing someone proclaim that debt is slavery. Still, you never know where a learning opportunity may exist – so it could be good to have an open mind as well.

While debt does not equal slavery in a historical sense it does produce many of the same byproducts.

How might this be so? Let’s take a look at how debt has evolved over history to find out.

Debt Enslavement In Ancient Times

Today, the penalties for defaulting on a debt don’t bad relative to the consequences of old. In fact, debtors in ancient times faced much stiffer penalties. One such penalty was debt enslavement where borrowers would become enslaved to their creditors.

A simple eviction doesn’t seem nearly as bad as a sentence of slavery for a missed rent payment. Thank goodness times have changed.

Indentured Servitude

In ancient times, debtors were explicitly sentenced to become slaves of their lenders. This system evolved over time and eventually took on the form of indentured service – a system which permeated the early American south.

Landowners leveraged their powerful economic positions against former black slaves (and poor whites) to entrap the freed slaves in debt-based arrangements. The freed slaves would become known as sharecroppers.

Sharecropping

Though these arrangements were not slavery in a technical sense, they produced the same results in the end.

In those days, owning land meant that you owned an enterprise in the form of crop production. Not owning land meant that you would likely have to work for the landowners in some fashion.

Seeing this, landowners capitalized by renting out plots of land as well as seeds, tools, clothing, and shelter to sharecroppers. In exchange, sharecroppers would agree to debt repayment plans. Unfortunately, these agreements would often be favorable for the landowner and prohibitive for the sharecroppers.

Sharecroppers were forbidden to leave the land until their debts were completely paid to the landowner. Landowners enforced this by deploying armed guards to supervise and discipline sharecroppers as they worked their plots of land.

What made sharecropping sinister was the fact that it bound sharecroppers to landowners by way of the one sided agreements.

These agreements featured high interest rates, deceptive practices, and no real way out for sharecroppers. In essence, sharecroppers were compelled into labor as a part of their contracts and had no recourse for an alternative life.

Modern Day Debt Slavery

Economic progress has created a more modern economy that is free from the antiquated forms of debt slavery. Thankfully, no more are there chains, armed men, and legal doctrine binding us to our creditors.

Be that as it may, our new economy features invisible devices to create a more modern class of slaves.

This new group of slaves mostly comprises the American middle class. And their instruments of bondage are credit cards, student loans, car loans, and mortgages.

The World Before Debt

Firstly, we know that the world has never been free of debt. As such, this section focuses on the more modern types of debt as mentioned above. I say that these types of debt are modern because they haven’t been around long in relative terms.

Sure, mortgages have been around in some form since the 1700s – but the current iteration is less than 100 years old. The same is true for car loans which have been around since 1919. At the same time, credit cards and student loans both hit the markets in the 1950s.

So, the question is – what did the world do before these types of loan became widely available?

The answer is quite simple actually. Consumers simply missed out on opportunities to have the products and services that debt affords us today.

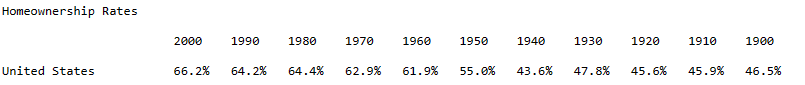

Homeownership, for example, has increased from a rate of around 45% in the first four decades of the 1900s to a rate of about 65% in over the decades since 1940.

Prior to the upward tick in ownership rates, consumers needed to have the cash to afford a home. But, the change during this period was the wider availability of mortgages which made homeownership more accessible to the masses.

Compelled, Bound, and Burdened

This takes us back to the original question of if you are financially beholden to anyone? If so, it is worthwhile for you to consider who’s pulling your strings.

To put it differently, you should ask yourself if you are in any way compelled, bound, or burdened simply because of your debt.

Take for example a credit card holder who is several thousands of dollars indebted to the card issuer. Whether they know it our not, this person is compelled, bound, and likely burdened by this debt.

For one, this person now must pay back the debt plus interest. To do this, the person must go to work and make money in order to service the debt. They must also make their payments on time or incur penalties.

This is just the start for the person in credit card debt.

In addition to being compelled to pay back the debt, make the payments, and go to work – this person is also intimately connected to the debt issuer for the duration of the loan.

In other words, being in credit card debt means they are bound to the creditor and cannot escape no matter how burdensome the debt becomes.

Modern Day Debt Servitude

For starters, I’d like to point out that this is in no way comparing being in debt to the traditional forms of slavery that have left a dark stain on much world’s history. Rather, the goal here is to examine how being financially bound can limit our freedom.

Still, an indebted borrower is required to make payments on their debts. The process of making debt payments is known as “servicing a debt”.

At the same time, part of the definition of the word servitude includes the phrase “compulsory service” which means that one is compelled by law to carry out an action. In the case of being in debt, one is compelled to service the debts owed to their creditors which fits neatly under the umbrella of servitude.

Is Debt Slavery?

We can see that rapidly evolving consumer markets have made it possible for consumers to access credit to purchase things they would never have been able to before. Undoubtedly, this has made us all better as we enjoy access to lifestyles that were only a dream a century ago.

But, has access to debt and credit also bound people to deals of compulsion where they now have to make decisions that they otherwise would not have made?

Sharecroppers were given land, seeds, tools, and shelter in exchange for deals compelling them toward labor and binding them to the land.

Likewise, today we are given college degrees, cars, homes, and trinkets. Of course, we service the debts that enabled us to acquire these things. We must go to work and be productive to ensure the we generate enough income to pay the debts we owe.

Do You Like Debt?

In the end, it’s really up to you to decide how you feel about debt. I’m curious to know where you all land on the matter.

My guess is that few people actually like being in debt. But I’m prone to being wrong quite often so do enlighten me!

Do you have debt? And if so, do you like it?