7 Things You Should Never Do With Your Money

Successfully managing money is both art and science. On one hand, you must control your emotions, impulses, and desires. At the same time, you must also strategically tend to every dollar to ensure you are maximizing your position.

That said, there are some major pitfalls that everyone should avoid along the path of financial success. This article covers the 7 things you should never do with your money so you can be sure to get the absolute most out of every dollar you earn.

Contents

Never Make It Rain

I know that this section has an odd title, but bear with me.

There was a funny, yet wildly popular song release in 2006 called Make It Rain by hip hop artist Fat Joe. I say that the song is funny because it essentially refers to people throwing money into the air to “make it rain” on everyone around them.

I was a junior in high school when this song came out, but wouldn’t fully appreciate its impact until several years later.

As it turns out, the concept of making it rain permeated through the culture by the time I made it to college. On any given night out in the clubs, the DJ would wait for the perfect moment to blast Make It Rain and there would suddenly be several guys throwing wads of money into the air on the nightclub dancefloor.

Predictably, dozens of single dollar bills being frivolously tossed in the air would always result in a bit of a frenzy with other guys and gals clamoring about to scoop up a few dollars. Perhaps they were hoping to collect enough money for a post clubbing taco bell run since it was the only place open late. But I digress.

The real title for this section is Never Buy Things Just to Impress People. I simply used the Make It Rain story to highlight how ridiculous it is to try to impress strangers who you will never see again.

What To Do Instead: Build Your Self Esteem & Focus On Impressing Those Who Really Matter

Never Buy A New Car Unless You’re Rich

One of the most important lessons I took from my undergraduate studies in Economics was that there are hidden costs to almost every financial decision we can make. Often, it’s the hidden costs of things that add up and limit our long term financial success.

As such, one financial decision that can make or break us is our car purchases. In addition to the huge upfront price tag, cars carry substantial hidden costs in the form of depreciation.

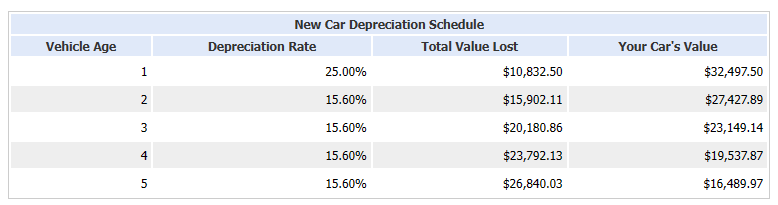

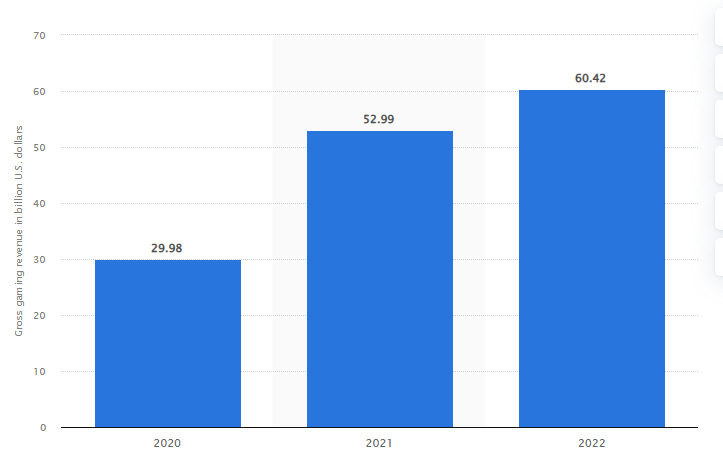

How significant is depreciation?

Well, both Kelley Blue Book and Lending Tree estimate that cars lose up to 20% of their value in the first year and 60% by year five.

The name of the personal finance game is to build wealth by growing our money by investmenting in assets that go up in value. Unfortunately, buying a new car takes you in the opposite direction.

What To Do Instead: Pay Cash for A Used Car That You Can Afford

Never Try To Get Rich Quick

Haste makes waste and becoming rich quickly is a dream that can quickly turn into a nightmare. As such, the primary problem with trying to get rich quickly is the level of risk involved in the process.

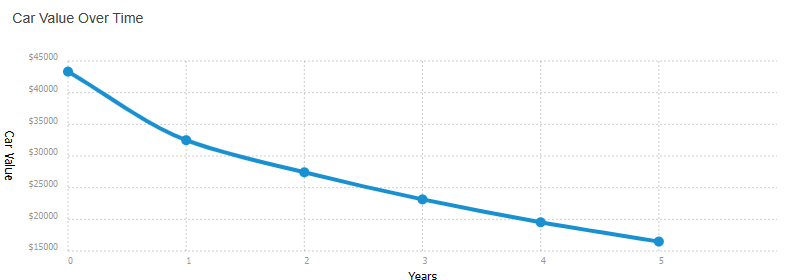

The rise of the internet has given rise to all sorts of get rich scams and schemes that seek to separate unsuspecting people from their hard earned dollars. Afterall, we’ve witnessed record levels of fraud reports in recent years thanks to widespread criminal activity.

Many of these schemes are taking advantage of social media driven investment frenzies aimed to dupe greedy consumers who are desperate to get in on the action. As a matter of fact, the FBI reports that investments scams were the costliest of all schemes in 2022 at $3.31 billion.

Cryptocurrency scams account for the bulk of the investment scams being reported. And sadly, many of the victims fall into my age cohort of 30 to 49.

There does seem to be a real zeal for investing and getting rich. Everywhere you turn, you find the next millennial talking about their investment choices, the latest cryptocurrency, or an impending real estate deal.

At the same time, I don’t see a lot of people actually becoming rich as a result of all of this interest. So, perhaps there is another way? There is actually. Though boring, getting rich slowly is the best path because it’s the surest.

What To Do Instead: Build Real Wealth Slowly By Focusing on the Fundamentals.

Never Invest In Things You Don’t Understand

This is a perfect segue from the last section since most get rich quick schemes also involve people investing in things they don’t fully understand.

The cryptocurrency space is a perfect example of this as we saw people flood into that market in recent years in a bout of fomo fueled irrational exuberance that lead to many being wiped out of their life savings.

Many people tried to get me to invest while the crypto markets were hot, but not a single one could fully explain to me what cryptocurrencies were or from where they derived their value. As a result, I stuck to a form of investing that I understood much more clearly. That was paying off all of my debt.

Investing doesn’t have to be complicated. I’m also not suggesting that you go get a PHD in derivatives to learn the ins and outs of investing. Instead, I’m suggesting that you spend some dedicated time educating yourself on the various options at your disposal.

You can do this by talking to a professional, reading books, or researching topics online. In the long run, all three of these methods could actually prove beneficial.

Finally, the one thing you should avoid is crowdsourcing your investing decisions. This is where you follow the general wisdom of the crowd for investment strategy. The problem with this approach is that the masses generally get hit all at once, while the outliers outperform.

Just ask billionaires Warren Buffet and Ray Dalio.

What To Do Instead: Be A Long Term Investor

Never Gamble Or Play The Lottery

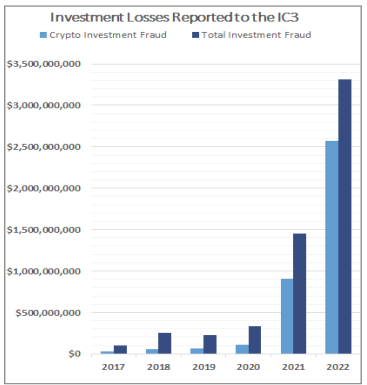

As of 2022, the commercial gambling industry had revenues of $60 billion. At the same time, the Mega Millions lottery jackpots are also well into the billion dollar range.

Have you ever wondered where all of this money comes from? The answer is simple as both the lottery and casinos get their revenues from their victims which I’m sure they eloquently refer to as customers.

Gambling with your money is a foolish thing to do because the odds of winning are so slim. I believe everyone knows that casinos are rigged to ensure the house always wins – so it baffles me as to why anyone would try in the first place.

I suppose the answer is that people are to get rich and therefore are willing to practically hand over their money for odds that are as long as one-in-several-million.

Indeed, I understand that hope can be a powerful thing. Unfortunately, building wealth is about more than having hope. Winning with money game is about protecting your money and carefully growing it over time.

What To Do Instead: Learn How To Invest & What To Invest In

Never Loan Someone Money

There is a humanistic element to money that is far more important than the number components. For example, the way you think and feel about money has more to do with your success with it than any budget or investment does.

I found this out the hard way back when I was going broke in 2018. At the time, I was so desperate and hard pressed that I could hardly see a way out of my situation. As a result, I asked my millionaire best friend for a bailout of $5,000 which I would pay back later.

Surprisingly, he said no.

Hearing no from my best friend was a blow to my ego back then, but I’ve actually come to appreciate him for not giving that money. In retrospect, I can’t really blame him because I would have done the same thing.

Don’t Lend, Give Generously Instead

Money is about relationships and it can certainly impact our relationships with other people. Lending money is risky because the borrower may never pay you back. Thus before loaning money, you should ask yourself if you are okay with potentially ruining the relationship in the process.

My solution to loaning money is simple. I don’t lend money as a part of my personal value system. Instead, I will gladly give money to those in need as a gift with no strings attached and no expectation of repayment.

This system is beautiful because it allows me to help someone else and avoids the relational problems that comes with lending money.

What To Do Instead: Give Generously When Possible

Never Cosign A Loan

This section is a nice follow-up since we are already on the topic of money lending. For this one, I’ll simply say that it’s financially and relationally risky to co-sign the loan for someone else. The odds of disaster are just too high so this should be avoided.

Further, when you co-sign a loan for someone – you are incurring all of the obligations and risks that comes with the debt while not receiving any of the benefits that taking on the debt provides.

For example, a relative needing a cosigner to lease an apartment will have all of the benefits of the new apartment, but only partial responsibility for it. The rest of that obligation falls on your shoulders. If they bail out of the lease or trash the place, you are just as much on the hook as they are although you never used the apartment.

We’d like to think that everyone has good intentions, but there is something about outsourcing accountability that makes even the best people do strange things. Avoid making this mistake and give people the gift of incurring full responsibility for their decisions.

It may not seem like you are helping them in the short run, but they will figure it out if they are a quality person of integrity. Further, they will be better for it in the end and may even thank you.

If they are a person who shirks personal accountability or are irresponsible, then you would have dodged a major bullet.

It’s a win-win either way.

What To Do Instead: Give Generously With No Strings Attached

The Many Pitfalls Of Money

This list is not exhaustive. The world presents us with a nearly unlimited number of opportunities to squander our money.

I’ve fallen into my fair share of pitfalls with money over the years and have fortunately learned from each of these mistakes. As such, I’m sure there are other traps waiting for me around the corner. My goal now is to avoid them as best I can as I trek along my wealth building journey.

Being successful with money is both art and science, and we must continue to learn, fail, and refine to reach our goals.